PM SVANidhi Scheme: Street vendors constitute a vital segment of the urban informal economy, playing a crucial role in ensuring the accessibility of goods and services at affordable rates right at the doorstep of city residents. They go by various names such as vendors, hawkers, thelewala, rehriwala, theliphadwala, and others, depending on the region and context. Their offerings encompass a wide range of products, including vegetables, fruits, ready-to-eat street food, tea, pakodas, bread, eggs, textiles, apparel, footwear, artisanal goods, books, and stationery. In addition to goods, they also provide services such as barber shops, cobblers, pan shops, and laundry services.

The livelihoods of street vendors were severely affected by the COVID-19 pandemic and the resulting lockdowns. Many of them operate with limited capital, which was depleted during the lockdown period. Therefore, it was imperative to urgently extend credit for working capital to these street vendors, enabling them to restart their businesses. Therefore, the PM SVANidhi Scheme was launched in 2020 to help street vendors in need. In this article, we are going to learn everything about the scheme.

What is the PM SVANidhi Scheme?

The Ministry of Housing and Urban Affairs (MoHUA) introduced the “PM SVANidhi” program on June 1, 2020, as a central-sector micro-credit initiative. This scheme is designed to offer support to street vendors by providing them with a collateral-free working capital loan of ₹10,000, which can be followed by subsequent loans of ₹20,000 and ₹50,000, featuring a 7% interest subsidy.

The Ministry of Housing and Urban Affairs has chosen the Small Industries Development Bank of India (SIDBI) as the partner responsible for implementing the scheme. SIDBI will utilize a network of lending institutions, such as Scheduled Commercial Banks (SCBs), Regional Rural Banks (RRBs), Small Finance Banks (SFBs), Cooperative Banks, Non-Banking Financial Companies (NBFCs), and Microfinance Institutions (MFIs), to carry out the scheme.

Please Note: The Scheme is accessible to individuals in states and union territories that have officially implemented regulations and the Street Vendors (Protection of Livelihood and Regulation of Street Vending) Act, 2014. Notably, beneficiaries from Meghalaya, which has established its own State Street Vendors Act, are also eligible to participate.

| PM SVANidhi Scheme 2023 Key Highlights | |

| PM SVANidhi Scheme 2023 Launch Date | June 1, 2020 |

| PM SVANidhi Scheme 2023 Official Website | Click Here |

| PM SVANidhi Scheme 2023 Objective | To offer support to street vendors by providing them with a collateral-free working capital loan of up to Rs 50,000 |

| PM SVANidhi Scheme 2023 Interest Subsidy | 7% |

| PM SVANidhi Scheme 2023 Benefit | Collateral-free working capital loan up to Rs 50,000 |

| PM SVANidhi Scheme 2023 Collateral free Loan Amount | Rs 10,000, Rs 20,000 and Rs 50,000 |

| PM SVANidhi Scheme 2023 Tenure | 1 Year |

| PM SVANidhi Scheme 2023 Scheme Validity | December 2024 |

| PM SVANidhi Scheme 2023 Mode of Application | Online |

| PM SVANidhi Scheme 2023 Implementing Agency | Small Industries Development Bank of India (SIDBI) |

| PM SVANidhi Scheme 2023 Top Performer | Varanasi |

| PM SVANidhi Scheme 2023 Application Form | Provided Below |

| PM SVANidhi Scheme 2023 Under which Ministry | Ministry of Housing and Urban Affairs |

| PM SVANidhi Scheme 2023 Helpline Number | 1800111979 |

PM SVANidhi Scheme 2023 Objective

This is a Central Sector Scheme, meaning it is entirely funded by the Ministry of Housing and Urban Affairs, and it is designed with the following goals in mind:

- To enable access to working capital loans of up to ₹50,000.

- To encourage consistent and timely repayments.

- To provide incentives for engaging in digital transactions.

The primary aim of this scheme is to formalize street vendors, aligning with the mentioned objectives, and creating fresh opportunities for them to advance economically.

PM SVANidhi Scheme In News | What’s New?

The PM Street Vendor’s AtmaNirbhar Nidhi (PM SVANidhi) Scheme has achieved a significant milestone with female participation at 43 percent, as reported by the State Bank of India’s economic research department (ERD). This gender-balanced participation reflects the empowerment of urban women in their entrepreneurial endeavors.

Furthermore, the report highlights that nearly 75 percent of the loan beneficiaries fall within the “non-general category,” demonstrating the transformative impact of well-designed policy initiatives. To date, the scheme has disbursed around 70 lakh loans across three tranches, providing support to over 53 lakh street vendors, with a total value exceeding ₹9,100 crore, according to the ERD’s special report.

The report also indicates that 68 percent of those who received the first loan of ₹10,000 have successfully repaid and taken a second loan of ₹20,000, while 75 percent of those who received the second loan of ₹20,000 have availed a third loan of ₹50,000.

The loan disbursement aligns with census data, with about 80 percent of borrowers being Hindu, and the remaining 20 percent being non-Hindu. The spending patterns of those in the bottom quintile reveal that poverty transcends religion, caste, creed, or gender, as noted by Soumya Kanti Ghosh, Group Chief Economic Adviser at SBI.

Remarkably, the average debit card spending of PM SVANidhi account holders has increased by 50 percent to approximately ₹80,000 in FY23 compared to FY21. This implies that, in just two years, the average annual spending per beneficiary has increased by about ₹28,000, thanks to the modest initial capital injected into urban informal entrepreneurs.

The PM SVANidhi scheme encourages regular repayments with a 7 percent interest subsidy, and it rewards digital transactions with a cashback of up to ₹1,200 per year.

- According to the PM SVANidhi dashboard, approximately 5.9 lakh borrowers are located in six major cities, while 7.8 lakh borrowers come from the top ten cities with a population exceeding one million. Among these cities, Varanasi stands out as the top performer, with 45 percent of total beneficiaries actively participating, followed by cities like Bengaluru, Chennai, and Prayagraj.

- It is worth noting that public sector banks have played a crucial role in achieving this milestone by supporting the first-ever micro-credit scheme designed for the urban poor. SBI alone has disbursed about 31 percent of the total loans, with the top five banks, including State Bank of India, Bank of Baroda, Union Bank of India, Punjab National Bank, and Canara Bank, contributing to two-thirds of the total disbursement.

PM SVANidhi Scheme Key Features

- PM SVANidhi is a centrally sponsored scheme.

- It aims to offer cost-effective working capital loans to street vendors adversely affected by the COVID-19 pandemic.

- The scheme will remain in effect until March 2022.

- Street vendors will receive an initial working capital amount of up to Rs. 10,000.

- Vendors who repay their loans early or on time will receive an interest subsidy of 7 percent.

- The program includes a monthly cash-back incentive for digital payments, ranging from Rs. 50 to Rs. 100.

- Vendors who repay their first loan on time have a higher likelihood of qualifying for a larger loan in the future.

- No collateral security is required for vendors to access these loans.

PM SVANidhi Scheme 2023 Benefits

- Street vendors can receive financial support of up to Rs. 10,000 to restart and expand their businesses.

- The loan comes with a low interest rate of 7%, which eases the repayment burden for street vendors.

- No collateral is needed to access the loan, ensuring greater accessibility for street vendors.

- Applying for the scheme is cost-effective since there are no processing fees.

- The loan amount can be utilized for various purposes related to the street vending business, such as purchasing raw materials, covering rent, or acquiring necessary equipment.

- This initiative promotes financial stability among street vendors and fosters self-reliance.

- With a one-year repayment period, street vendors have ample time to repay the loan.

- The program encourages entrepreneurship and opens up employment opportunities.

- It focuses on providing financial aid to street vendors impacted by the economic fallout of the COVID-19 pandemic, aiding in their recovery.

- Implemented nationwide, the scheme is accessible in all States and Union Territories, ensuring that street vendors from all corners of the country can benefit from it.

PM SVANidhi Scheme Lending Institutions

- Regional Rural Banks

- Cooperative Banks

- Scheduled Commercial Banks

- Non-Banking Financial Companies

- Micro-Finance Institutions

- Self Help Groups (SHG) Banks

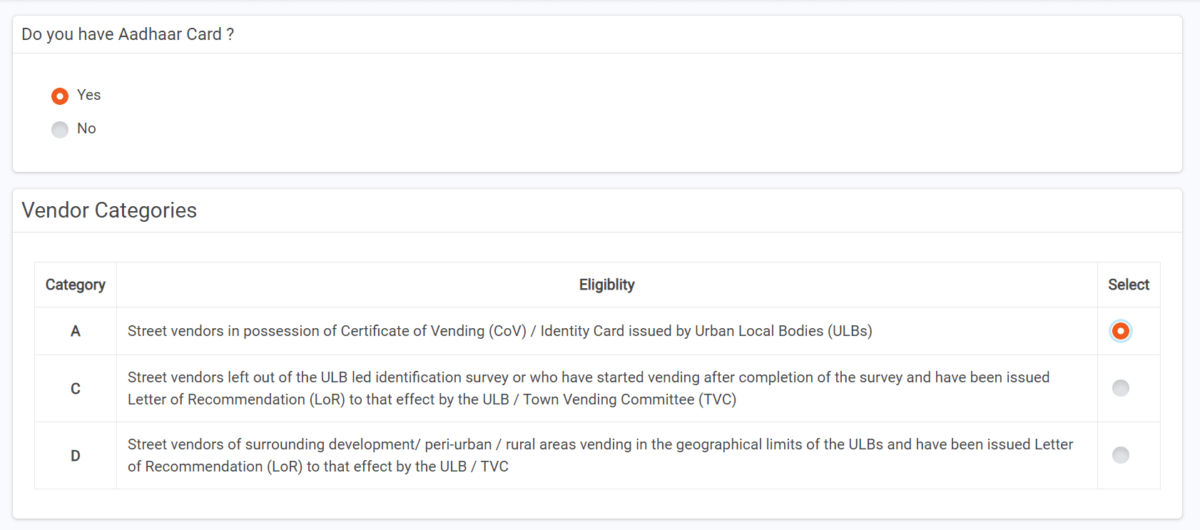

PM SVANidhi Scheme 2023 Eligibility Criteria

- Street vendors who possess a Certificate of Vending or Identity Card issued by Urban Local Bodies (ULBs).

- Street vendors who have been identified in the survey but have not yet received a Certificate of Vending or Identity Card.

- Street vendors who were not included in the ULB-led identification survey or those who commenced vending after the survey’s completion. They should have a Letter of Recommendation (LoR) issued by the ULB or Town Vending Committee (TVC) to confirm their status.

- Vendors from surrounding development, peri-urban, or rural areas engage in vending within the geographical boundaries of ULBs. They should also have a Letter of Recommendation (LoR) issued by the ULB or TVC to establish their eligibility.

PM SVANidhi Scheme 2023 Documents Required

The following are the important documents required for the PM SVANidhi Scheme.

- Aadhar Card

- Voter Identity Card

PM SVANidhi Scheme 2023 Loan Amount

The loan amount under the PM SVANidhi Scheme will be provided based on your requirements. It is advised to check the pre-application process before checking the loan amount. The loan that will be provided under this scheme starts at Rs 10,000 which will be collateral-free. Also, there will be no pre-penalty fees in case you repay the loan before the tenure ends. The loan tenure will be 1 year. After the successful repayment of the first loan, you will now be eligible for the Rs 20,000 loan. Similarly, you would be able to take the Rs 50,000 loan. Here is the complete information regarding the PM SVANidhi Scheme.

| PM SVANidhi Loan Amount 2023 | |

| First Term | Rs 10,000 |

| Second Term | Rs 20,000 |

| Third Term | Rs 50,000 |

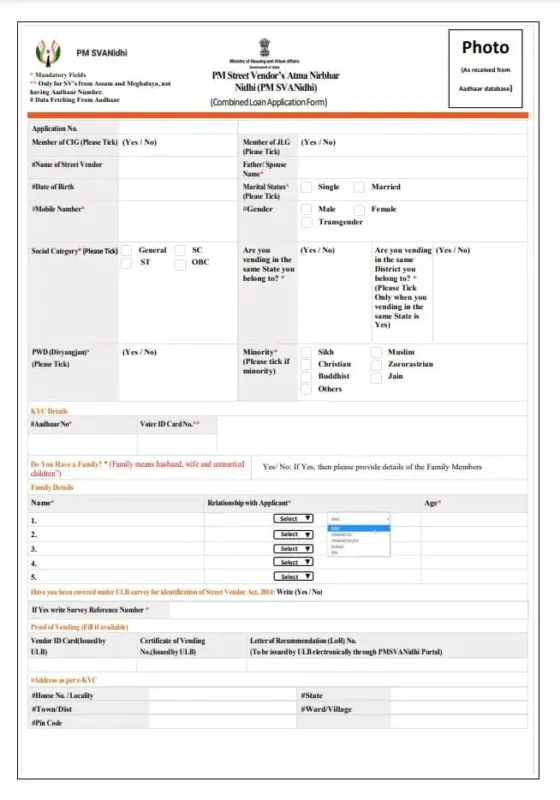

PM SVANidhi Scheme 2023 Application Process

If you want to apply for a loan under PM SVANidhi Yojana, you need to follow these easy steps and you will get the loan in no time. It should be noted that the information that you will provide to the authority must be true and valid. Any mistake in the application form can lead to the rejection of the loan. Here is the step-by-step process of the PM SVANidhi scheme that you have to follow.

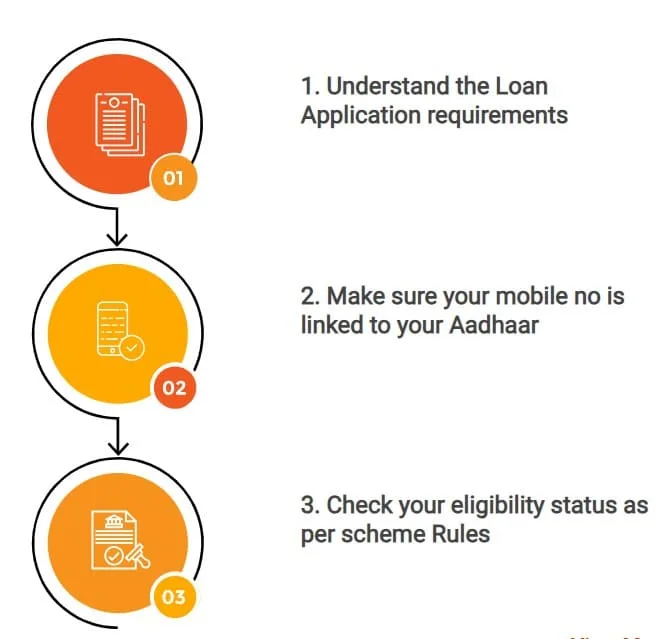

Pre-Application Steps:

Before you apply for the loan make sure to complete these vital pre-application steps that will increase your chances of approval for the loan.

- You first need to understand your loan requirements. It must be clear in your mind about the business that you need to take the loan for. After that, read the application form very carefully and arrange all the required information that is asked in the form.

- Secondly, you must ensure that your mobile number is linked with your Aadhar Card. This is essential.

- A third and most important step that you need to do before starting the application process is to check your eligibility status as per scheme Rules in order to keep the documents ready. Here is the complete information regarding the categories under which your loan will be sanctioned.

| Category | Vendor Status | Action required by Vendor |

| A. | The vendor has been covered in the survey of Urban Local Body (ULB) and has been issued a Certificate of Vending (CoV) or Identity card (ID Card) by ULB or the Town Vending Committee | Check your name in the survey list on the portal and note your Survey Reference Number (SRN).Keep a copy of your CoV or ID card ready for uploading during the application process |

| B. | The vendor has been covered in the survey of Urban Local Body (ULB) and has not been issued a Certificate of Vending or Identity card by the ULB or the Town Vending Committee | Check your name in the survey list on the portal and note your Survey reference Number (SRN).A Provisional CoV shall be generated for you by the system while making online application |

| C. | Street vendors left out of the ULB-led identification survey or who have started vending after completion of the survey.2 subcategories will be there : | |

| C1: Vendor has been issued a Letter of Recommendation by ULB/ TVC | Keep a copy of LoR ready for uploading | |

| C2 : Vendor has not been issued LoR | Vendor to declare one of the following: i. Vendor has received One Time assistance during the Covid lockdown ii. The vendor is a member of the vending/ Hawkers association. | |

| D. | Street vendors of surrounding development/peri-urban/rural areas vending in the geographical limits of the ULBs (not covered in the Survey)2 subcategories will be there: | |

| D1: The vendor has been issued a Letter of Recommendation by ULB/ TVC | Keep a copy of LoR ready for uploading | |

| D2: Vendor has not been issued LoR | Vendor to declare one of the following: i. Vendor has received One Time assistance during the Covid lockdown ii. The vendor is a member of the vending/ Hawkers association. | |

Online Application Process

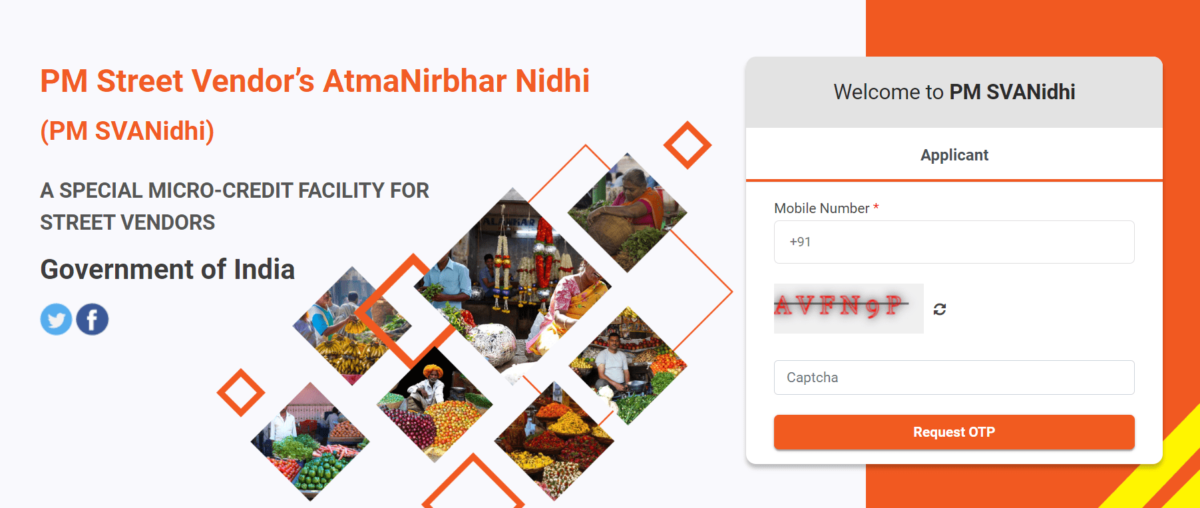

After completing the three aforementioned steps, you are prepared to initiate the application process on the portal. You have the option to apply directly on your own or seek assistance through a nearby Common Service Centre (CSC) in your area.

- Visit the official website of “PM SVANidhi” and click on “Apply Loan for 10k”

- After that new screen will appear where you have to enter your “Mobile Number”

- An “OTP” will be sent to your mobile number. It is required to enter the mobile number that is linked to your Aadhar Card.

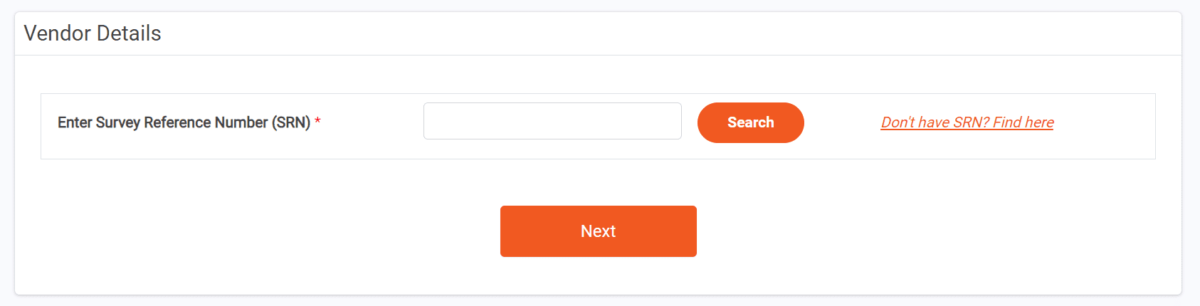

- After entering the OTP, the following screen will be displayed where you have to enter your “Survey Reference Number” along with other required details.

- Based on your information, an application form will appear on the screen where you must provide the required information.

- The next step is to UPLOAD the required documents needed for the combined loan application form.

- After filling out the application form, you need to “Submit” Button.

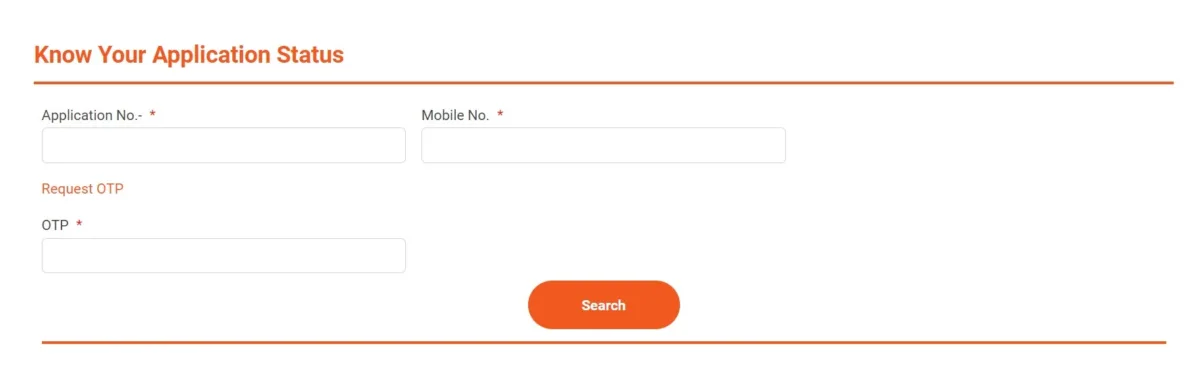

PM SVANidhi Scheme 2023 Check Application Status

After applying for the PM SVANidhi Scheme, you have to wait a little. At this time, the information provided in the application form will be scrutinized by the authority. You can check whether your application request is accepted or not by checking your application status on the official PM SVANidhi Scheme website.

- Visit the official PM SVANidhi Scheme website.

- Click on the “Know your Application Status” tab. This will take you to another page.

- In the application status screen, you have to provide your “Application Number” and “Mobile Number”. You then have to request for OTP.

- After receiving the OTP, you need to enter that in the OTP Section and press the “Search” button.

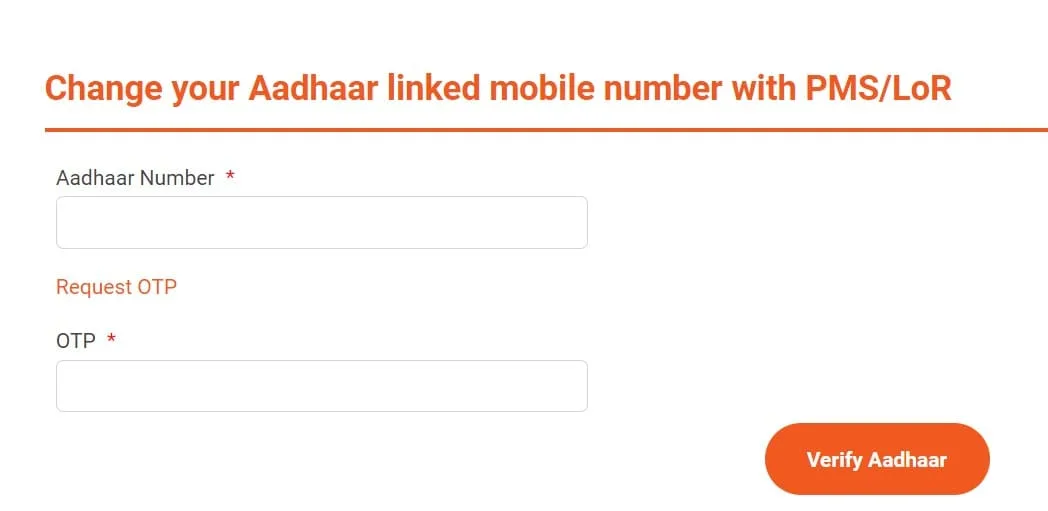

Please Note:

You can change your mobile number through the official website. You just need to login through your mobile number and OTP.

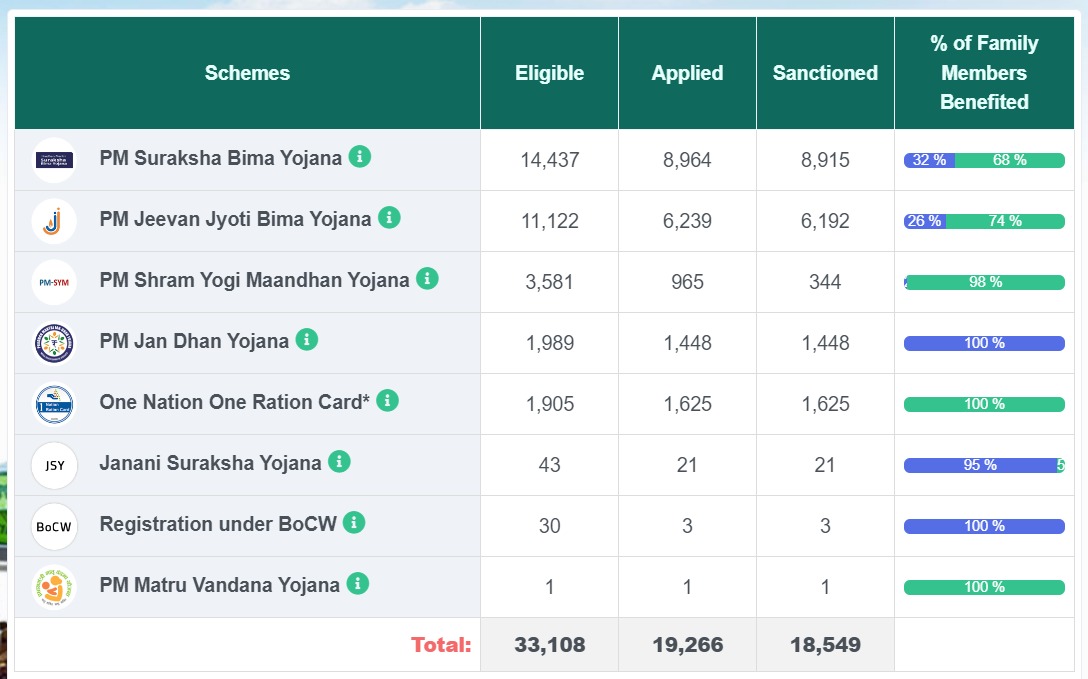

SVANidhi se Samriddhi Program

On January 4, 2021, ‘SVANidhi se Samriddhi,’ an extension of the PMSVANidhi program, was inaugurated in the first phase, encompassing approximately 35 Lakh street vendors and their families across 125 cities. A total of 22.5 Lakh scheme approvals were granted, including 16 Lakh beneficiaries receiving insurance benefits from schemes like Pradhan Mantri Suraksha Bima Yojana and Pradhan Mantri Jeevan Jyoti Yojana, as well as 2.7 Lakh beneficiaries availing pension benefits through the Pradhan Mantri Shram Yogi Maandhan Yojana, among other benefits.

Following the successful implementation of Phase I, the Ministry of Housing and Urban Affairs (MoHUA) expanded the program to an additional 126 cities, aiming to encompass 28 Lakh street vendors and their families, with a total target of 20 Lakh scheme approvals for the fiscal year 2022-23. To date i.e. October 03, 2023, over 51 lakh sanctions under these schemes have been granted for the upliftment of beneficiary street vendors’ families.

Here is the list of schemes included under the ‘SVANidhi se Samriddhi,’ program.

| Name of the Scheme | Ministry/Department Name |

| Pradhan Mantri Jeevan Jyoti Bima Yojana | Department of Financial Services |

| PM Suraksha Bima Yojana | Department of Financial Services |

| Pradhan Mantri Jan Dhan Yojana | Department of Financial Services |

| Pradhan Mantri Shram Yogi Maandhan Yojana | Ministry of Labour and Employment |

| One Nation One Ration Card (ONORC) | Ministry of Consumer Affairs, Food and Public Distribution |

| Janani Suraksha Yojana | Ministry of Health and Family Welfare |

| Pradhan Mantri Matru Vandana Yojana (PMMVY) | Ministry of Women and Child Development |

| Registration under BoCW | Ministry of Labour and Employment |

PM SVANidhi Scheme FAQs

What is the PM SVANidhi Scheme?

PM SVANidhi Scheme is a special micro-credit facility for street vendors in India. Under this scheme, eligible street vendors will be provided a loan of up to Rs 50,000 starting from Rs 10k. This loan will be collateral-free and can be repaid in a one-year term.

What is the interest rate of the loan taken under PM SVANidhi Shceme?

Under the PM SVANidhi Scheme, street vendors can take the loan at a subsidized interest rate of 7%. Please note that this loan will be collateral-free.

How to check the Application Status under this scheme?

Under the PM SVANidhi Scheme, you can check your application status from the official website. You just need to enter your application number and registered mobile number

Which City has been ranked as a top performer under the PM SVANidhi Scheme in 2023?

Varanasi has been ranked as the top performer under the PM SVANidhi Scheme followed by cities like Bengaluru, Chennai, and Prayagraj.

What are the KYC documents required in addition to the Certificate of Vendor/ ID / LoR?

Aadhaar Card*

Voter Identity Card

Driving License

MNREGA Card

PAN Card.

What is the amount of incentive for digital transactions under the PM SVANidhi Scheme?

The on-boarded vendors would be provided with a monthly cashback in the range of Rs 50 – Rs 100 as per the following criteria:

On executing 50 eligible transactions – Rs50

On executing the next 50 eligible transactions – Additional Rs 25,

On executing the next 100 eligible transactions – An additional Rs 25.

Each transaction > Rs 25 will be counted.