In India, unorganized workers constitute a significant segment of the labor force, playing a crucial role in various sectors of the economy. This vast and diverse group encompasses individuals engaged in informal and non-contractual employment, often lacking job security, social protection, and other basic rights. From street vendors and domestic workers to agricultural laborers, the unorganized workforce forms the backbone of many industries. Despite their substantial contribution to the economy, these workers face numerous challenges, including low wages, limited access to healthcare and education, and vulnerability to exploitation. To improve the conditions of unorganized workers, the Pradhan Mantri Shram Yogi Maandhan Yojana was launched on February 15, 2019.

In this article, we are going to talk about the scheme in detail. I am certain that by the end of the article, you won’t have any doubt left regarding the same.

What is Pradhan Mantri Shram Yogi Maandhan Yojana?

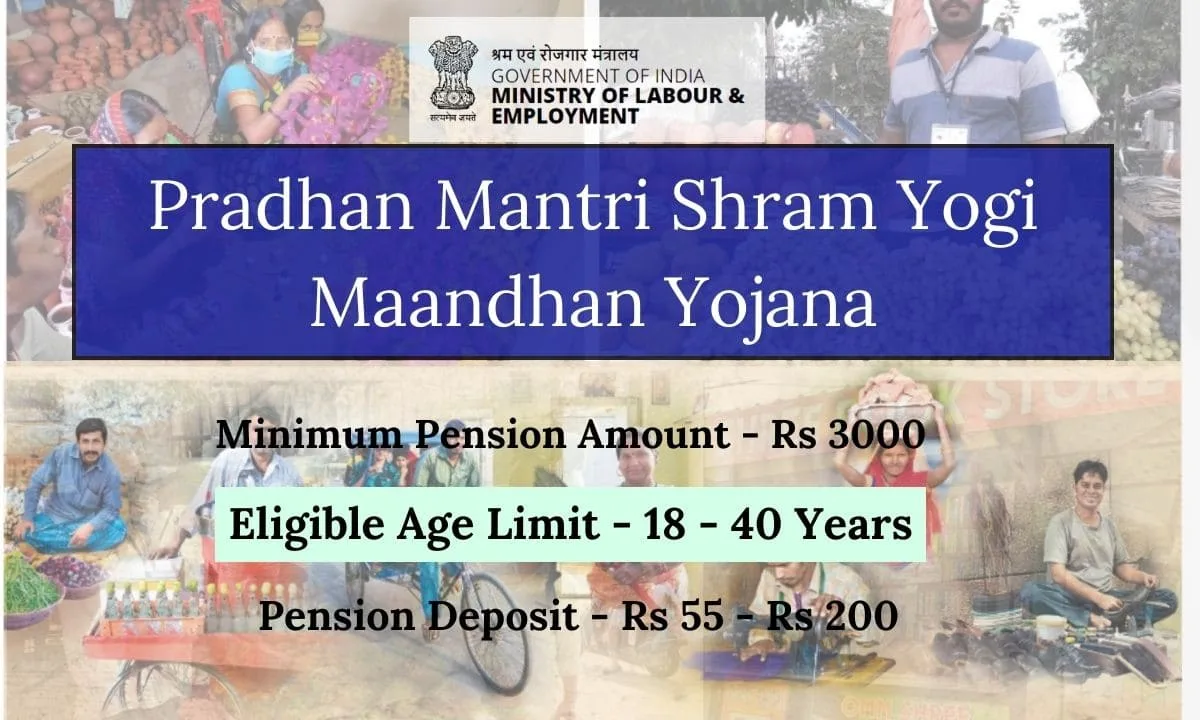

Pradhan Mantri Shram Yogi Maandhan Yojana is a contributory pension scheme for the unorganized workers of India. This scheme was launched on February 15, 2019, by the current Prime Minister Narendra Singh Modi. Under this scheme, the minimum pension of Rs 3000 is guaranteed and will be available upon reaching 60 years of age and afterward. This scheme is for people working as unorganized workers and earning Rs 15,000 or less per month. Applicants only between 18 and 40 years of age can apply for the scheme. Also, this scheme is meant for old age and social security of unorganized workers.

The unorganized workers mostly engaged as home-based workers, street vendors, mid-day meal workers, head loaders, brick kiln workers, cobblers, rag pickers, domestic workers, washer men, rickshaw pullers, landless laborers, own account workers, agricultural workers, construction workers, beedi workers, handloom workers, leather workers, audio- visual workers, and similar other occupations. Let’s talk about the scheme in detail.

| Pradhan Mantri Shram Yogi Maandhan Yojana 2023 Key Highlights | |

| Pradhan Mantri Shram Yogi Maandhan Yojana Launch Date | February 15, 2019 |

| Pradhan Mantri Shram Yogi Maandhan Yojana Official Website | Click Here |

| Pradhan Mantri Shram Yogi Maandhan Yojana Objective | To provide old age pensions and social security to unorganized workers in India |

| Pradhan Mantri Shram Yogi Maandhan Yojana Pension Amount | Minimum – Rs 3000Maximum – Based on the Deposit |

| Pradhan Mantri Shram Yogi Maandhan Yojana Age Limit | Between 18 and 40 years of age |

| Pradhan Mantri Shram Yogi Maandhan Yojana Pension Deposit | Rs 55 to Rs 200 per month |

| Pradhan Mantri Shram Yogi Maandhan Yojana Government Contribution percentage | 50% |

| Pradhan Mantri Shram Yogi Maandhan Yojana Mode of Application | Offline- CSC CentreOnline -Maandhan |

| Pradhan Mantri Shram Yogi Maandhan Yojana Implementing Agency | LIC |

| Pradhan Mantri Shram Yogi Maandhan Yojana under which Ministry | Minister of Labour and Employment |

| Pradhan Mantri Shram Yogi Maandhan Yojana Helpline Number | 14434 1800 267 6888 (Toll Free) |

Pradhan Mantri Shram Yogi Maandhan Yojana Objective

The primary objective of the Pradhan Mantri Shram Yogi Maandhan Yojana is to provide an old age pension to the people working in the unorganized sector. This scheme also provided social security to the workers working in the unorganized sector like street vendors and others.

- Provide financial security to unorganized workers.

- Ensure a pension for individuals in the informal sector.

- Facilitate voluntary and contributory pension contributions.

- Offer a minimum assured pension of Rs 3000 per month after the age of 60.

- Extend family pension benefits to the spouse.

- Allow for flexible exit and withdrawal options.

- Enable contributions through auto-debit from savings bank accounts.

- Promote grievance redressal through a dedicated customer care number and online platforms.

- Foster financial inclusivity by providing a pension solution for those without formal employment benefits.

Pradhan Mantri Shram Yogi Maan Dhan Yojana Features

- Voluntary and Contributory Scheme:

- PM-SYM is a voluntary pension scheme where subscribers contribute towards their pension.

- Minimum Assured Pension:

- Subscribers are assured a minimum pension of Rs 3000 per month upon reaching the age of 60.

- Family Pension Benefit:

- In the event of the subscriber’s demise during the pension receipt period, the spouse is entitled to receive 50% of the pension as a family pension. This benefit is exclusive to the spouse.

- Continuation by Spouse:

- If a beneficiary, who has made regular contributions, passes away before the age of 60, the spouse has the option to join and continue the scheme by paying regular contributions. Alternatively, they can exit the scheme following the provisions of exit and withdrawal.

Pradhan Mantri Shram Yogi Maan Dhan Yojana Benefits

- Minimum Assured Pension:

- A guaranteed monthly pension of Rs 3000/- is provided upon reaching 60.

- Survivor Benefits:

- In the event of the applicant’s demise before the age of 60, the spouse can continue the scheme, receiving 50% of the pension amount.

- Pension Claim:

- Upon attaining the age of 60, the applicant can claim the fixed pension amount, deposited monthly into their pension account.

- Early Exit (Less than 10 Years):

- If the subscriber exits within less than 10 years, only the beneficiary’s share of the contribution is returned with savings bank interest.

- Exit After 10 Years but Before 60:

- If the subscriber exits after 10 years but before reaching 60, the beneficiary receives their share of the contribution with accumulated interest, either as earned by the fund or at the savings bank interest rate, whichever is higher.

- Death of Contributor:

- If a contributor dies after regular contributions, the spouse can continue the scheme by paying regular contributions or exit by receiving the beneficiary’s contribution with accumulated interest, based on the higher of the fund’s actual earnings or the savings bank interest rate.

- Permanent Disability of Contributor:

- In the case of permanent disability before 60, if the contributor cannot continue, the spouse can either continue the scheme with regular contributions or exit, receiving the beneficiary’s contribution with interest, based on the higher of the fund’s actual earnings or the savings bank interest rate.

- Corpus Distribution After Subscriber and Spouse’s Death:

- Upon the death of both the subscriber and their spouse, the entire corpus will be credited back to the fund.

Please Note: They should not be covered under the New Pension Scheme (NPS), Employees‟ State Insurance Corporation (ESIC) scheme, or the Employees‟ Provident Fund Organisation (EPFO).

Pradhan Mantri Shram Yogi Maan Dhan Yojana Eligibility Criteria

- Individuals categorized as Unorganized Workers (UW) are eligible.

- Entry age must fall within the range of 18 to 40 years.

- Monthly income should not exceed Rs 15,000

Exclusions:

- Those liable to pay Income Tax are not eligible.

- Individuals who are members or beneficiaries of the Employees’ State Insurance Corporation (ESIC) are excluded.

- Individuals who are members or beneficiaries of the Employees’ Provident Fund Organisation (EPFO) are also not eligible.

Pradhan Mantri Shram Yogi Maandhan Yojana Documents Required

- Aadhaar Card

- Savings Bank Account or Jan Dhan account number along with the IFSC

- Optionally, the Shram UAN Card Number can be provided.

Pradhan Mantri Shram Yogi Maandhan Yojana Apply Online

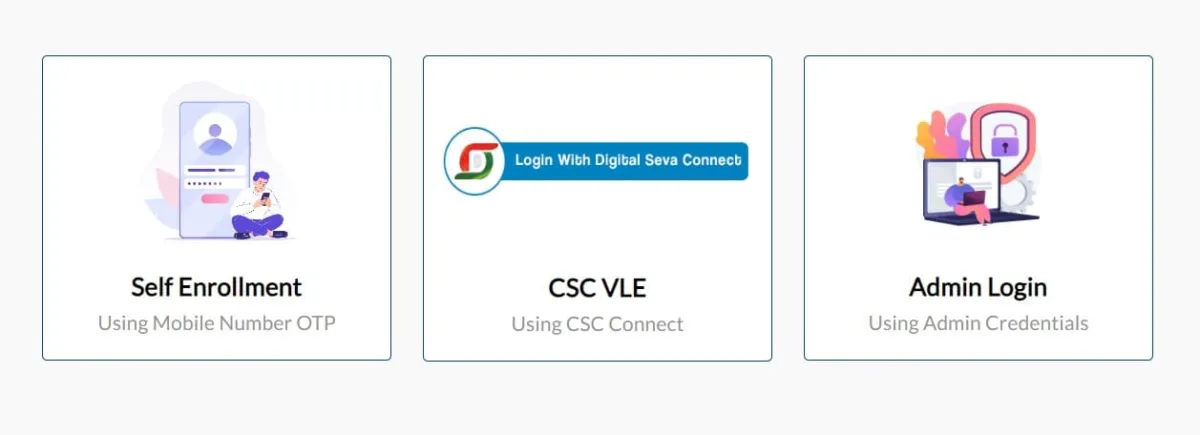

You can also self-enroll for the Pradhan Mantri Shram Yogi Maandhan Yojana by visiting the official website.

Self-Enrollment Prerequisites:

Before applying for the PMSYM Yojana, it is important to have the following documents in hand.

- The applicant needs to possess an Aadhaar Card.

- Savings/Jan Dhan Bank Account details, including the IFSC Code, are required, supported by documentation such as the Bank Passbook, Cheque Leave/book, or a bank statement.

Self-Enrollment Process:

- Visit the official website of Pradhan Mantri Shram Yogi Maandhan Yojana.

- Click on “Services” and click on the “New Enrollment” Tab.

- A new page will be displayed.

- The applicant initiates the process by inputting the mobile number. An OTP will be generated by entering your number. Enter the OTP and click on the submit button.

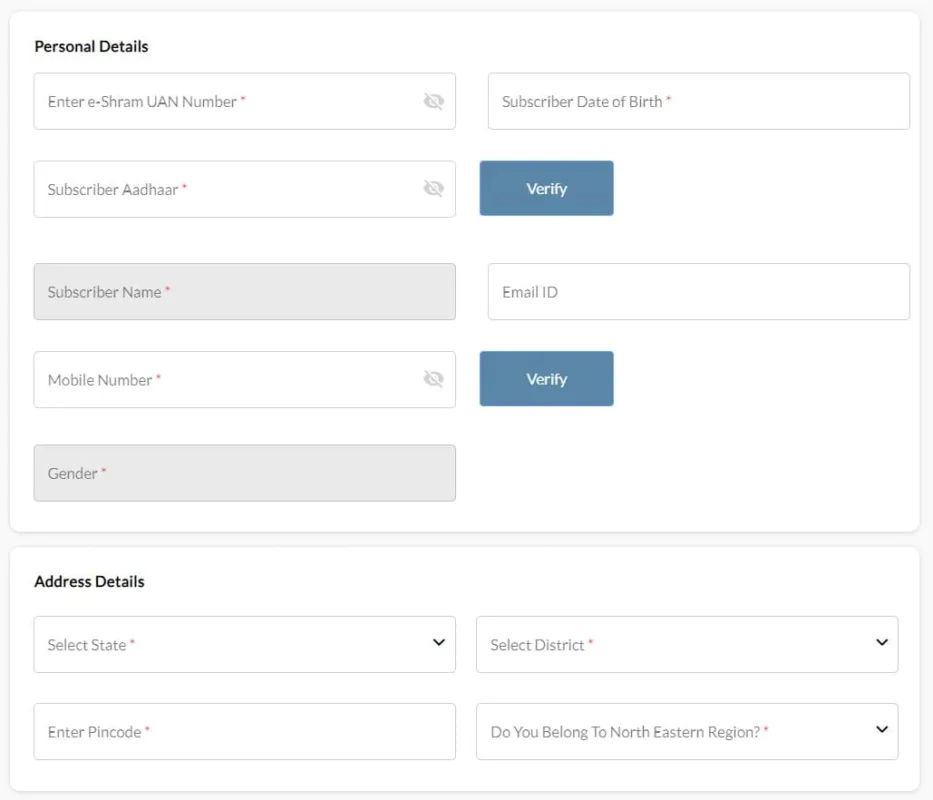

- The complete Pradhan Mantri Shram Yogi Maandhan Yojana application form will be displayed on the screen.

- Here you have to enter all the required information asked in the application form.

- You need to provide comprehensive details like Bank Account information, Mobile Number, Email Address, Spouse information (if applicable), and Nominee details.

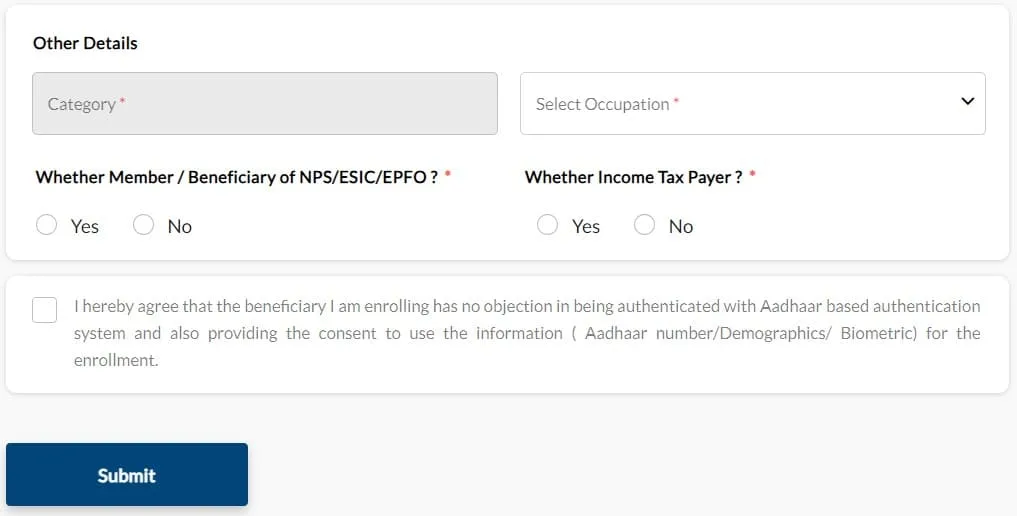

- The applicant engages in self-certification, ensuring compliance with eligibility conditions.

- The system autonomously calculates the monthly contribution based on the age of the beneficiary.

- The Enrollment cum Auto Debit mandate form is generated, signed by the applicant, and subsequently scanned and uploaded by the Village Level Entrepreneur (VLE).

- You then need to complete the payment of the first subscription amount using Internet Banking.

Documentation and Verification:

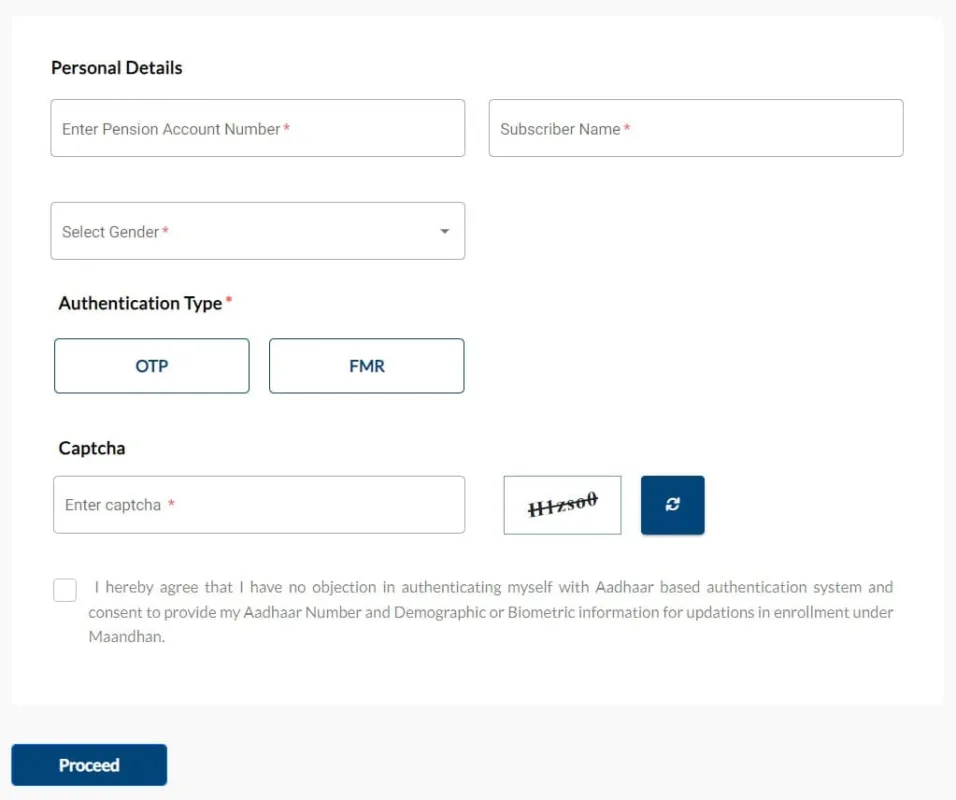

- A unique Shram Yogi Pension Account Number (SPAN) is generated for the applicant.

- The ShramYogi Card, containing pertinent details, is printed and provided to the applicant.

Pradhan Mantri Shram Yogi Maandhan Yojana Apply Online- Via CSC

Prerequisites for Enrollment:

- Aadhaar Card

- Savings/Jan Dhan Bank Account details with IFSC Code (Bank Passbook, Cheque Leave/book, or bank statement as evidence)

- Initial cash contribution to the Village Level Entrepreneur (VLE)

Enrollment Process Steps:

- VLE inputs Aadhaar number, beneficiary’s name, and date of birth for authentication

- Online registration completed by the VLE, capturing Bank Account details, Mobile Number, Email Address, Spouse info (if any), and Nominee details

- Self-certification for eligibility conditions

- The system auto-calculates monthly contributions based on the beneficiary’s age

- The beneficiary pays the first subscription amount in cash to the VLE

Documentation and Verification:

- Enrollment cum Auto Debit mandate form generated

- Beneficiary signs the form, and VLE scans and uploads it into the system

- Unique Shram Yogi Pension Account Number (SPAN) generated

- Shramyogi Card printed for the beneficiary

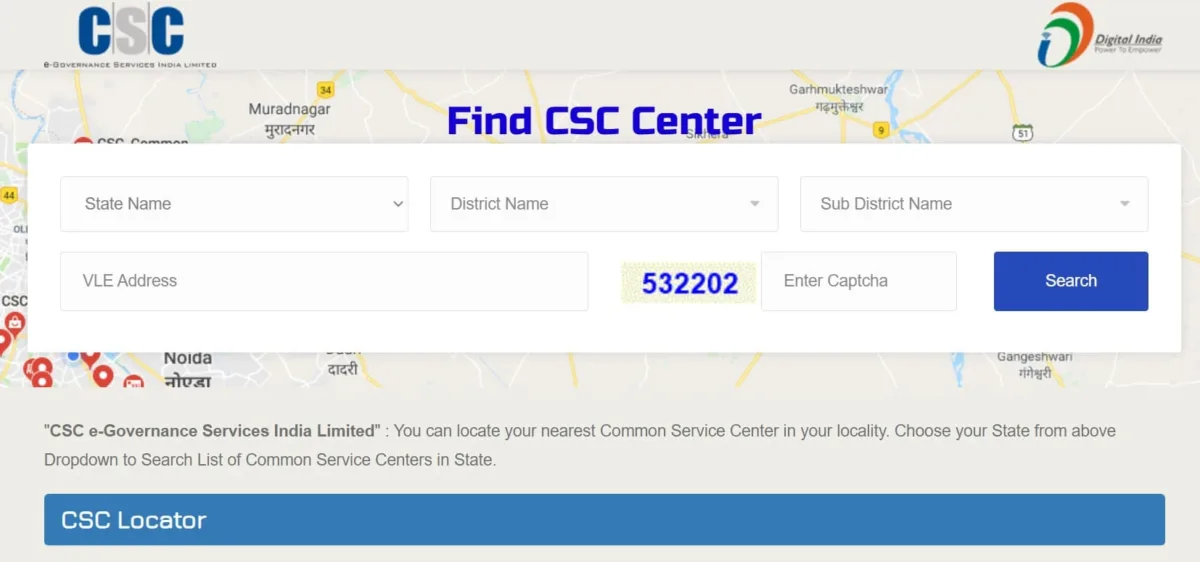

Please Note: To locate the closest CSC center, kindly visit this website. You need to provide State Name, District Name, and other relevant information.

Pradhan Mantri Shram Yogi Maandhan Yojana Exit and Withdrawal Guidelines

One can exit volunteer or involuntarily under this scheme. You can know everything about the rules and regulations by reading below.

Voluntary Exit Application Form

- If a subscriber exits within less than 10 years, only the beneficiary’s contribution will be returned with savings bank interest.

- For exits after 10 years but before reaching the superannuation age of 60, the beneficiary receives their contribution with accumulated interest, either as earned by the fund or at the savings bank interest rate, whichever is higher.

- In the unfortunate event of the death of a beneficiary who made regular contributions, the spouse can continue the scheme by paying regular contributions or exit, receiving the beneficiary’s contribution with interest based on the higher of the fund’s actual earnings or the savings bank interest rate.

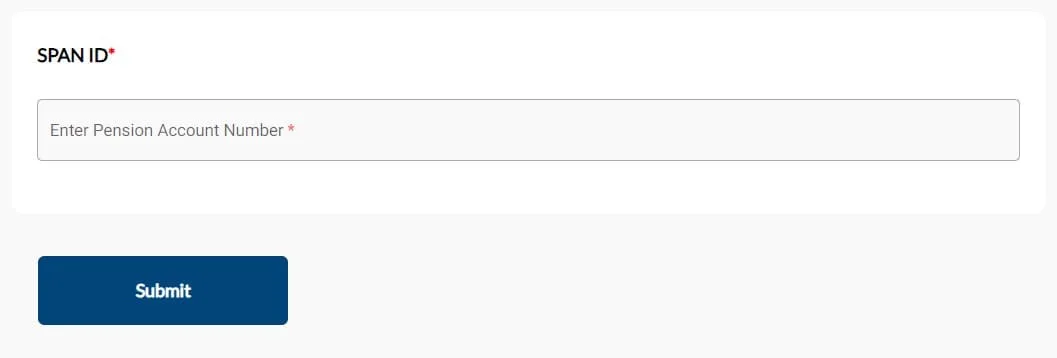

Involuntary Exit: For that, you just need to enter your SPAN Number

- If a beneficiary becomes permanently disabled before the age of 60 and cannot continue contributing, the spouse can either continue the scheme with regular contributions or exit, receiving the beneficiary’s contribution with interest, based on the higher of the fund’s actual earnings or the savings bank interest rate.

- Upon the death of both the subscriber and their spouse, the entire corpus will be credited back to the fund.

- Any additional exit provisions will be determined by the Government on the advice of NSSB.

Pradhan Mantri Shram Yogi Maandhan Yojana Pension Amount

Upon enrollment in the scheme at an entry age between 18 and 40 years, the beneficiary is required to make contributions until reaching the age of 60. Upon reaching 60 years of age, the subscriber becomes eligible to receive the assured monthly pension of Rs. 3000, along with the potential benefit of a family pension, if applicable.

- Contributions to PM-SYM are facilitated through the automatic debit (auto-debit) feature from the subscriber’s savings bank account or Jan-Dhan account.

- Subscribers are obligated to contribute the specified amount from the time of joining PM-SYM until reaching the age of 60.

The monthly contribution chart, categorized by entry age, is provided below.

| Entry Age | Superannuation Age | Member Monthly’s Contribution (in Rupees) | Central Government Monthly Contribution (in Rupees) | Total Monthly Contribution (in Rupees) |

| 18 | 60 | 55 | 55 | 110 |

| 19 | 60 | 58 | 58 | 116 |

| 20 | 60 | 61 | 61 | 122 |

| 21 | 60 | 64 | 64 | 128 |

| 22 | 60 | 68 | 68 | 136 |

| 23 | 60 | 72 | 72 | 144 |

| 24 | 60 | 76 | 76 | 152 |

| 25 | 60 | 80 | 80 | 160 |

| 26 | 60 | 85 | 85 | 170 |

| 27 | 60 | 90 | 90 | 180 |

| 28 | 60 | 95 | 95 | 190 |

| 29 | 60 | 100 | 100 | 200 |

| 30 | 60 | 105 | 105 | 210 |

| 31 | 60 | 110 | 110 | 220 |

| 32 | 60 | 120 | 120 | 240 |

| 33 | 60 | 130 | 130 | 260 |

| 34 | 60 | 140 | 140 | 280 |

| 35 | 60 | 150 | 150 | 300 |

| 36 | 60 | 160 | 160 | 320 |

| 37 | 60 | 170 | 170 | 340 |

| 38 | 60 | 180 | 180 | 360 |

| 39 | 60 | 190 | 190 | 380 |

| 40 | 60 | 200 | 200 | 400 |

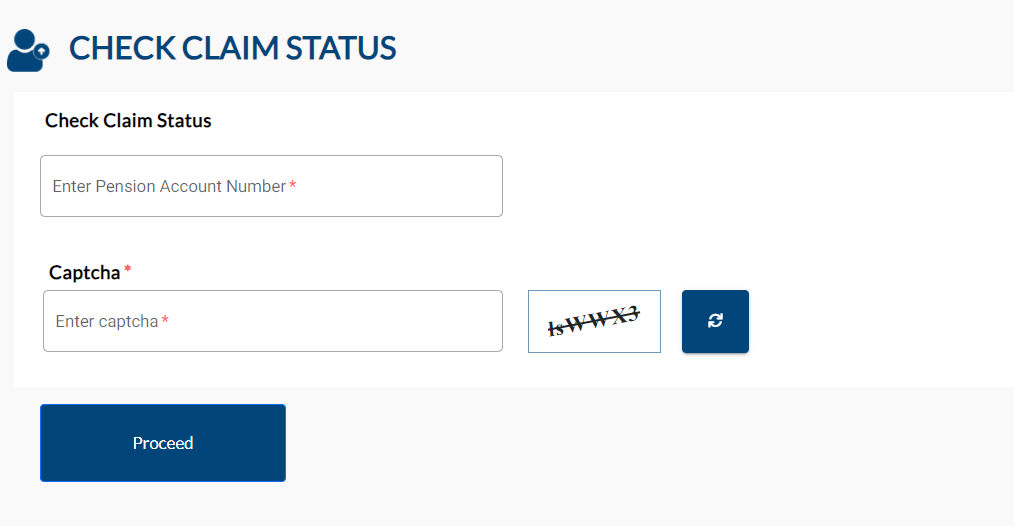

Pradhan Mantri Shram Yogi Maandhan Yojana Check Claim Status

You can check your claim status by entering Pension Account Number and captcha.

Pradhan Mantri Shram Yogi Maandhan Yojana FAQs

What is Pradhan Mantri Shram Yogi Maandhan Yojana?

Pradhan Mantri Shram Yogi Maandhan Yojana is a special pension scheme for unorganized workers in India. Under this scheme, a minimum pension of Rs 3000 is guaranteed.

What is the minimum investment one has to make per month at 29 years of age?

At 29 years of age, one would have to invest Rs 100 every month. The same amount will be contributed by the central government.

What is the eligible age limit for the Pradhan Mantri Shram Yogi Maandhan Yojana?

The eligible limit for the Pradhan Mantri Shram Yogi Maandhan Yojana is 18 – 40 years of age.

Who is the implementing agency under the Pradhan Mantri Shram Yogi Maandhan Yojana?

LIC of India is the implementing agency under the Pradhan Mantri Shram Yogi Maandhan Yojana.

Who is eligible to subscribe to this Scheme?

Any unorganized worker between the ages of 18 and 40, engaged in casual occupations like home-based work, street vending, manual labor, etc., with a monthly income below Rs 15,000/- can subscribe. Eligible occupations include but are not limited to street vendors, rag pickers, domestic workers, agricultural laborers, construction workers, and more. It’s essential that the worker is not covered by existing social security schemes like the National Pension Scheme (NPS), Employees’ State Insurance Corporation scheme, or Employees’ Provident Fund Organization Scheme, and is not an income taxpayer.

What happens if a worker initially joins the Scheme as an unorganized worker, later transitions to the organized sector by enrolling under EPFO, and then returns to the unorganized sector?

If a worker moves from the unorganized sector to the organized sector, they can still continue with the scheme. However, the government contribution will cease, and the member will need to pay an additional amount equivalent to the government’s share. Alternatively, the member has the option to withdraw their contribution along with accrued interest.

Is there a nomination facility under the scheme?

Certainly, the scheme provides a nomination facility. The beneficiary can nominate one person as their nominee under the scheme.

| OTHER SCHEMES FOR THE WORKERS IN UN-ORGANIZED SECTOR of India |

| PM SVANidhi Scheme 2023 |

| Pradhan Mantri Jeevan Jyoti Bima Yojana |

| PM Suraksha Bima Yojana |

| Pradhan Mantri Jan Dhan Yojana |