The Atal Pension Yojana (APY), introduced by the Government of India on June 1, 2015, is a comprehensive social security system for all citizens, particularly those who are economically disadvantaged and employed in the unorganized sector. The administration of APY falls under the jurisdiction of the Pension Fund Regulatory and Development Authority (PFRDA), operating within the overarching administrative and institutional framework of the National Pension System (NPS). In this article, we are going to talk about the scheme in detail.

What is Atal Pension Yojana?

The Atal Pension Yojana (APY) is a government-supported initiative designed to provide income security for individuals aged 60 and above. Primarily targeted at those engaged in the unorganized sector, this scheme aims to address the financial well-being of individuals during their non-productive years. To be eligible for the APY, applicants must fall within the age range of 18 to 40 years. It is important to note that individuals exceeding 40 years, even by a day, are ineligible to apply for this scheme. Under the Atal Pension Yojana (APY), subscribers are assured a guaranteed minimum monthly pension ranging from Rs. 1000 to Rs. 5000.

The Government of India (GoI) ensures the minimum pension benefit, providing a safety net for subscribers.

Additionally, the GoI participates by co-contributing 50% of the subscriber’s contribution or Rs. 1000 per annum, whichever is lower. This government co-contribution applies to individuals not covered by any Statutory Social Security Schemes and who are not income taxpayers.

Please Note: For those who enroll in the scheme between June 1, 2015, and December 31, 2015, the GoI extends its co-contribution to each eligible subscriber for 5 years. It’s important to note that the government’s co-contribution benefits, under APY, will not exceed a cumulative period of 5 years for all subscribers, including those who have migrated from the Swavalamban scheme.

Let’s explore the key features of the Atal Pension Yojana for a comprehensive understanding.

| Atal Pension Yojana 2023 Highlights | |

| Atal Pension Yojana Launch Date | May 09, 2015 |

| Atal Pension Yojana Official Website | APY Official Website |

| Atal Pension Yojana Objective | To provide an easy and secure pension option to the workers on unorganized workers |

| Atal Pension Yojana Beneficaires | Unorganized Workers in India |

| APY Age Limit | 18 – 40 Years |

| Atal Pension Yojana Implementing Agency | Pension Fund Regulatory and Development Authority (PFRDA), |

| APY Interest Rate (Latest) | Fixed interest rate (Compound Interest) |

| Minimum Guaranteed Pension | Rs 1000 per month |

| Maximum Guaranteed Pension | Rs 5000 per month |

| Tenure | 20 years (minimum). |

| Atal Pension Yojana Mode of Application | Offline |

| APY customer care | 1800-110-069 |

Why Does One Need a Pension?

Receiving a pension becomes crucial for individuals in their non-productive years, typically after reaching the age of 60. It enables them to lead a dignified life by reducing their financial reliance on others. As earning family members often migrate to urban areas for better employment prospects, elderly parents are left behind, rendering them vulnerable. The provision of a pension fosters financial independence among the elderly, contributing to an improved quality of life and potentially extending their longevity.

Atal Pension Yojana Features

Atal Pension Yojana is a voluntary pension system based on periodic contributions, offering subscribers the following benefits:

Guaranteed Minimum Pension by the Central Government: Each APY subscriber is assured a minimum pension amount of Rs. 1000, Rs. 2000, Rs. 3000, Rs. 4000, or Rs. 5000 per month from the Central Government after reaching the age of 60, continuing until the subscriber’s demise.

Guaranteed Minimum Pension for the Spouse: In the event of the subscriber’s death, the spouse is entitled to receive the same pension amount as the subscriber until the spouse’s death.

Pension Wealth Return to the Nominee: Following the demise of both the subscriber and the spouse, the nominee of the subscriber is entitled to receive the accumulated pension wealth until the subscriber’s age of 60.

Atal Pension Yojana Benefits

A confirmed minimum pension amount is assured, ranging from Rs. 1000 to Rs. 5000 per month, determined by the individual’s contributions, and will be provided until the individual’s demise. Subsequently, the spouse will continue to receive the guaranteed minimum pension amount until their demise. In the unfortunate event of both the subscriber and the spouse passing away, the nominee of the subscriber is eligible to receive the accumulated pension wealth, accrued until the subscriber’s 60th birthday.

Atal Pension Yojana Eligibility Criteria

Let’s check in detail on who is eligible for the Atal Pension Yojana

- He/she must be a citizen of India

- He/she must fall in the age bracket of 18-40 years.

- He/she must have a savings account in a bank/post office and should allow the auto-debit facility for the monthly/quarterly/ yearly installments.

You may also ask to provide your mobile number for any update in the scheme. Also, while enrolling, you may ask to provide your Aadhaar card. You must keep both things handy with you.

Documents required for APY

Here are the documents required to apply for the APY scheme

- Aadhaar Card

- Savings Account Details of Active Bank/Post Office

Can I Voluntarily Exit Before Attaining 60 Years of Age?

Yes. You can voluntarily exit before 60 Years of age. But the refund will be the contribution made by him along with the net actual accrued income earned on his contributions (after deducting the account maintenance charges). Do note that, in case you have joined the scheme before March 31, 2016, and received Government Co-Contribution. You won’t receive the Government co-contribution and the accrued income earned on the same if you opt for Voluntary exit before 60 years.

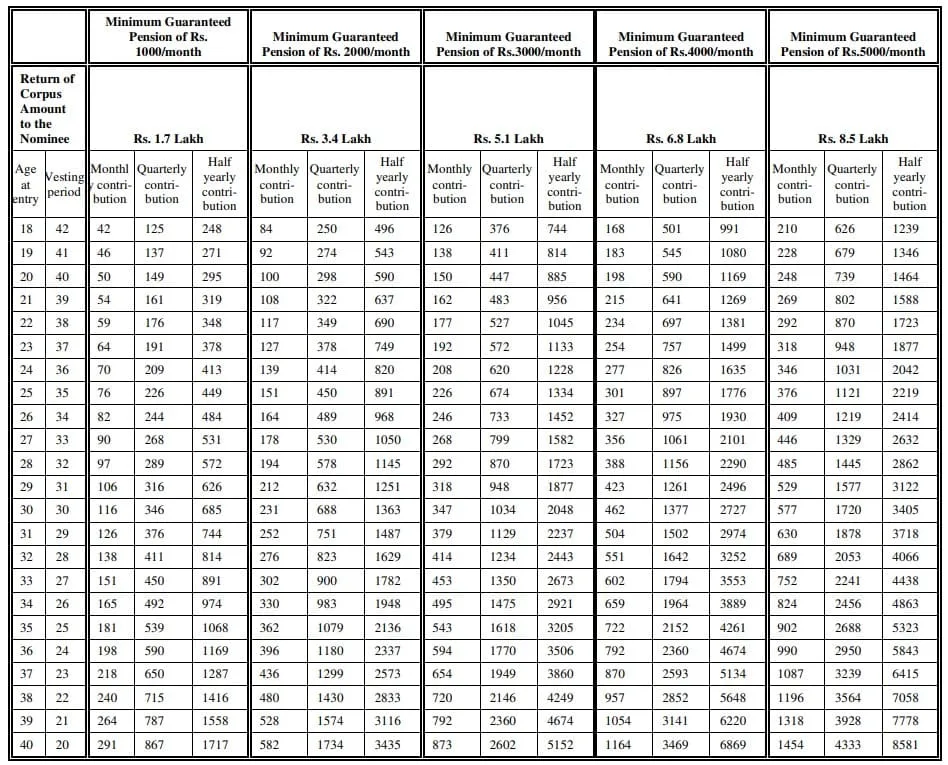

APY Contribution Chart

In case you would like to see how much you have to invest to acquire 1000/2000/3000/4000 and 5000 pensions per month, you can do so by checking the APY contribution chart. Please note that you can opt for monthly/ quarterly and yearly contributions in the APY scheme. Kindly check the APY contribution chart below.

Atal Pension Yojana Eligible Enrollment Centres

Enrollment agencies for Atal Pension Yojana (APY) accept applications through various channels, including:

- All types of banks, encompass nationalized banks, private banks, banking companies, regional rural banks, cooperative banks, etc. The submission can be made directly or through enablers such as:

- All Points of Presence (Service Providers) and Aggregators are governed by the institutional framework of the National Pension System (NPS). These entities are appointed as facilitators by the Pension Fund Regulatory and Development Authority (PFRDA) to collaborate with banks.

- Business Correspondents (BCs) and existing non-banking aggregators, Micro Finance Institutions (MFIs), etc., who are appointed as enablers by banks.

- Other enrollment agencies designated by PFRDA or the Central Government, such as the Department of Posts operate under the Core Banking Solution (CBS) Platform.

How to apply for Atal Pension Yojana Online?

You can apply for the Atal Pension Yojana online mode by the following means.

- By the net Banking facility of your bank: You have to visit the official website of your bank. Login with credentials and search for APY in the dashboard. After that, you have to fill in all the required details along with Nominee details. You also have to give consent for the auto-debit facility by the bank.

- By visiting the eNPS website: You can visit the official website of NPS and search for Atal Pension Yojana. Here are the steps you need to follow.

- Look for “APY Registration”.

- Fill the basic details in the form. One can complete KYC through 3 options – Offline KYC – Where one has to upload an XML file of one, Aadhaar – Where KYC is done through OTP verification on a Mobile Number registered with Aadhaar and Virtual ID – Where Aadhaar virtual ID is created for KYC.

- After all the basic details are filled, an acknowledgment number will be generated

- You have to fill in personal details and decide the pension amount you would want after 60 years. You can also decide the frequency of contribution for the scheme.

- After confirming personal details, you then have to fill in the nominee details (this is essential).

- After submitting the personal and Nominee details, you will be redirected to the NSDL website for eSign.

- Once Aadhaar is OTP verified, you will successfully register in APY.

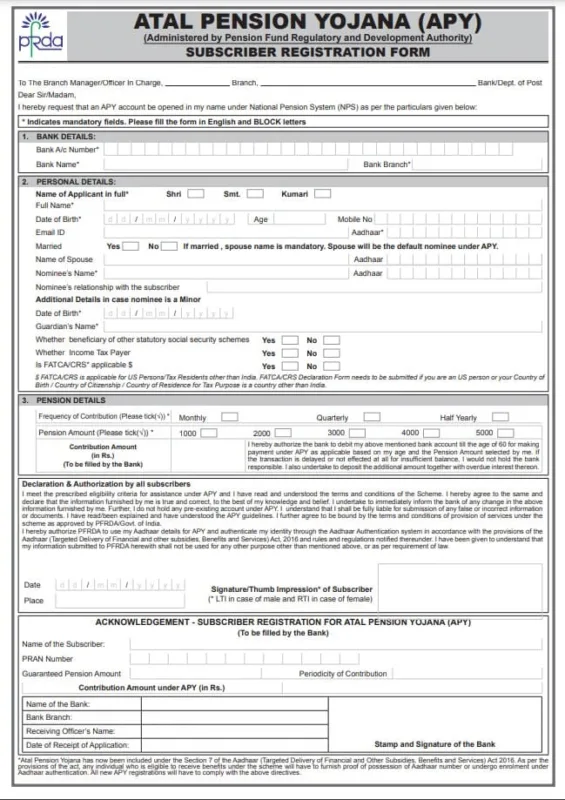

How to apply for Atal Pension Yojana APY Offline?

If you aren’t comfortable applying online, you can always go ahead and apply for the same through offline mode.

- All you have to do is visit your Bank/post office and fill out the APY Subscriber Application Form provided by them.

- Fill in all the basic details along with nominee details.

- You then have to decide the pension that you would like every month.

- Also, the frequency of the contribution should be mentioned.

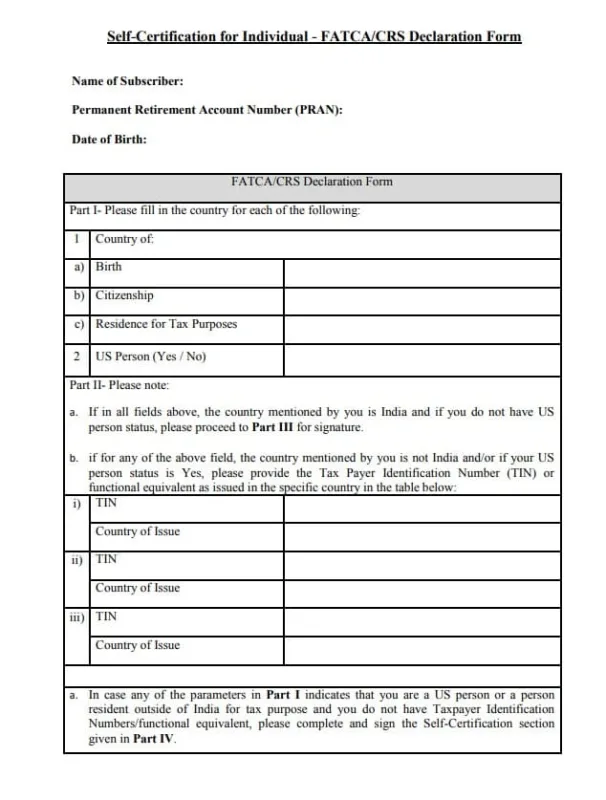

- After that, you also have to fill out a self-declaration form which should be submitted along with the application form.

- After submitting all the details, you will be provided with an acknowledgment number that you have to keep with yourself for future reference.

- You have successfully registered for the APY scheme.

How to Close or Exit from the Atal Pension Yojana Account?

You can also exit from the scheme anytime you want (before 60 years of age). For that, you have to visit your bank/post office branch and duly fill “Account Closure Form (Voluntary Exit) form”.

Along with the form, you also have to submit other relevant documents to the concerned APY-Service Provider branch.

In case you want to download the form in any other language, you can visit the official website. Got to >> Home >> Atal Pension Yojana >>Forms >>Withdrawal Form >> Voluntary exit APY withdrawal form.

Please note that the form can also be collected from the APY-Service Provider branch as well.

It is advisable for the subscriber to not close the savings bank account linked with the APY account even though the APY account gets closed because the closure proceeds that the subscriber will receive on the premature exit are transferred into the APY linked savings bank account and closure of this account may create problem in transfer of closure proceeds.

What if I don’t contribute to the APY Scheme on time?

Under APY, subscribers have to contribute every month. However, if you don’t do it on time, banks will be collecting additional amounts for delayed payments. The amount which will be levied as penalty is shown below.

- Rs. 1 per month for contributions up to Rs. 100 per month.

- Rs. 2 per month for contributions up to Rs. 101 to 500/- per month.

- Rs. 5 per month for contributions between Rs 501/- to 1000/- per month.

- Rs. 10 per month for contributions beyond Rs 1001/- per month.

The fixed amount of interest/penalty will remain as part of the pension corpus of the subscriber.

In case you don’t make payment for a long period, this shall lead to the following

- Your account will be frozen after 6 months

- Your account will be deactivated after 12 months.

- After 24 months, your account will be closed.

Who Cannot Apply for the APY Scheme?

From October 01, 2022, taxpayers won’t be allowed to join the APY scheme. If it is later discovered that the APY subscriber who has joined on or after October 01, 2022 has paid income taxes, his/her APY account will be terminated, and the subscriber will be given the total amount of pension wealth up to that point.

Members of statutory social security schemes are also not eligible under the APY scheme. Any member who is a beneficiary of any of the statutory schemes won’t be allowed to apply for the APY scheme. If you don’t know whether or not your scheme comes under a statutory social security scheme, you can ask your bank the same. Here are some statutory social security schemes that are not allowed.

Statutory social security scheme

- Employees’ Provident Fund and Miscellaneous Provision Act, 1952.

- The Coal Mines Provident Fund and Miscellaneous Provision Act, 1948.

- Assam Tea Plantation Provident Fund and Miscellaneous Provision, 1955.

- Seamens’ Provident Fund Act, 1966.

- Jammu Kashmir Employees’ Provident Fund and Miscellaneous Provision Act, 1961.

- Any other statutory social security scheme.

What if One Dies Before 60 Years of Age?

If the subscriber dies before attaining 60 years of age, the nominee/spouse can opt for two options.

Option 1: In case of the death of the subscriber before 60 years, his/her spouse has the option to continue contribution in the APY account of the subscriber, which can be maintained in the spouse’s name, for the remaining period, (till the original subscriber would have attained the age of 60 years).

The spouse of the subscriber then will be entitled to receive the same pension amount as the subscriber until the death of the spouse.

Please note: The spouse can maintain his/her pension amount, in addition to the subscriber APY account.

Option 2: The entire accumulated amount to date under APY will be returned to the spouse/nominee.

Why do we need APY when NPS is there for old-age pensions?

APY scheme and NPS scheme are both pension schemes, however, APY has been launched to cater the unorganized workers who don’t come under the tax slab and would want to draw certain pension after 60 years of age. The government is more focused on providing financial independence to people working in unorganized sectors and would want people coming under tax slab to incest in the NPS scheme.

Conclusion

APY is a very good step towards making people working in unorganized sectors financially independent in their old age. With vast options to choose from, APY has become a choice of many people.

Atal Pension Yojana FAQs

What is Atal Pension Yojana (APY)?

Atal Pension Yojana (APY) is a government-backed pension scheme introduced by the Government of India to provide a sustainable pension to unorganized sector workers. The scheme aims to ensure financial security during their old age. It is administered by the Pension Fund Regulatory and Development Authority (PFRDA) and is open to all Indian citizens aged between 18 and 40 years.

How does the Atal Pension Yojana work?

Under the Atal Pension Yojana, individuals can contribute a specific amount regularly, based on their chosen pension amount and age at entry. The pension amount options include Rs. 1,000, Rs. 2,000, Rs. 3,000, Rs. 4,000, and Rs. 5,000 per month. The contributions are made until the age of 60. The government also co-contributes 50% of the total contribution or Rs. 1,000 per year, whichever is lower, for five years for eligible subscribers who join the scheme between 2015 and 2020.

How can one enroll in the Atal Pension Yojana?

To enroll in the Atal Pension Yojana, individuals can visit their nearest bank branch or approach a registered service provider. They need to submit their Aadhar card, bank account details, and a filled-in APY registration form. The scheme can also be availed through internet banking facilities. After successful registration, the pension amount will be automatically debited from the bank account on the chosen contribution frequency (monthly, quarterly, or half-yearly).

What happens if one joins the scheme after the age of 40?

To avail of the benefits of Atal Pension Yojana, individuals need to join before the age of 40. If someone joins after the age of 40, they will not be eligible for government co-contribution. However, they can still continue contributing to the scheme until the age of 60 and receive the accumulated pension amount along with the interest upon reaching the retirement age.

Can a subscriber exit Atal Pension Yojana before the age of 60?

Yes, subscribers can exit Atal Pension Yojana before the age of 60, but there are specific conditions. In case of the subscriber’s unfortunate demise, the spouse can continue the scheme or claim the accumulated pension amount. Also, in the case of critical illnesses, subscribers can exit the scheme early, but the entire pension corpus will be paid to the subscriber or nominee, depending on the situation.

Who can apply for the Atal Pension Yojana?

APY is accessible to all Indian citizens who meet the specified eligibility criteria:

Individuals must be aged between 18 and 40 years.

A savings bank account or post office savings bank account is required.

As of October 1, 2022, individuals who are current or former income-tax payers under the Income-tax Act, 1961, are not eligible to open a new APY account.

Prospective applicants are encouraged to furnish their mobile numbers to the bank during the APY enrollment process to receive regular updates on their accounts and the scheme. Additionally, providing Aadhaar during enrollment is advisable, as APY is aligned with Aadhaar requirements.

Can a subscriber continue with APY if they become a taxpayer after enrollment?

Yes, the customer must not be an income-tax payer at the time of applying for registration under APY. If the subscriber becomes an income-tax payer at a later date, it will not affect their existing APY account. All such APY subscribers can continue contributing to their APY account and avail the benefits provided under the scheme.

How many APY accounts can I open?

An individual is allowed to open only one APY account. Multiple APY accounts for the same individual are not permitted. However, each eligible family member within the age range of 18-40 years can open their individual APY account.

Can a taxpayer open an APY account in their spouse’s name?

Yes, if the APY subscriber is an income taxpayer, their spouse, who is not an income taxpayer and meets other eligibility criteria, can open an individual APY account in their name.