Scheduled Castes (SC), Scheduled Tribes (ST), and women play pivotal roles in the societal fabric, each facing unique challenges and contributing significantly to the diversity and richness of our communities. Historically marginalized, SC and ST communities have faced social and economic disparities, often struggling against discrimination and limited access to resources. In efforts towards their empowerment, various schemes are launched including affirmative action policies and schemes like the Stand Up India initiative, which aim to provide financial support and create opportunities for entrepreneurship. In this article, we are going to talk about the Stand Up India Scheme in detail. If you have any queries about the scheme, you can comment below and you will soon get your answer.

What is the Stand Up India Scheme?

Stand Up India initiative was launched on April 5, 2016, by Prime Minister PM Modi in order to support and finance SC/ST and/or Women Entrepreneurs. Under this scheme, the eligible beneficiaries will get a bank loan between 10 lakh and 1 Crore at subsidized interest rate. The target is to provide loans to at least one SC, One ST, and one woman per bank branch.

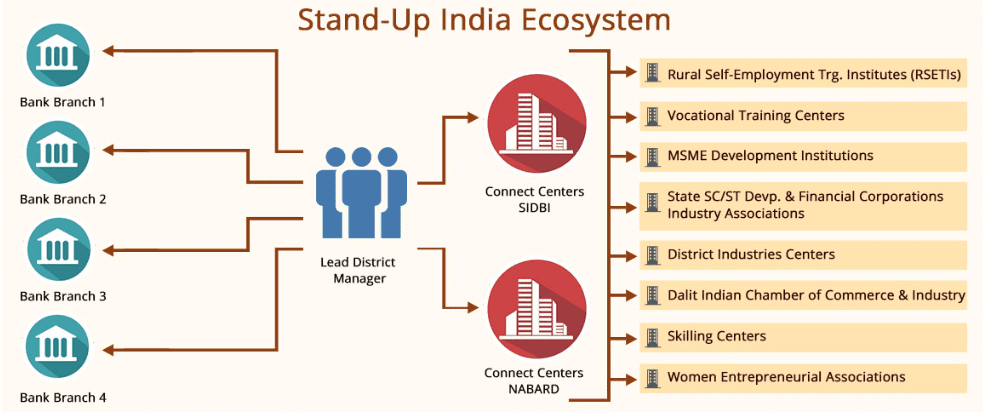

The Stand-Up India scheme is grounded in the acknowledgment of the obstacles encountered by SC, ST, and women entrepreneurs when establishing enterprises and securing essential support, including loans, crucial for their business success. The scheme is dedicated to establishing an ecosystem that fosters and sustains a supportive business environment. This initiative encompasses all branches of Scheduled Commercial Banks and can be accessed through three main channels:

- Directly at the branch,

- via SIDBI’s Stand-Up India portal, or

- Lead District Manager (LDM).

This multi-channel approach aims to enhance accessibility and streamline the process for aspiring entrepreneurs from marginalized communities, promoting inclusivity and equal opportunities.

| Stand Up India 2023 Key Highlights | |

| Stand Up India Launch Date | April 5, 2016, |

| Stand Up India Official Website | Stand Up India |

| Stand Up India Objective | To provide financial support and create opportunities for entrepreneurship to the eligible beneficiaries. |

| Stand Up India Loan Amount | Rs 10 lakh and Rs 1 Crore |

| Stand Up India Interest Rate | the lowest applicable rate of the bank not to exceed (base rate (MCLR) + 3%+ tenor premium). |

| Stand Up India Beneficiaries | SC/ST and Women |

| Stand Up India Shareholding of SC/ST/Women in Case of Non-Individual Business | 51% |

| Stand Up India Age Limit | Above 18 Years of age |

| Stand Up India Type of Project eligible | Only Green-field Projects – Manufacturing, services, agri-allied activities, or the trading sector |

| Stand Up India Nature of the loan | Composite loan (inclusive of term loan and working capital) |

| Stand Up India Repayment Duration | 7 Years |

| Stand UP India Maximum Moratorium Period | 18 months |

| Stand Up India Helpline Number | 1800-180-1111 |

Stand Up India Scheme Objective

- The Stand-Up India scheme aims to enable bank loans ranging from 10 lakh to 1 Crore for the establishment of greenfield enterprises, ensuring the participation of at least one Scheduled Caste (SC) or Scheduled Tribe (ST) borrower and one woman borrower per bank branch.

- These enterprises encompass various sectors, including manufacturing, services, agri-allied activities, or the trading sector.

- In the case of non-individual enterprises, it is mandated that a minimum of 51% of the shareholding and controlling stake is held by either an SC/ST or a woman entrepreneur.

- This strategic allocation of resources seeks to promote diversity and inclusivity in entrepreneurship, fostering economic empowerment among marginalized communities and women.

Stand Up India Scheme Features

- Interest Rate: Computed as (Base Rate + (MCLR) + 3% + Tenor Premium)

- Loan Amount: Ranges from a minimum of Rs. 10 lakh to a maximum of Rs. 1 crore

- Repayment Tenure: Extends up to 7 years, inclusive of an 18-month moratorium period

- Project Cost Coverage: Anticipated to encompass 85% of the project cost, with an exception if the borrower’s contribution, combined with convergence support from other schemes, exceeds 15%.

- Collateral/Security: Secured by the Guarantee of Credit Guarantee Fund Scheme for Stand Up India Loans (CGFSIL) as defined by the Banks

- Working Capital Limit: Sanctioned for amounts above Rs. 10 lakhs in the form of a Cash Credit limit

- Eligibility for Agricultural Activities: Entities engaged in activities allied to agriculture are also eligible to apply for loans under Stand Up India.

Stand Up India In News | What’s New

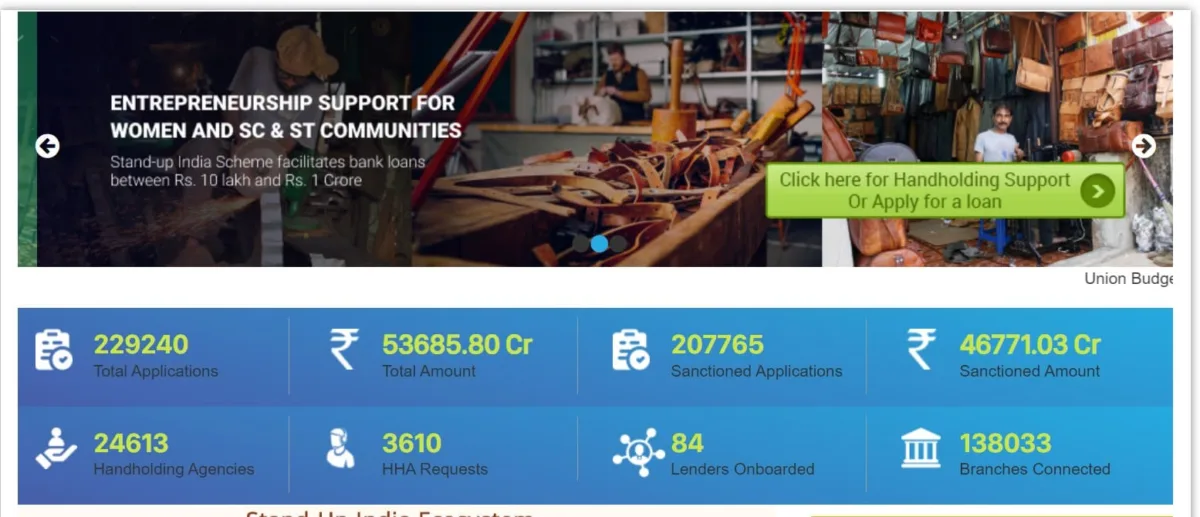

On the occasion of the 7th anniversary of the Stand-Up India Scheme, Union Finance & Corporate Affairs Minister, Smt. Nirmala Sitharaman, expressed pride and satisfaction in announcing that over 1.8 lakh women and entrepreneurs from Scheduled Castes (SC) and Scheduled Tribes (ST) have been granted loans exceeding Rs. 40,600 crore.

Smt. Sitharaman highlighted the scheme’s success in establishing an ecosystem that supports the establishment of new enterprises by providing access to loans through branches of all Scheduled Commercial Banks. She emphasized that the Stand-Up India Scheme has played a crucial role in fostering entrepreneurship among SC, ST, and women, marking a significant milestone.

The Finance Minister noted that the scheme has positively impacted numerous lives by ensuring hassle-free access to affordable credit for the underserved and unserved entrepreneurial segments. She praised the scheme for empowering aspiring entrepreneurs, enabling them to demonstrate their business acumen and contribute to economic growth, emphasizing their potential to create jobs and strengthen the overall ecosystem.

Union Minister of State for Finance, Dr. Bhagwat Kisanrao Karad, also commemorated the 7th anniversary of the Stand-Up India Scheme, stating that it is aligned with the third pillar of the National Mission for Financial Inclusion, focusing on “Funding the unfunded.” Dr. Karad emphasized that the scheme has facilitated seamless credit flow from branches of Scheduled Commercial Banks to SC/ST and women entrepreneurs, significantly improving living standards for them, their employees, and their families.

Dr. Karad highlighted that over the past seven years, more than 1.8 lakh entrepreneurs have benefited from the scheme, with particular satisfaction in noting that over 80% of the loans extended have been directed towards women entrepreneurs. Source: PIB

Stand Up India Scheme Eligibility Criteria

It is imperative to check the complete eligibility criteria before making the decision to get a loan under Stand Up India. Here is the complete list of Stand Up India eligibility criteria.

- Eligibility criteria encompass entrepreneurs who are either SC/ST or women and are above the age of 18.

- The scheme exclusively applies to greenfield projects, emphasizing the initiation of the beneficiary’s first venture in manufacturing, services, agri-allied activities, or the trading sector.

- In the case of non-individual enterprises, a minimum of 51% of the shareholding and controlling stake must be held by SC/ST and women entrepreneurs.

- Borrowers must not be in default to any bank or financial institution to qualify for loans under the scheme.

Stand Up India Scheme Documents Required

- Completed Application Form with Passport-sized Photographs:

- Ensure that the application form is fully filled out, providing accurate and up-to-date information. Include recent passport-sized photographs as specified.

- Identity Proof:

- Submit a valid identity proof such as a Passport, driver’s license, voter’s ID card, PAN card, etc. Ensure that the document is current and meets the bank’s requirements.

- Residence Proof:

- Present a residence proof, which can include a Voter’s ID card, passport, latest electricity and telephone bills, property tax receipt, etc. The document should reflect your current and valid residential address.

- Business Address Proof:

- Furnish proof of your business address to establish the legitimacy of your enterprise. This may include utility bills, property documents, or any other relevant document.

- Partnership Deed of the Partners:

- If applicable, provide the partnership deed outlining the terms and conditions agreed upon by the partners involved in the business.

- Copies of Lease Deeds or Rent Agreements:

- Include copies of lease deeds or rent agreements if the business premises are leased. This documentation is essential to verify the authenticity of the business location.

- Last 3 Years Balance Sheets of the Association:

- Submit the balance sheets of the association for the last three years, offering insights into the financial standing and performance of the business.

- Assets and Liabilities Statement of the Promoters and Guarantors:

- Provide a comprehensive statement detailing the promoters’ and guarantors’ assets and liabilities. This information aids in assessing the financial stability of those associated with the business.

- Any Other Document Required by the Bank:

- Be prepared to submit any additional documents as requested by the bank during the application process. This may vary based on specific requirements and financial regulations.

Stand Up India Scheme Loan Size

- The scheme provides a composite loan, which includes both term loans and working capital, ranging from 10 lakh to a maximum of 100 lakh.

- The loan size is a composite amount equivalent to 85% of the overall project cost, encompassing both the term loan and working capital.

- However, the condition that the loan should cover 85% of the project cost is exempt if the borrower’s contribution, coupled with support from other schemes, surpasses 15% of the total project cost.

- This ensures flexibility in the loan size determination based on the financial contributions and support from the borrower and other schemes.

Stand Up India Scheme Loan Repayment

The loan provided under the Stand Up India scheme comes with a repayment period of up to 7 years. During this time frame, borrowers have the flexibility to structure their repayments. Additionally, the scheme offers a maximum moratorium period of 18 months. The moratorium period allows borrowers to delay the commencement of their loan repayments, providing a strategic cushion for businesses to establish themselves before the repayment obligations begin.

This feature is particularly beneficial in supporting the initial phases of the business when financial resources may be directed towards operational setup and stability. The combined flexibility of the repayment tenure and the moratorium period enhances the adaptability of the loan structure to the specific needs and circumstances of the entrepreneurs.

Stand Up India Scheme Working Capital

- To facilitate the withdrawal of working capital up to 10 lakh, it can be approved through the mechanism of an overdraft, with the added convenience of issuing a Rupay debit card for the borrower’s ease of use.

- For working capital limits exceeding 10 lakh, the sanctioning will be done through a Cash Credit limit. This dual approach ensures a tailored and scalable financial arrangement, accommodating the specific requirements of the borrower based on their working capital needs.

Stand Up India Scheme Money Margin

- The Stand-Up India Scheme mandates a 15% margin money requirement, which can be sourced through collaboration with eligible Central/State schemes.

- Eligible schemes can be utilized for accessing permissible subsidies or meeting margin money obligations, with a minimum of 10% of the project cost expected as the borrower’s own contribution.

- Illustratively, if a State scheme provides 20% of the project cost as a subsidy, the borrower must contribute a minimum of 10% of the project cost.

- Any unforeseen subsidy received by a unit during loan appraisal will be credited to the loan account.

- In cases where a subsidy was anticipated during appraisal but received after commissioning, it may be released to the borrower for repaying loans used to arrange margin money.

- A comprehensive list of Central/State-wise subsidy and incentive schemes will be available on the Portal, with updates as new schemes become available. This ensures transparency and accessibility of information for potential beneficiaries.

Stand Up India Scheme Loan Assistance

Afrer loan disbursement, regular district events are planned every few months for individuals involved in businesses. During these gatherings, participants discuss successful strategies, address challenges, and offer assistance to those aspiring to start their own businesses. These events also provide opportunities to access helpful services, such as obtaining better deals on bills, engaging in online sales, and understanding tax-related matters. NABARD takes the lead with support from SIDBI to ensure comprehensive support for entrepreneurs, creating a welcoming environment for them to connect, learn, and address any issues they may encounter.

Stand Up India Scheme Process of Taking a Loan

- Borrower Registration:

- The borrower has the option to register on the Stand-Up India portal immediately or visit and register later.

- Accessible from home, Common Service Centers (CSCs), bank branches, or through the Lead District Manager (LDM).

- Initial Questionnaire:

- The portal initiates a handholding approach by seeking answers to 8-10 questions, including:

- Borrower’s location

- Category (SC/ST/Woman)

- Nature of planned business

- Availability of business premises

- Need for project plan assistance

- Skill/training requirements

- Details of present bank account

- Amount of own investment

- Need for help in raising margin money

- Previous business experience

- The portal initiates a handholding approach by seeking answers to 8-10 questions, including:

- Portal Feedback:

- Based on the responses, the portal categorizes the visitor as a Ready Borrower or a Trainee Borrower and provides relevant feedback.

- Ready Borrower:

- If no handholding support is needed, registration as a Ready Borrower initiates the loan application process.

- An application number is generated, and borrower information is shared with the selected bank, LDM, and the relevant NABARD/SIDBI office.

- Trainee Borrower:

- If handholding is required, registration as a Trainee Borrower links the borrower to the LDM and the relevant NABARD/SIDBI office.

- Support for training may be arranged through financial literacy centers, skilling centers, entrepreneurship development programs, work shed provision, margin money offices, mentorship from established entrepreneurs, utility providers, and assistance in preparing Detailed Project Reports (DPRs).

- Access to Connect Centers:

- Borrowers, even after loan sanction, can access services provided by Stand-Up Connect Centers.

- Monitoring and Follow-up:

- The LDM monitors the process, collaborates with SIDBI and NABARD for issue resolution, and informs the concerned bank branch about potential cases.

- SIDBI and NABARD engage with stakeholders such as DICCI, Women’s Entrepreneur Associations, and others for additional support.

- Loan Application Generation:

- Once handholding requirements are met to the satisfaction of the LDM and the trainee borrower, a loan application is generated through the portal.

This comprehensive process ensures a systematic and supportive approach, leveraging technology and collaboration with various entities to guide and empower potential entrepreneurs throughout the loan application and handholding journey.

Stakeholders’ Duties and Obligations:

SIDBI Responsibilities:

- Operate and maintain the Stand-Up India web portal.

- Facilitate handholding support for Trainee Borrowers.

- Collaborate with banks for follow-up on potential cases through LDM/SLBC.

- Coordinate with LDM to address bottlenecks.

- Assist SLBC and DLCC in reviews and monitoring.

- Participate in Stand-Up events organized by NABARD.

NABARD Responsibilities:

- Conduct Training of Trainers, LDMs, and Bank officers for Stand-Up India.

- Organize handholding support for trainee borrowers.

- Liaise with banks for follow-up on potential cases through the LDM.

- Coordinate with LDM to address bottlenecks.

- Assist SLBC and DLCC in reviews and monitoring.

- Organize events for stakeholders to share experiences and best practices.

LDMs Responsibilities:

- Monitor the progress of cases.

- Act as a contact point for SIDBI/NABARD to address bottlenecks.

- Sensitize bankers on potential borrowers.

- Follow up with the concerned bank offices to ensure timely processing/sanction of loans.

- Ensure the borrower’s handholding requirements are met to the extent possible.

- Convene DLCC meetings periodically.

- Participate in quarterly events organized by NABARD with stakeholders.

DLCC Responsibilities:

- Periodically review progress under the Collector’s supervision.

- Address grievances at the district level.

- Assist in resolving issues related to public utility services and workspaces for potential borrowers.

Bank Branches Responsibilities:

- Assist potential borrowers in accessing the portal.

- Process loan applications received online or in person within specified timeframes.

- Provide reasons for rejection in line with the Code of Bank’s Commitment to Customers.

- Address grievances at the bank level within 15 days.

- Implement an internal mechanism for monitoring scheme performance.

Borrowers Responsibilities:

- Access the portal or visit a bank branch and complete a short set of questions.

- Undergo handholding support if categorized as a Trainee Borrower.

- Provide necessary documentation as required by the bank branch.

- Attend quarterly events for experience sharing and best practices.

- Set up and operate the unit diligently.

- Make repayments on time.

Stand Up India Scheme Application Process

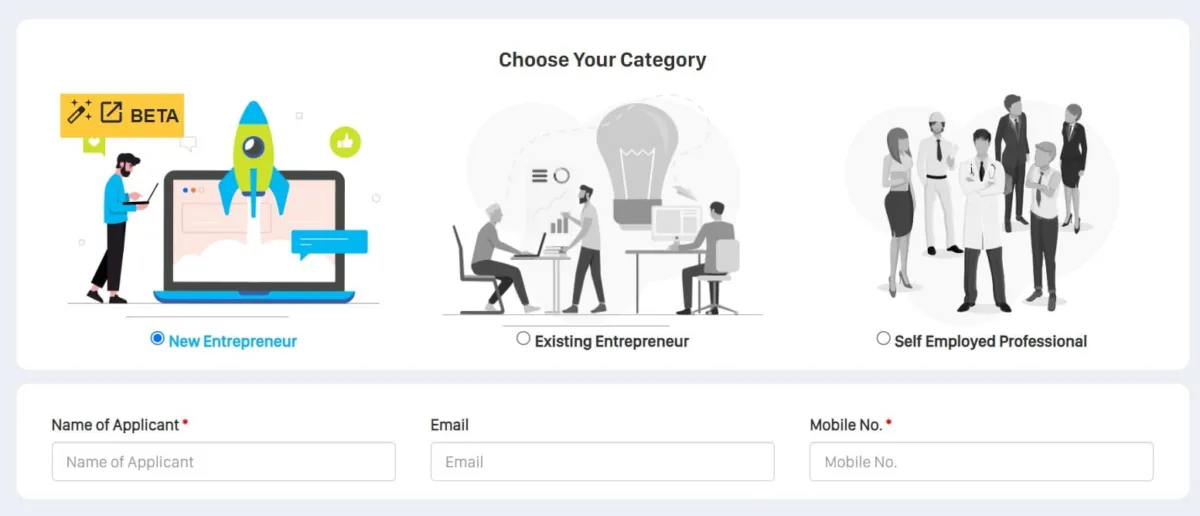

- Visit the Stand Up India official website and click on “Apply Here”. You can also apply by visiting a bank branch or by taking the assistance of the Lead District Manager. Here is the process in case you want to do it by yourself.

- A new page will be displayed where you have to click on “New Entrepreneur”. You can also click between Existing Business and Self-Employed Professional.

- After clicking on the “New Entrepreneur” option, the Stand Up India application form will open.

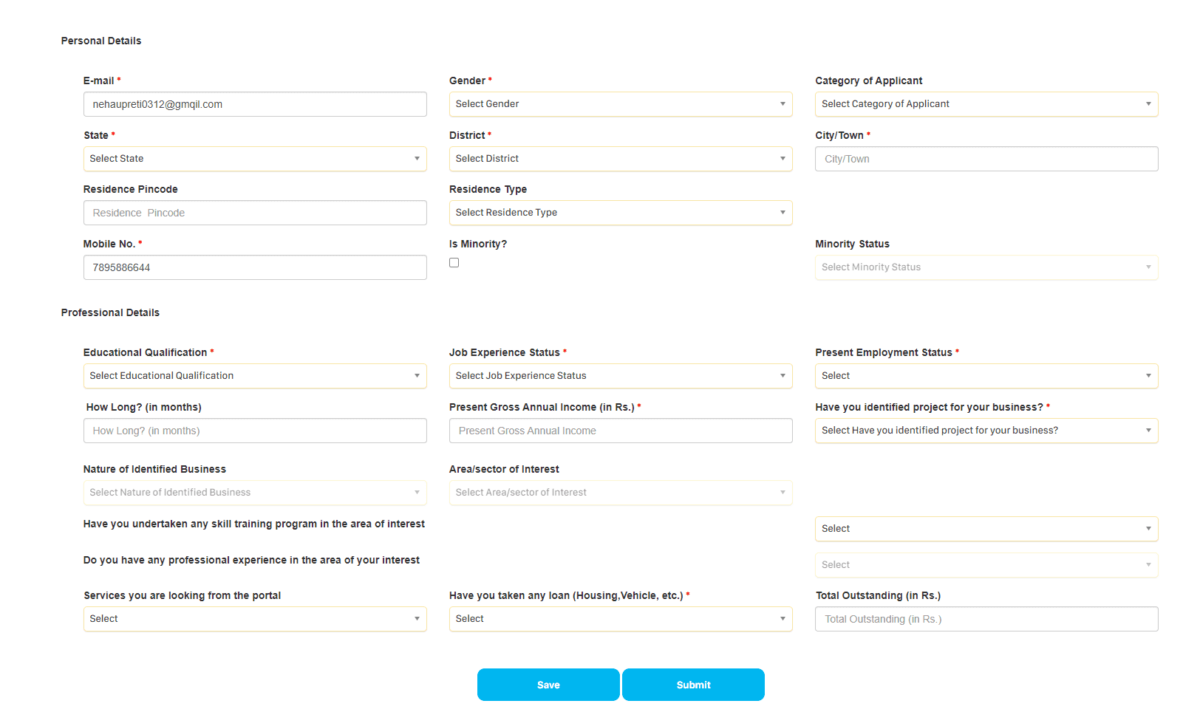

- You will be required to enter your name, email ID, and mobile number. You will also required to enter the OTP sent to your registered mobile number

- After that complete the Stand Up India application form will open on the screen.

- Fill in all the required information asked in the form and click on Submit Button.

Download the Stand Up India Application Form

References:

Stand Up India Official Website

| OTHER SCHEMES FOR SC/ST or Women Entrepreneurs |

| Karnataka Udyogini Scheme 2023 | Rs 3,00,000 Loan for Women Entrepreneurs |

| Telangana Dalit Bandhu Scheme | 10 Lakh Grant to Scheduled Castes for Enterprenuarahip |

Stand Up India Scheme FAQs

What is the Stand Up India Scheme?

Stand Up India initiative is a financial assistance scheme for the SC/ST and women entrepreneurs of India. Under this scheme, a subsidized loan between 10 lakhs to 100 lakh can availed. The target is to provide loans to at least one SC, One ST, and one woman per bank branch.

How much loan can be sanctioned under the Stand Up India Scheme?

As per the rules any amount between Rs 10 lakh to Rs 1 crore can be sanctioned under this scheme

What is the interest rate under this scheme?

As per the rules, the lowest applicable rate of the bank is not to exceed (base rate (MCLR) + 3%+ tenor premium) will be the interest rate.

What type of project is eligible under this scheme for the new entrepreneurs?

Under the Stand-Up India initiative, as new entrepreneurs, only Green Filed projects are eligible for taking loans under this scheme.

I am a male from the General Category. Can I take a loan under this scheme?

The only condition under which you can take the loan for your business is to include at least one SC/ST or woman with a shareholding of 51% in the business.