The Pradhan Mantri MUDRA Yojana (PMMY) is a government-backed initiative designed to facilitate micro-loans of up to 10 lakh for individuals engaged in income-generating activities in the non-farm sector, including manufacturing, processing, trading, or the service sector. Launched on April 8, 2015, by Prime Minister Narendra Modi, MUDRA, which stands for Micro Units Development & Refinance Agency Ltd., serves as a financial institution established by the government. In this article, we will talk about the PM MUDRA Yojana in detail. Keep reading the article to learn more about the Pradhan Mantri Mudra Yojana Online Apply, and Pradhan Mantri Mudra Yojana Application Form.

What is Pradhan Mantri Mudra Yojana ?

Pradhan Mantri Mudra Yojana (PMMY) stands as a flagship initiative of the Government of India, designed to facilitate micro credit/loans of up to Rs. 10 lakhs for income-generating micro-enterprises operating in the non-farm sector. This includes activities in manufacturing, trading, or service sectors, as well as allied agricultural pursuits like poultry, dairy, beekeeping, etc. The scheme involves financial assistance provided by Member Lending Institutions to support the non-corporate, non-farm sector income-generating activities of micro and small entities.

Source: Official Website

These entities encompass a vast array of proprietorship/partnership firms functioning as small manufacturing units, service sector units, shopkeepers, fruit/vegetable vendors, truck operators, food service units, repair shops, machine operators, small industries, artisans, food processors, and various others. Let’s talk about the scheme in detail.

| PM MUDRA Yojana 2024 Key Highlights | |

| PM MUDRA Yojana Launch Date | April 8, 2015, |

| PM MUDRA Yojana Official Website | PM MUDRA Official Website |

| PM MUDRA Yojana Objective | To provide financial assistance and eliminate any middlemen in acquiring a loan |

| PM MUDRA Yojana Beneficairy | Individuals Proprietary concern Partnership Firm. Private Ltd. Company. Public Company. Any other legal forms |

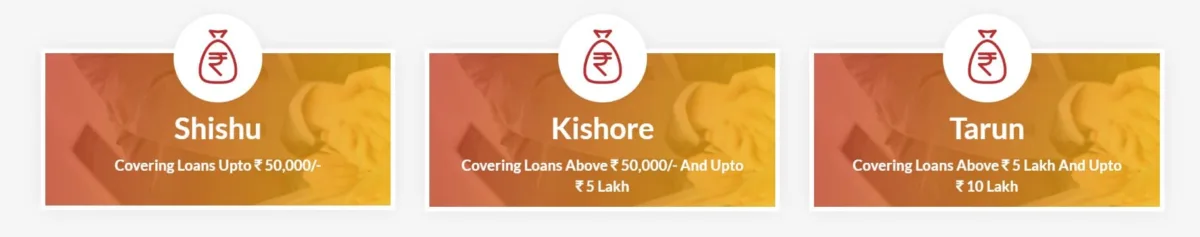

| PM MUDRA Yojana Types of Loans | Sishu – Upto Rs 50,000 Kishore – From Rs 50,000 to Rs 5 Lakhs Tarun – From Rs 5 Lakh to Rs 10 Lakhs |

| PM MUDRA Yojana Interest Rate | Set by the RBI |

| PM MUDRA Yojana Age Limit | 18 to 65 Years |

| PM MUDRA Yojana Collartoral | NO Collateral Required |

| PM MUDRA Yojana Helpline Number | 1800 180 1111 1800 11 0001 |

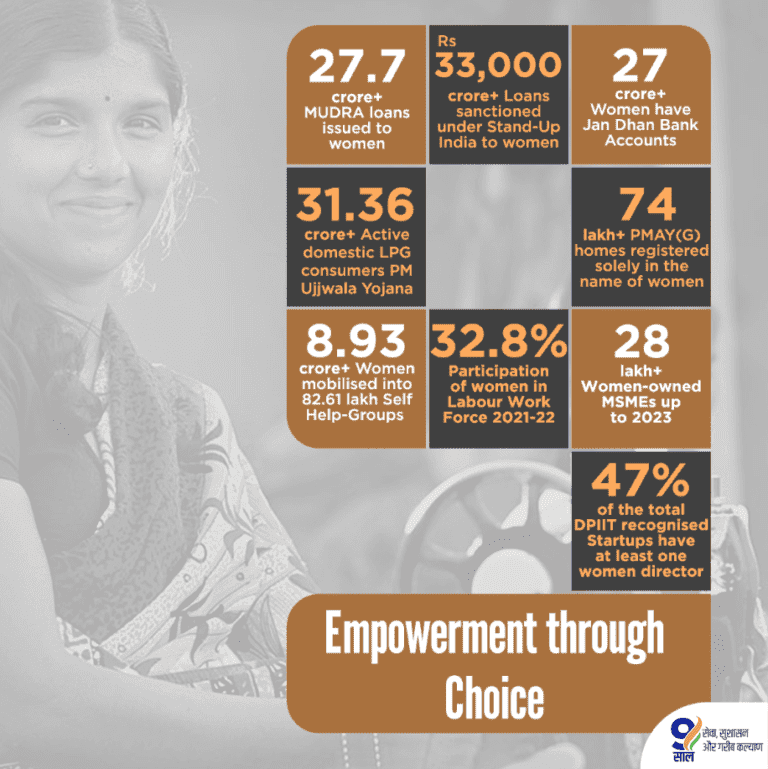

# 9 Years of Women Development ( MUDRA Loan to Women)

On June 06, 2023, Amit Shah took to Twitter to announce the achievements of their Government. Under the aegis of their government, 27 minted women entrepreneurs took a MUDRA loan which is a huge achievement.

Pradhan Mantri MUDRA Yojana in News

On April 08, 2023, the government marked the completion of 08 years of the PM MUDRA scheme where the government notified that more than 40.82 crore loans amounting to ₹23.2 lakh crore sanctioned under Pradhan Mantri MUDRA Yojana (PMMY) since inception.

Achievements under Pradhan Mantri Mudra Yojana (PMMY) as on March 24, 2023

- More than 40.82 crore loans amounting to ₹23.2 lakh crore have been sanctioned since the launch of the Scheme. Approximately 21% of the total loans have been sanctioned to New Entrepreneurs.

- Approximately 69% loans of the total number of loans have been sanctioned to Women Entrepreneurs & 51% of loans have been sanctioned to SC/ST/OBC categories of borrowers.

Category-wise breakup of the Loans sanctioned

| Category | No. of Loans (%) | Amount Sanctioned (%) |

| Shishu | 83% | 40% |

| Kishore | 15% | 36% |

| Tarun | 2% | 24% |

| Total | 100% | 100% |

Who can lend Pradhan Mantri MUDRA Loan?

Any individual operating a business enterprise can apply for a Mudra (Micro Units Development and Refinance Agency) loan, specifically designed to support small and medium businesses lacking access to formal channels for borrowing funds. Public, private, and regional rural banks are among the eligible institutions to provide Mudra Loans. The following institutions participate in offering Mudra loans:

1. Non-Banking Financial Companies (NBFC)

2. Public and Private Sector Banks

3. Micro Finance Institutions (MFI)

4. Regional Rural Banks (RRB)

5. Small Finance Banks (SFB)

To be eligible for Mudra Loan, lending institutions must meet certain criteria, including:

- Generating Profits: The bank must have demonstrated profitability in the last two years.

- Net Performing Assets: Net-performing assets for public, private, and regional rural banks should not exceed 15%, 10%, and 6%, respectively.

- Net Worth: The net worth of the lending institution should be above ₹250 crore for private and public sector banks and above ₹50 crore for rural banks.

In total, 27 public sector banks, 31 regional rural banks, 17 private sector banks, 36 micro-finance institutions, 25 non-banking financial institutions, and 4 cooperative banks have been selected as participants for Mudra loans.

Pradhan Mantri MUDRA Yojana Benefits 2024

The applicant in MUDRA yojana is entitled to choose from three categories. These are provided below:

- Shishu: Covering loans up to Rs. 50,000/-

- Kishor: Covering loans from Rs. 50,001 to Rs. 5,00,000/-

- Tarun: Covering loans from Rs. 5,00,001 to Rs. 10,00,000/-

However, one should note that applicants should not be defaulters to any bank or financial institution and should have a satisfactory credit track record.

Also, one should be required to possess the necessary skills/experience/ knowledge to undertake the proposed activity.

Pradhan Mantri MUDRA Yojana Eligibility Criteria 2024

- Age Requirement: Applicants should fall within the age range of 18 to 65 years.

- Loan Amount: Each eligible individual is entitled to a loan amount of up to ₹10 Lakhs.

- Eligible Entities: Mudra loans are available for various entities, including:

- Startups

- Small manufacturers and vendors

- Artisans

- Fruits and vegetables dealers

- Individuals engaged in agricultural activities like livestock and poultry

- Shopkeepers

- Retailers

- MSMEs (Micro, Small, and Medium Enterprises)

- Citizenship: Applicants must be Indian citizens with a clean legal record.

- Financial History: Applicants should have no history of defaults with any bank.

- Business Statements: Applicants are required to provide business statements and reports projecting their revenue.

- Non-farm Enterprises: Mudra loans apply to all non-farm enterprises engaged in trading, services, and manufacturing sectors.

- Eligible Lending Institutions: Public and Private sector banks, regional rural banks, and micro-finance institutions are eligible lending institutions.

- Documentation: Required documents include proof of identity, proof of residence, a completed application form, and passport-sized photographs.

Pradhan Mantri MUDRA Yojana Documents Required

The Requirements for the documents for the Shishu loan are different and the Kishore/Tarun loan is different. It is imperative to check all the requirements for the documents before applying for the loan be it Sishu, Tarun, or Kishore. Here to make it easier for you, we have listed the documents that are needed for the Shishu/Kishore and Tarun loan.

Shishu Loan

- Proof of identity – Self-attested copy of Voter’s ID Card / Driving Licence / PAN Card / Aadhaar Card / Passport / Photo IDs issued by Govt. authority etc.

- Proof of Residence: Recent telephone bill/electricity bill/property tax receipt (not older than 2 months) / Voter’s ID Card / Aadhar Card / Passport of Individual / Proprietor/partner bank passbook or latest account statement duly attested by Bank Officials / Domicile Certificate / Certificate issued by Govt. Authority / Local Panchayat / Municipality etc.

- Applicant’s recent Photograph (2 copies) not older than 6 months.

- Quotation of Machinery / other items to be purchased.

- Name of Supplier/details of machinery/price of machinery and/or items to be purchased.

- Proof of Identity / Address of the Business Enterprise – Copies of relevant Licenses / Registration Certificates / Other Documents about the ownership, identity of the address of the business unit, if any

- Proof of category like SC / ST / OBC / Minority etc.

How to Apply for PM MUDRA Yojana (Online) or eMUDRA Loan?

Applying for a MUDRA loan is an easy and quick process. However, you need to have the prerequisites for the enrollment process. Those are the following

- ID Proof

- Address Proof

- Passport size photograph

- Applicant Signature

- Proof of Identity / Address of Business Enterprises

After assembling the above-mentioned documents/information, you have to follow the following steps.

- Visit the PM MUDRA official website or you can directly go to the Udyamimitrta portal.

- You will see the icon for the MUDRA Loan. Click on Mudra loan “Apply Now“

- Select one of the following: New entrepreneur/ Existing Entrepreneur/Self-employed professional

- Then, Fill in the applicant’s name, email, and Mobile number and Generate OTP. Please keep your mobile number and valid email ID handy with you.

- You will be successfully registered.

After Registration

- You will be required to fill in your Personal and Professional Details

- After that click on “Loan Application Center” and apply now.

- Select the category of loan required – Mudra Sishu / Mudra Kishore/ Mudra Tarun.

- Fill in the required Business Information like business name, Business Activity etc., and select Industry type like Manufacturing, service, Trading, and Agricultural allied.

- Fill in Other Information like Fill the director Details, Banking/ Credit facilities Existing, Credit facilities Proposed, Future estimates and Preferred Lander

- Attached all required Documents: ID proof, address proof, Applicant photo, Applicant Signature, Proof of Identity/ Address of Business Enterprise etc.

- After submitting the application form, an Application Number will be generated. Keep that for future reference.

Kishore and Tarun Loan

- Proof of identity – Self-certified copy of Voter’s ID card / Driving License / PAN Card / Aadhar Card/Passport.

- Proof of Residence – Recent telephone bill, electricity bill, property tax receipt (not older than 2 months), Voter’s ID card, Aadhar Card & Passport of Proprietor/Partners/Directors.

- Proof of SC/ST/OBC/Minority.

- Proof of Identity/Address of the Business Enterprise -Copies of relevant licenses/registration certificates/other documents about the ownership, identity, and address of the business unit.

- Applicants should not be defaulters in any Bank/Financial institution.

- Statement of accounts (for the last six months), from the existing banker, if any.

- Last two years’ balance sheets of the units along with income tax/sales tax return etc. (Applicable for all cases from Rs.2 Lacs and above).

- Projected balance sheets for one year in case of working capital limits and for the period of the loan in case of term loan (Applicable for all cases from Rs.2 Lacs and above).

- Sales achieved during the current financial year up to the date of submission of application.

- Project report (for the proposed project) containing details of technical & economic viability.

- Memorandum and articles of association of the company/Partnership Deed of Partners etc.

- In the absence of a third-party guarantee, Asset & Liability statements from the borrower including Directors & Partners may be sought to know the net worth.

Interest Rate:

Member Lending Institutions declare interest rates periodically following the guidelines set by the Reserve Bank of India, determining the applicable interest rate.

Upfront Fee/Processing Charges:

Banks may consider imposing upfront fees in line with their internal guidelines. It’s worth noting that most banks waive the upfront fee/processing charges for Shishu loans (covering loans up to Rs. 50,000).

Note:

MUDRA does not employ agents or intermediaries for Mudra Loans. Borrowers are strongly advised to steer clear of individuals claiming to be agents or facilitators of MUDRA/PMMY.

Pradhan Mantri MUDRA Yojana Additional Information

The margin or promoter’s contribution is determined following the policy framework of the lender, which aligns with the overall guidelines provided by the RBI. It’s noteworthy that banks may not require a margin for Shishu loans.

The interest rates applied will adhere to the policy decisions of the bank. However, it is emphasized that the interest rates imposed on the ultimate borrowers must be reasonable.

A primary charge is asserted on all assets generated from the loan provided to the borrower. This includes assets directly linked to the business or project for which credit has been extended.

Conclusion

PM MUDRA has emerged as particularly effective and advantageous for women entrepreneurs and the SC/ST community. Official government data indicates that over 27.7 crore loans have been approved for women entrepreneurs, leading to their self-reliance and empowerment. This demonstrates the success of the government’s initiative since its inception in 2015.