Women, recognizing the importance of financial empowerment, are increasingly turning to banks and post offices as reliable avenues for investing their money. This trend reflects a growing awareness of the significance of financial literacy and the need for women to secure their financial futures. By entrusting their funds to established financial institutions, women not only benefit from the security and stability these entities provide but also contribute to the broader economic landscape. The government of India has always been an avid supporter of women in general. With the Mahila Samman Savings Scheme, women now have a great option to invest money that gives them a higher rate of Interest.

The Mahila Samman Savings Scheme, initiated by the Ministry of Finance, is a small savings program designed to assist women investors in achieving favorable returns on their investments. This article aims to provide insights into the recently introduced small savings initiative, the Mahila Samman Savings Certificate. If you are preparing for competitive examinations and seek clarity on this subject, you have landed in the appropriate resource.

What is the Mahila Samman Savings Scheme?

Mahila Samman Savings Scheme, also known as the Mahila Samman Savings Certificate, is a small savings initiative introduced by the Ministry of Finance to assist women investors in securing favorable returns on their investments. This scheme is now accessible at all nearby Post Offices. Unveiled during the Budget 2023 session to commemorate the 75th Azaadi Ka Amrit Mahotsav, the MSSC is a commendable step towards women’s empowerment. Launched nationwide on April 1, 2023, across all post offices in India, it is highly advisable for women or guardians investing on behalf of minor girls to consider this scheme due to its attractive interest rate of 7.5% (compounded quarterly). Let’s delve into the key features of the Mahila Samman Savings Scheme.

The Mahila Samman Savings Certificate is a limited-time initiative accessible for a duration of two years, spanning from April 2023 to March 2025. This scheme provides the opportunity for individuals to make a one-time deposit, with a maximum limit of Rs. 2 lakh, under the names of women or girls. The funds deposited in this scheme will accrue interest at a fixed rate for the specified two-year period.

Mahila Samman Savings Scheme Key Highlights

Let’s look at the highlights of the Mahila Samman Savings Scheme 2023.

| Mahila Samman Savings Certificate Scheme (MSSC) | |

| Mahila Samman Savings Certificate Launched Date | April 01, 2023, |

| Mahila Samman Savings Certificate Official Website | MSSY Official Website |

| Mahila Samman Savings Certificate Objective | To provide risk-free investment scheme for the women and girl child of India |

| Mahila Samman Savings Certificate Beneficiary | Women and Girl Child |

| Mahila Samman Savings Certificate Tax exemption | No tax deduction under Section 80C |

| MSSC Interest Rate | 7.5% |

| Who can Open | By a woman for herself.By the guardian on behalf of a minor girl. |

| Minimum Investment | Rs 1000 |

| Maximum Investment | Rs 2 Lakh |

| Maturity Period | 2 Years |

| Mahila Samman Savings Certificate Duration | April 01, 2023, to March 31, 2025, |

Mahila Samman Savings Scheme Features 2023

Here are some features of the Mahila Samman Savings Certificate that you must know before you consider investing your amount in this scheme.

- Government-Backed Security:

- The Mahila Samman Savings Certificate is a government-backed small savings scheme, ensures no credit risk for investors.

- Eligibility Criteria:

- The certificate can be opened only in the name of a girl child or woman. Either a woman or the guardian of a minor girl child is eligible to initiate a Mahila Samman Saving Certificate scheme.

- Deposit Limits:

- The scheme accepts a minimum deposit of Rs.1,000 in increments of one hundred rupees. The maximum deposit allowed is Rs.2 lakh in a single account or across all accounts held by the account holder. A second account can be opened after a minimum three-month gap from the existing account’s opening.

- Maturity Period:

- The Mahila Samman Savings Certificate has a maturity period of two years, with the maturity amount paid to the account holder after this duration.

- Withdrawal Option:

- The scheme offers a partial withdrawal facility, allowing account holders to withdraw up to 40% of the account balance after one year from the opening date.

- Tax Benefits:

- Tax Deducted at Source (TDS) is not deducted from the interest received under this scheme. However, as per CBDT notification, TDS applies only if the interest received exceeds Rs.40,000 in a financial year (or Rs.50,000 for senior citizens) under the Mahila Samman Saving Certificate Scheme. Given that the interest for a maximum Rs.2 lakh investment for two years does not surpass Rs.40,000, TDS is not deducted.

Mahila Samman Savings Certificate in News | What’s New?

The Mahila Samman Savings Certificate Scheme (MSSC) is a recently introduced small savings initiative by the Government, commemorating the Azadi ka Amrit Mahotsav, specifically designed for the empowerment of women and girls in India. This information was conveyed by Shri Pankaj Chaudhary, the Union Minister of State for Finance, in a written response to a query in Lok Sabha on July 31, 2023.

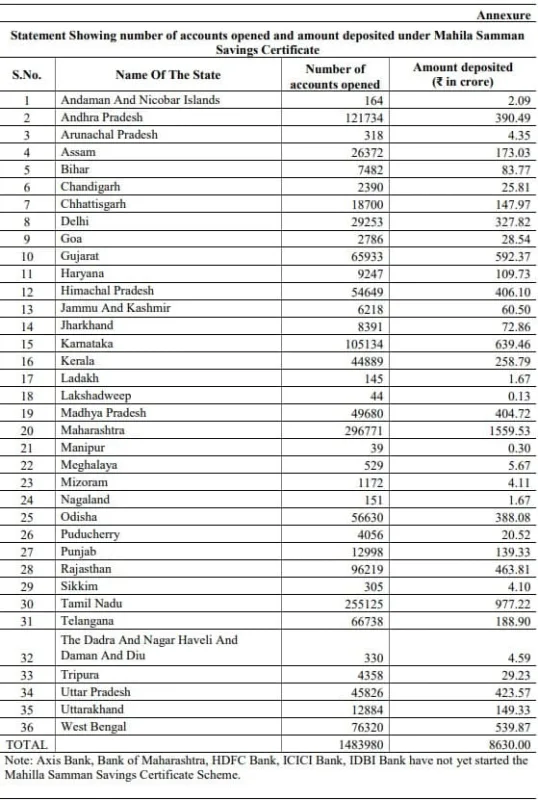

To date, a total of 14,83,980 accounts have been established, accumulating deposits amounting to Rs 8,630 crore under this scheme. The breakdown of deposits and accounts opened across different states for the Mahila Samman Savings Certificate Scheme (MSSC) is provided in the attached document.

Source: Press Information Bureau

Mahila Samman Savings Certificate Benefits

- Empower women and girl children through targeted financial opportunities.

- Offers an attractive interest rate of 7.5%, compounded quarterly.

- Provides women with a favorable avenue to invest their savings.

- The quarterly compounding feature ensures higher interest accumulation over the two-year period.

- Strategic and lucrative choice for women seeking substantial financial growth.

Mahila Samman Savings Certificate Eligibility Criteria

- Any Woman herself can open the Mahila Samman Savings Certificate (MSSC) at any nearby post office.

- She must be a citizen of India.

- Any Mother or any guardian can open the account on behalf of a girl child.

Mahila Samman Savings Certificate Scheme Documents Required

Here are the documents that you need to carry while opening the Mahila Samman Savings Scheme Account

- Aadhar Card ( Original and Photocopy)

- Pan Card (Original and Photocopy)

- Cheque / Cash

Mahila Samman Savings Scheme Withdrawal Rules and Maturity Period

The Post office also provides you a way of withdrawing your money in case of urgent needs. You can withdraw 40% of the eligible balance after a year of account opening.

Maturity Period: This scheme is for 2 years. You can invest your desired amount of between 1000 and 2 lakh for two years only. You cannot reinvest it as the scheme is valid only from April 01, 2023, to March 31, 2025.

Mahila Samman Savings Certificate Premature Closure

Premature Closure of the Mahila Samman Savings Certificate is allowed under specific circumstances. These are as follows.

- After six months of opening the account without providing a reason, closure is permitted with an interest rate of 5.5%.

- Closure is also allowed in the event of the account holder’s death, with interest paid on the principal amount.

- Extreme compassionate grounds, such as a life-threatening disease of the account holder or the death of the guardian (with relevant documents), permit premature closure, with interest paid on the principal amount.

How to Apply for the Mahila Samman Savings Scheme Online?

Unfortunately, there is no provision for applying to the Mahila Samman Savings Scheme Online right now. You have to visit your nearest post office to open the MSSC account.

Mahila Samman Savings Scheme Offline How to Apply in the Post Office

The procedure for Opening a Mahila Samman Savings Certificate at the Post Office has been provided in the table below.

- You have to Download the ‘Application for purchasing the certificate’ from the official Indian Post website or obtain it from the nearest Post Office branch.

- Complete the ‘To The Postmaster’ section by providing the Post Office address.

- Enter your name and specify the account as ‘Mahila Samman Savings Certificate.’

- Submit the KYC document ( Aadhar Card and PAN card)

- If you don’t have the KYC document, fill in the KYC form provided by the post office itself.

- Provide details for account type, payment, and personal information.

- Complete the declaration and nomination sections on the form.

- Submit the form along with the required documents.

- Make the deposit at the Post Office using cash or cheque.

- Submit the Pay-in slip or Cheque of the amount you would like to deposit.

- Receive the certificate, serving as proof of investment in the Mahila Samman Savings Certificate scheme.

Mahila Samman Savings Scheme Offline How to Apply in the Banks

- In order to apply for the Mahila Samman Savings Certificate, you need to visit your desired bank and ask them for the Mahila Samman Savings Certificate Application form.

- You can also download the ‘Mahila Samman Savings Certificate Application’ either from the official website of the qualifying bank or by visiting the nearest branch.

- After that, complete the necessary details on the application form.

- Fill in the required information in the declaration and nomination sections.

- Submit the fully filled form, along with the necessary documents, to the bank’s branch office.

- Initiate the opening of the scheme account by depositing the required amount with the bank officials.

- Don’t forget to obtain the certificate, which serves as concrete proof of your investment in the Mahila Samman Savings Certificate scheme.

Mahila Samman Savings Certificate In Banks

As unveiled in the Union Budget 2023, the Finance Minister has introduced a scheme tailored for the women of India. This high-yield initiative, disbursing interest on a quarterly basis, is accessible not only through post offices but also through various banks. Presently, the scheme is accessible in 12 public sector banks and 4 private banks, with a detailed list provided below.

Public Sector Banks

| Name of the Bank | Address |

| Bank of Baroda | Central Office, P.O. Box No. 10046, 9th Floor, Baroda Corporate Centre, Bandra Kurla Complex, Bandra (East), Mumbai-400 051. |

| Bank of India | Head Office, Star House, C-5, G-Block, Bandra Kurla Complex, Bandra (East), Mumbai-400 051 |

| Bank of Maharashtra | Head Office, Lokmangal, 1501, Shivaji Nagar, Pune-411 005. |

| Canara Bank | Head Office, 112, J.C. Road, P.B. No. 6648, Bangalore-560 002. |

| Central Bank of India | Head Office, Chandramukhi, Nariman Point, Mumbai-400 021. |

| Indian Bank | Head Office, 31, Rajaji Road, Chennai-600 001 |

| Indian Overseas Bank | Central Office, 763, Anna Salai, P.B. No. 3765, Chennai-600 02. |

| Punjab National Bank | Head Office, Plot No 4, Sector-10,Dwarka New Delhi-110 066. |

| Punjab & Sind Bank | Head Office, Bank House, 21, Rajendra Place, New Delhi-110 008. |

| Union Bank of India | Head Office, 239, Vidhan Bhavan Marg, Nariman Point, Mumbai-400 021. |

| UCO Bank | Head Office, 10, B.T.M. Sarani, Brabourne Road, Calcutta-700 001. |

| State Bank of India | Central Office, State Bank Bhavan, Madam Cama Road, Mumbai-400 021 |

Private Sector Banks

| Name of the Bank | Address |

| ICICI Bank | Mumbai |

| Axis Bank | Wadia International Centre, Pandurang Budhkar Marg, Worli, Mumbai – 400 025. |

| HDFC Bank | Mumbai |

| IDBI Bank | IDBI Tower, WTC Complex, Cuffe Parade, Colaba, Mumbai 400005. |

Why Women Should Consider Investing in the MSSC Scheme:

The Mahila Samman Savings Certificate (MSSC) stands as a passionate initiative designed exclusively for the women of India. Beyond the symbolic gesture of launching a scheme tailored for women, MSSC actively promotes women’s empowerment by offering an attractive interest rate disbursed quarterly—an enticing prospect. With a manageable 2-year duration, this scheme caters to those seeking short-term investments without imposing a lock-in period; no penalties apply for premature closure of the account. For women contemplating investments, the MSSC scheme emerges as a compelling option, blending empowerment and financial growth seamlessly.

Banks Offering Mahila Samman Savings Certificate

The Department of Economic Affairs, Ministry of Finance authorized all public sector banks and qualified private sector banks to operate the Mahila Samman Savings Certificate scheme through an e-gazette announcement on 27 June 2023. The list of qualified banks offering this scheme is as follows:

- Bank of Baroda

- Canara Bank

- Bank of India

- Punjab National Bank

- Union Bank of India

- Central Bank of India

Mahila Samman Savings Certificate Calculation

Let’s look at the benefit of opening a Mahila Samman Savings Certificate account. Suppose you invest Rs.2,00,000 under the scheme; you get an interest fixed at 7.5% yearly. Thus, in the first year, you will get Rs.15,000 interest on the principal amount, and in the second year, you will get Rs.16,125 interest. Thus, by the end of two years, you will get 2,31,125 (2,00,000 initial investment + 31,125 interest for two years). Thus, your maturity amount, which you get after two years, will be Rs.2,31,125.

Sukanya Samriddhi Yojana Vs Mahila Samman Savings Certificate

Sukanya Samriddhi Yojana is also one of the schemes that provide high-interest rates. In case you are thinking of investing in the Mahila Samman Savings Scheme for your girl child consider reading about Sukanya Samriddhi Yojana which is a better option to invest in if considering a girl child. Here is the difference between SSY and the Mahila Samman Certificate.

| Parameters | Mahila Samman Savings Certificate | Sukanya Samriddhi Yojana |

| Eligibility | Women and girl children | Only in the name of a girl child before she attains 10 years |

| Interest Rate | 7.5% | 8.0% |

| Duration | 2 years | 21 years from opening the account or when the girl child attains 18 years |

| Deposit Limit | Minimum – Rs.1,000Maximum – Rs.2 lakh | Minimum – Rs.250 Maximum – Rs.1.5 lakh |

| Premature Withdrawal | Permits 40% withdrawal after one year | Allowed under certain circumstances |

| Tax Benefit | No tax deduction under Section 80C | Exempt-Exempt-Exempt (EEE) category under Section 80C category |

Mahila Samman Savings Certificate FAQs

Can I Open more than one MSSC account?

Yes, you can open more than one MSSC account, However, A time gap of three months shall be maintained between the existing account and the opening of another account.

Is the Mahila Samman Savings Certificate taxable under the law?

Unfortunately, as of now, the Mahila Samman Savings Scheme is not exempted under the 80C. The government has clarified that tax deducted at source will not apply on interest earned on the Mahila Samman Savings Certificate, but it will be added to the total income for tax calculation.

What is the exemption limit on the Mahila Samman Savings Certificate?

The tax exemption limit on MSSC accounts is Rs 40,000. However, for senior citizens, it is Rs 50,000.

What is the maximum amount invested in the Mahila Samman Savings Certificate?

A maximum amount of Rs 2 lakh can be invested in Mahila Samman Savings Certificate.

Where can I open the Mahila Samman Savings Scheme?

The MSSC scheme has been launched by the Ministry of Finance. It is now operational from April 01, 2023. You can open the MSSC account at any post office or in 12 Public Sector Banks. One can open an MSSC account in four private banks as well. These are HDFC Bank, Axis Bank, ICICI Bank, and IDBI Bank.

Can I open a Mahila Samman Savings Certificate in SBI?

Yes, you can open a Mahila Samman Savings Certificate in any nearby SBI branch. You just need to bring all the relevant documents required to open an account. The documents that you would need while opening the account are mentioned in the blog above.