Pradhan Mantri Fasal Bima Yojana (PMFBY) is a flagship crop insurance scheme in India aimed at providing financial protection to farmers against crop loss due to natural calamities, pests, and diseases. The scheme is designed to mitigate the financial risks faced by farmers by offering them affordable insurance coverage. Under PMFBY, farmers pay a nominal premium, and in case of crop failure, they receive compensation to help recover their losses. The program also encourages the widespread adoption of modern agricultural practices and technologies to enhance productivity. In this article, we will talk about the scheme in detail. This will be important for the candidates preparing for UPSC, SSC, UKPSC, and other competitive examinations.

What is Pradhan Mantri Fasal Bima Yojana?

Pradhan Mantri Fasal Bima Yojana popularly known as PMFBY is a crop insurance scheme for farmers to support them in case of crop failure and encourage them to try new yields in their farm. Pradhan Mantri Fasal Bima Yojana was launched on February 18, 2016, by Prime Minister Narendra Singh Modi. This scheme integrates multiple stakeholders in a single platform. In this article, we will learn in detail about the PMFBY which will be important for various competitive examinations like SSC/Bank/UPSC and others

It is made in the line of One Nation – One Scheme by replacing two old schemes for crop insurance i.e. National Agricultural Insurance Scheme (NAIS) and Modified National Agricultural Insurance Scheme (MNAIS). In PMFBY, they took these two schemes’ best features and removed their drawbacks. PMFBY aims to reduce the premium burden on farmers and ensure early settlement of crop assurance claims.

With a focus on inclusivity, PMFBY strives to reach a large number of farmers across the country, ensuring the welfare of those who depend on agriculture for their livelihoods. The scheme is a crucial component of the government’s efforts to safeguard the interests of the farming community and promote sustainable agriculture in India.

| Pradhan Mantri Fasal Bima Yojana Key Highlights | |

| Pradhan Mantri Fasal Bima Yojana Launch date | February 18, 2016 |

| Pradhan Mantri Fasal Bima Yojana Official website | PMFBY Official Website |

| Pradhan Mantri Fasal Bima Yojana Objective | To provide insurance coverage and financial support to the farmers in the event of failure of any of the notified crops as a result of natural calamities, pests & diseases. |

| Pradhan Mantri Fasal Bima Yojana Premium Rate | Check below |

| Pradhan Mantri Fasal Bima Yojana Implementing Agency | Department of Agriculture, Cooperation & Farmers Welfare (DAC&FW)Ministry of Agriculture & Farmers Welfare (MoA&FW)Government of India (GOI) The concerned State |

| Pradhan Mantri Fasal Bima Yojana Helpdesk | 18001801551 18002664141 |

Pradhan Mantri Fasal Bima Yojana Objectives

Here are some objectives of PMFBY

- To provide insurance coverage and financial support to the farmers in the event of failure of any of the notified crops as a result of natural calamities, pests & diseases.

- To encourage farmers to adopt innovative and modern agricultural practices.

- To ensure the flow of credit to the agriculture sector.

- To stabilize the income of farmers to ensure their continuance in farming.

Who is the Implementing Agency?

PMFBY works not as a single but multi-agency framework. The implementing agency is decided

under the overall guidance of

- Department of Agriculture, Cooperation & Farmers Welfare (DAC&FW)

- Ministry of Agriculture & Farmers Welfare (MoA&FW)

- Government of India (GOI)

- The concerned State.

Note: The concerned state does this in coordination with various other agencies such as

Financial Institutions like Commercial Banks, Co-operative Banks, Regional Rural Banks and their regulatory bodies, Government Departments viz. Agriculture, Co-operation, Horticulture, Statistics, Revenue, Information/Science & Technology, Panchayati Raj etc

Pradhan Mantri Fasal Bima Yojana Benefits

There are numerous benefits of Pradhan Mantri Fasal Bima Yojana. Some of them are listed below.

- Risk Coverage: Provides comprehensive insurance coverage for crop losses due to natural calamities, pests, and diseases.

- Affordable Premiums: Offers subsidized premium rates for farmers, making it affordable and accessible.

- Reduced Farmer’s Burden: The scheme eases farmers’ financial burden by compensating for crop loss.

- Covers all Crops: The scheme covers almost all crops cultivated in the notified areas, ensuring widespread coverage.

- Covers Pre-sowing Risks: It covers risks from the pre-sowing stage to post-harvest, including localized risks.

- Technology Integration: Utilizes technology like remote sensing, drones, and smartphones to assess and process claims quickly.

- Timely Compensation: Farmers receive timely compensation for their losses, helping them recover and continue farming.

- Financial Security: Provides farmers with a safety net, assuring them of support in case of crop failure.

- Easy Enrollment: Simple enrollment process with the involvement of local banks and insurance agencies.

- Support for Loan Repayment: Farmers who have taken agricultural loans get relief as their loan liability reduces in case of crop loss.

- Encourages Investment: Boosts farmer confidence, encouraging them to invest in modern agricultural practices.

- Aids in Agricultural Growth: By safeguarding farmer income, it promotes overall agricultural growth and food security.

- Enhanced Welfare: Contributes to the well-being of farmers and their families, reducing distress during crop failures.

- Risk Mitigation: Helps in stabilizing farm incomes, reducing the adverse impact of crop loss on the farming community.

- Pradhan Mantri Fasal Bima Yojana Mobile App: Allows farmers to access insurance-related information and services easily.

- Transparency and Accountability: Ensures transparency in claim settlement and minimizes chances of fraud.

Who is Eligible for the Pradhan Mantri Fasal Bima Yojana?

To be automatically eligible for the PMFBY scheme. A farmer has to be doing these things.

- He must be growing notified crops.

- It must be grown in a notified area.

- It must be grown during the season

- He must have an insurable interest in the crop.

Who is Covered under the PMFBY Scheme?

There are two types of coverage notified under this scheme

- Compulsory coverage

- Voluntary coverage

Compulsory Coverage

Enrollment under the scheme, subject to possession of insurable interest on the cultivation of the notified crop in the notified area, shall be compulsory for the following categories of farmers:

- Farmers in the notified area who possess a Crop Loan account/KCC account (called as Loanee Farmers) to whom credit limit is sanctioned/renewed for the notified crop during the crop season.

- Such other farmers whom the Government may decide to include from time to time

Voluntary Coverage

Voluntary coverage may be obtained by all farmers not covered above, including Crop KCC/Crop Loan Account holders whose credit limit is not renewed.

What is a NOTIFIED AREA in the PMFBY Scheme ?

A Notified Area is nothing but the Unit of Insurance decided by the State Govt. for notifying a Crop during a season. The size of the Unit of Insurance shall depend on the area under cultivation within the unit. For major crops, the Unit of Insurance shall ordinarily be Village/Village Panchayat level and for minor crops may be at a higher level so that the requisite number of CCEs could be conducted during the notified crop season.

States may notify Village / Village Panchayat as insurance units in case of minor crops too if they want.

Insurance Companies Involved in PMFBY Scheme

The government in participation of empanelled insurance companies is carrying out the claims of PMFBY. The complete list of empanelled insurance companies in the PMFBY scheme is provided below

- Cholamandalam MS General Insurance Company Ltd.

- Bajaj Allianz General Insurance Company Ltd.

- Reliance General Insurance Company Ltd.

- Future Generali India Insurance Company Ltd.

- Tata-AIG General Insurance Company Ltd.

- Agriculture Insurance Company of India Ltd

- ICICI-Lombard General Insurance Company Ltd

- HDFC-ERGO General Insurance Company Ltd.

- IFFCO-Tokio General Insurance Company Ltd.

- SBI General Insurance Company Ltd.

- Universal Sompo General Insurance Company Ltd.

Who Manages the PMFBY Scheme?

The State Level Coordination Committee on Crop Insurance (SLCCCI), SubCommittee to SLCCCI, and District Level Monitoring Committee (DLMC) are responsible for the complete management of the PMFBY Scheme. These agencies are already overseeing the implementation & monitoring of the ongoing crop insurance schemes like

- National Agricultural Insurance Scheme (NAIS

- Weather Based Crop Insurance Scheme(WBCIS)

- Modified National Agricultural Insurance Scheme(MNAIS)

- Coconut Palm Insurance Scheme(CPIS)

Please Note: IA or Implementing Agency shall be an active member of SLCCCI and District Level Monitoring Committee (DLMC) of the scheme.

What Losses/Risks are covered under the PMFBY Scheme?

Here are the losses that have been included by the government in the PMFBY scheme are given below:

Yield Losses (standing crops, on notified area basis):

The government has included Comprehensive risk insurance to cover yield losses due to non-preventable risks, such as

- Natural Fire and Lightning

- Storm, Hailstorm, Cyclone, Typhoon, Tempest, Hurricane, Tornado etc.

- Flood, Inundation and Landslide

- Drought, Dry spells

- Pests/ Diseases etc.

Prevented Sowing (on a notified area basis):-

Insured farmers of the notified area are eligible for an indemnity claim up to 25% (maximum) of the sum insured in case of adverse weather conditions while sowing/ planting the insured crop.

Post-Harvest (individual farm basis):

In the Post – Harvest case, coverage is available up to a maximum period of 14 days from harvesting for those crops that are kept in “cut & spread” condition to dry in the field after harvesting, against specific perils of cyclone / cyclonic rains, unseasonal rains throughout the country.

Localised Calamities (individual farm basis):

Loss/damage of crops due to identified localized risks such as hailstorms, landslides, and Inundation affecting isolated farms in the notified area are covered under the PMFBY Scheme.

What Risks/ Losses are not covered Under the PMFBY Scheme?

Certain risks are excluded from the PMFBY Scheme. Those are given below

War & kindred perils, nuclear risks, riots, malicious damage, theft, acts of hostility, grazed and destroyed by domestic and wild animals,

In the case of post-harvest losses the harvested crop is bundled and heaped at a place before threshing, other preventable risks are not covered under the scheme.

Premium Rates under the PMFBY Scheme

The rate of Insurance Charges payable by the farmer under the PMFBY scheme will be as per the given table. These rates would be charged under PMFBY by the concerned Implementing Agency.

| Season | Crops | Maximum Insurance charges payable by the farmer (% of Sum Insured) |

| Kharif | Food and oilseeds crops (all cereals, millets, & oilseeds, pulses) | 2.0% of SI or Actuarial rate, whichever is less |

| Rabi | Food and oilseeds crops (all cereals, millets, & oilseeds, pulses) | 1.5% of SI or Actuarial rate, whichever is less |

| Kharif & Rabi | Annual Commercial / Annual Horticultural crops | 5% of SI or Actuarial rate, whichever is less |

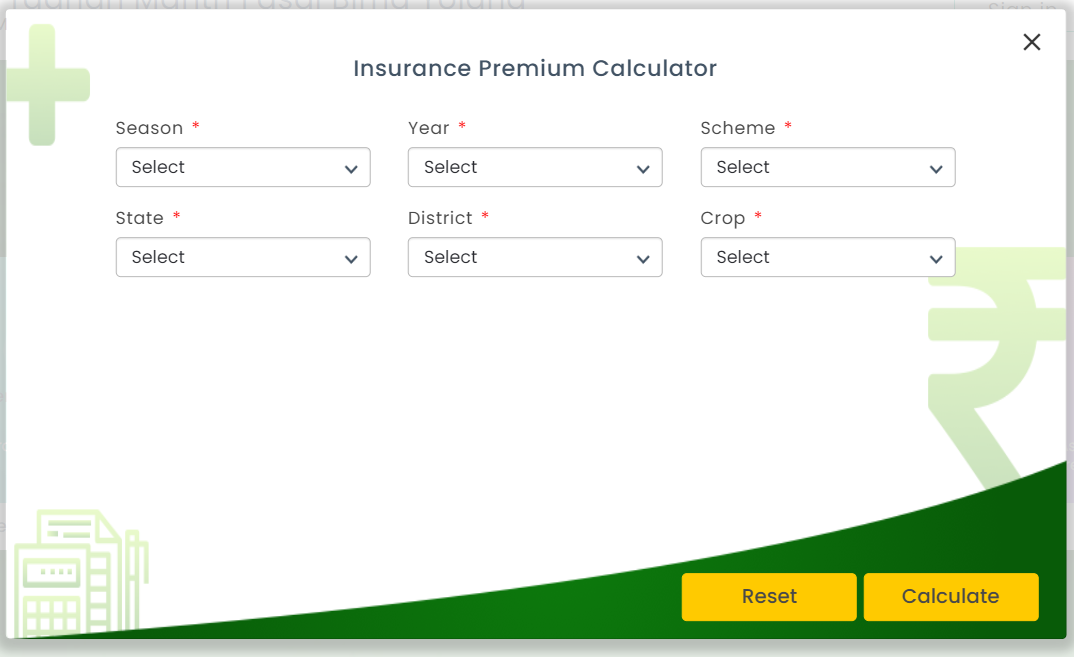

All about PMFBY Insurance Calculator

You can check the PMFBY interest in your crop by using the PMFBY Insurance calculator. Through this calculator, you can check your claim amount. You just have to select your season ( Kharif/ Rabi), State, district, Area (In hectare), and crop. After this, you will be able to check your Insurance premium as well as claim. You can check your PMFBY Insurance form at the link given below.

Click Here for the PMFBY Insurance Calculator

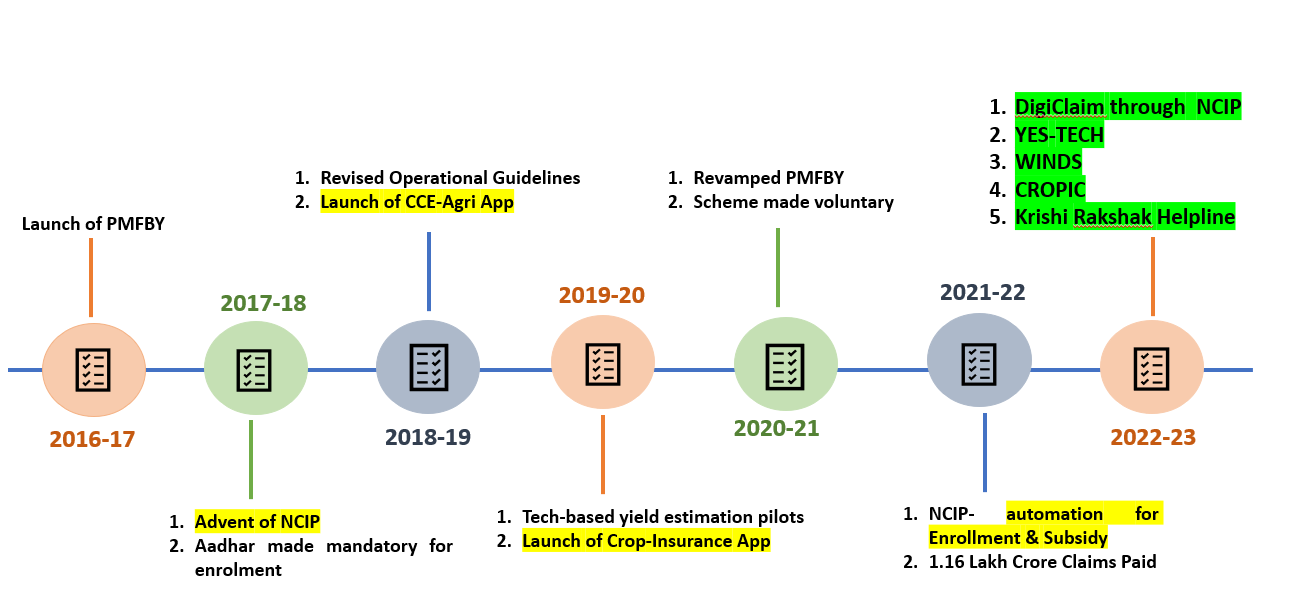

PMFBY 3.0: PMFBY Journey So Far / Conclusion

PMFBY has gone through some major changes since its inception. Here is the Tech Journey so far of PMFBY

Image from: Ministry of Agriculture

Since its launch, PMFBY has gone through some major changes, and some more related apps were also launched in between. In 2020 PMFBY was revamped and the scheme became voluntary for the states; however, after excluding themselves from the scheme, certain states like Jharkhand, Punjab, and Telangana are actively considering rejoining. Moreover, Andhra Pradesh has rejoined the scheme. Insurance companies and PSUs like ICICI Lombard and United India respectively have also rejoined the scheme. This shows the strength this scheme holds. Also, it shows that this scheme is beneficial for the farmers and has been helping farmers in distress for the past 6 years.