Having a home of one’s own in India is paramount, representing stability, security, and a sense of accomplishment. It is a cornerstone for family well-being, fostering a foundation for personal growth and community engagement. Homeownership not only fulfills a basic human need for shelter but also establishes a tangible asset, contributing to financial stability and a better quality of life. Acknowledging this, the Indian Government has launched a housing scheme called Pradhan Mantri Awas Yojana-Urban. The scheme has been launched by the Ministry of Housing and Urban Affairs (MoHUA). In this article, we will talk about the scheme in detail. I am certain that by the end of the article, you won’t have any problem regarding the same.

What is Pradhan Mantri Awas Yojana-Urban ?

Pradhan Mantri Awas Yojana (PMAY) Urban is a housing scheme launched by the Prime Minister with the aim of alleviating the shortage of urban housing. This program is designed to benefit Economically Weaker Sections (EWS), Low-Income Groups (LIG), and Middle-Income Groups (MIG), including slum dwellers. Under the PMAY-Urban framework, there is a significant Credit Linked Subsidy Scheme (CLSS) that provides a beneficial aspect. This component allows individuals opting for a home loan to receive an interest subsidy, capped at Rs. 2.67 lakh. This financial support is extended to eligible beneficiaries who are seeking housing loans for the purpose of purchasing, constructing, or even renovating homes under the PMAY-Urban scheme.

This comprehensive initiative encompasses the entire urban landscape, including Statutory Towns, Notified Planning Areas, Development Authorities, Special Area Development Authorities, Industrial Development Authorities, or any similar authority operating under State legislation with responsibilities related to urban planning and regulations.

| Pradhan Mantri Awas Yojana (PMAY) Urban Key Highlights | |

| Pradhan Mantri Awas Yojana-Urban Launch Date | June 25, 2015, |

| Pradhan Mantri Awas Yojana-Urban Official Website | PMAY Official Website |

| Pradhan Mantri Awas Yojana (PMAY) Urban Objective | To provide subsidies for easy and affordable housing to eligible beneficiaries |

| Pradhan Mantri Awas Yojana-Urban Beneficiaries | Economically Weaker Sections (EWS), Low-Income Groups (LIG), and Middle-Income Groups (MIG) |

| Pradhan Mantri Awas Yojana-Urban under which Ministry | Ministry of Housing and Urban Affairs (MoHUA) |

| Pradhan Mantri Awas Yojana-Urban Validity | December 31, 2024, |

| Pradhan Mantri Awas Yojana (PMAY) Urban Interest Subsidy | 3% to 6.5% per annum |

| Pradhan Mantri Awas Yojana (PMAY) Urban | 1800-11-6163 – HUDCO1800 11 3377, 1800 11 3388 – NHB |

Pradhan Mantri Awas Yojana-Urban Objective

- The primary goal is to ensure that all eligible urban households, as defined by the Census 2011 data, have access to a secure and permanent residence by the year 2022.

- To be eligible for any component of this scheme, beneficiaries must possess an Aadhaar or Aadhaar Virtual ID.

- The scheme seeks to address the escalating prices of land and property, making them more affordable. Known as the “Housing for All by 2022” initiative, the Pradhan Mantri Awas Yojana (PMAY) operates as a Credit Linked Subsidy Scheme (CLSS).

- It encourages sustainable and economical housing practices. Individuals obtaining loans for the acquisition of residential property, land, or home construction are eligible for interest subsidies on the credited amount.

Pradhan Mantri Awas Yojana-Urban Key Highlights

Given below are the key features of the Pradhan Mantri Urban Awas Yojana for the EWS,LIC. MIG-1 and MIG-2.

| Particulars | EWS | LIG |

| Discounted Rate for Calculation of Net Present Value of InterestSubsidy | Up to Rs.6 lakh | Up to Rs.6 lakh |

| Maximum Loan Tenure | 20 years | 20 years |

| Discounted Rate for Calculationof Net Present Value of InterestSubsidy | 9.00% | 9.00% |

| Dwelling Unit Carpet Area(sq.m.) | Up to 30 sq.m. | Up to 60 sq.m. |

| Maximum Interest SubsidyAmount | Rs.2,67,280 | Rs.2,67,280 |

| Parameters | MIG I | MIG II |

| Lump Sum Amount Paid for for Sanctioned Housing Loan Application Instead of Processing Fee | Up to Rs.9 lakh | Up to Rs.12 lakh |

| Maximum Loan Tenure | 20 years | 20 years |

| Dwelling Unit Carpet Area(sq.m.) | 160 sq.m. | 200 sq.m |

| Maximum Interest Subsidy Amount | Rs.2,35,068 | Rs.2,30,156 |

| Discounted Rate for Calculation of Net Present Value of InterestSubsidy | Rs.2,000 | Rs.2,000 |

| Discounted Rate for Calculationof Net Present Value of InterestSubsidy | 9.00% | 9.00% |

Pradhan Mantri Awas Yojana-Urban Benefits

- Advantages of the program include the rehabilitation of eligible slum dwellers, facilitated by the involvement of private developers who utilize land as a valuable resource.

- The initiative also promotes affordable housing through the Credit Linked Subsidy Scheme (CLSS), with specific criteria for income and house sizes:

- Economically Weaker Sections (EWS): Annual Household Income up to Rs. 3,00,000; house sizes up to 30 sq.m.

- Low-Income Groups (LIG): Annual Household Income from Rs. 3,00,001 to Rs. 6,00,000; house sizes up to 60 sq.m.

- Middle Income Group I (MIG I): Annual Household Income from Rs. 6,00,001 to Rs. 12,00,000; house sizes up to 160 sq.m.

- Middle Income Group II (MIG II): Annual Household Income from Rs. 12,00,001 to Rs. 18,00,000; house sizes up to 200 sq.m.

- Additionally, the program encourages affordable housing initiatives in collaboration with both public and private sectors.

- Central assistance is provided for each Economically Weaker Sections (EWS) house in projects where at least 35% of the houses are designated for EWS beneficiaries.

- There is also a subsidy available for individual house construction or enhancement led by beneficiaries falling under the EWS category, constituting a separate project for such individuals.

- PMAY-U’s Credit Linked Subsidy Scheme (CLSS) offers beneficiaries interest subsidies on home loans, easing the financial burden and making homeownership more accessible.

- PMAY-U targets diverse segments of society, including Economically Weaker Sections (EWS), lower-income groups (LIG), middle-income groups (MIG), women, minorities, and marginalized communities, ensuring widespread housing benefits.

- Preference is given to women beneficiaries or households with female ownership, empowering women and involving them in housing-related decision-making.

- PMAY-U beneficiaries receive legal property ownership, enhancing their social and economic security.

- Access to affordable housing options through PMAY-U contributes to an improved quality of life for urban residents, impacting health, education, and overall well-being positively.

- Increased demand for affordable housing under PMAY-U stimulates the construction and real estate sectors, fostering job creation and economic growth.

- PMAY-U encourages environmentally sustainable practices in housing construction, emphasizing energy efficiency and a reduced carbon footprint.

- PMAY-U utilizes technology for transparent and efficient implementation, providing beneficiaries with online tools to track application status and receive updates.

- The financial assistance under PMAY-U is often disbursed through direct bank transfers, minimizing the risk of fraud and ensuring funds reach the intended beneficiaries efficiently.

Pradhan Mantri Awas Yojana-Urban Eligibility Criteria:

- The household must fall into one of the following categories:

| Beneficiary Category | Annual Family Income | Approve Carpet Area |

| EWS | 3 lakh | 30 SqM. |

| LIG | 3-6 lakh | 60 SqM. |

| MIG-1 | 6-12 lakh | 90 SqM. |

| MIG -2 | 12-18 lakh | 110 SqM. |

- The family should consist of a husband, wife, and unmarried children.

- The town or city of residence must be covered under the scheme.

- The family should not have previously benefited from any housing-related schemes initiated by the Government of India.

Pradhan Mantri Awas Yojana-Urban Required Documents

Before you apply for the PMAY-U, it is imperative to check the documents required for the same. Here is the complete list of the documents that are required for the Pradhan Mantri Awas Yojana Urban.

1. Aadhaar Number (or Aadhaar/Aadhaar Enrolment ID)

2. Self-Certificate/Affidavit serving as Proof of Income.

3. Identity and Residential Proof (such as PAN card, Voter ID, and Driving License).

4. Proof of Minority Community status (if the applicant belongs to a Minority Community).

5. Proof of Nationality.

6. Certificate for Economically Weaker Section (EWS) / Low Income Group (LIG) / Middle Income Group (MIG) (as applicable).

7. Salary Slips.

8. Income Tax Return Statements.

9. Property Valuation Certificate.

10. Bank Details and Account Statement.

11. Affidavit or Proof confirming that the applicant does not own a permanent residence (‘pucca’ house).

12. Affidavit or Proof affirming that the applicant is constructing a home under the scheme.

Pradhan Mantri Awas Yojana-Urban Interest Subsidy

Here is the complete list of Pradhan Mantri Awas Yojana – Urban Interest Subsidy that will be provided by the government. The subsidy depends on the categories.

| Particulars | Interest Subsidy | Maximum Loan for Subsidy |

| EWS | 6.50% p.a. | Rs.6 lakh |

| LIG | 6.50% p.a. | Rs.6 lakh |

| MIG -1 | 4.00% p.a. | Rs.9 lakh |

| MIG-2 | 3.00% p.a. | Rs.12 lakh |

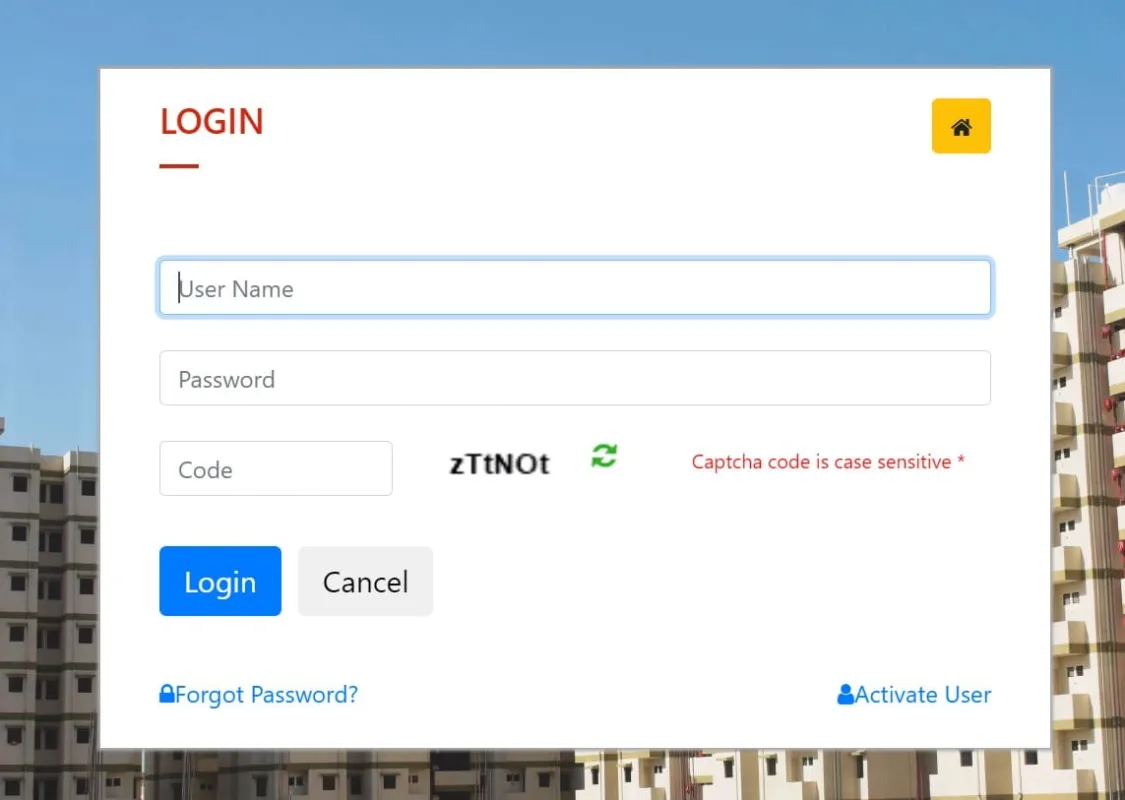

Pradhan Mantri Awas Yojana-Urban How to Apply Online

The Pradhan Mantri Awas Yojana Urban application process can be done through both online and offline modes. Both processes are equally reliable provided that you have all the required documents for the scheme.

To apply for the Pradhan Mantri Awas Yojana Urban through online mode, you can follow the step-by-step process provided below.

- Visit the official website of PMAY-Urban.

- Opt for the ‘Citizen Assessment’ option and select the relevant choice: “For Slum Dwellers” or “Benefits under other three components.”

- Input your Aadhaar Card details.

- This action will direct you to the online application form.

- Complete all mandatory sections in the form, providing necessary details such as your name, contact number, personal information, bank account details, income details, and more.

- Ensure you also upload the required documents.

- Toward the end of the form, click on ‘Save’ and input the Captcha code.

- Your application is now finished, and you can choose to print a copy for future reference.

List of State-Level Nodal Agencies for PMAY(U)

Pradhan Mantri Awas Yojana-Urban Application Procedure Offline

In order to apply offline, you need to follow the steps given below.

- Visit a nearby Common Service Centre (CSC).

- Acquire the application form by making a payment of ₹25 (plus GST) at the counter.

- Complete all essential sections in the form, providing necessary details such as your name, contact number, personal information, bank account details, income details, etc.

- Attach copies of the required documents.

- Submit the appropriately filled and signed application form at the CSC.

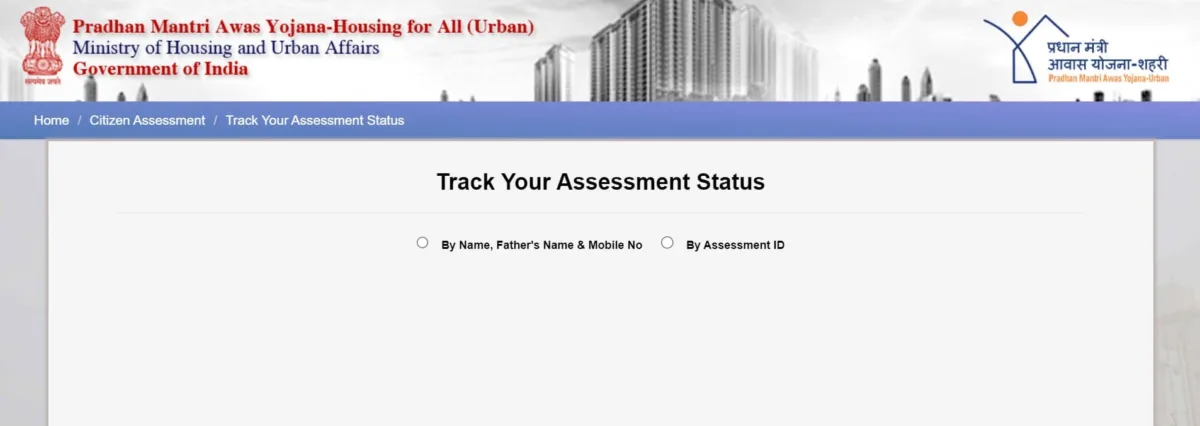

Pradhan Mantri Awas Yojana-Urban Check Status

Click here to check or Track the Application Status of Pradhan Mantri Awas Yojana – Urban.

Pradhan Mantri Awas Yojana-Urban List of Banks

| Private Sector Banks Offering PMAY Home Loan |

| Allahabad Bank |

| Andhra Bank |

| Bank of Baroda |

| Bank of India |

| Bank of Maharashtra |

| Canara Bank |

| Central Bank of India |

| Corporation Bank |

| Dena Bank |

| IDBI Bank Ltd. |

| Indian Bank |

| Indian Overseas Bank |

| Oriental Bank of Commerce |

| Punjab & Sind Bank |

| Punjab National Bank |

| State Bank of India* |

| Syndicate Bank |

| UCO Bank |

| Union Bank of India |

| United Bank of India |

| Vijaya Bank |

| Private Sector Banks offering PMAY Home Loan |

| Axis Bank Ltd. |

| Bandhan Bank Ltd. |

| Catholic Syrian Bank |

| City Union Bank |

| DCB Bank Ltd. |

| Dhanlaxmi Bank Ltd. |

| Deutsche Bank AG |

| ICICI Bank Ltd. |

| IDFC Bank Ltd. |

| J&K Bank |

| Karnataka Bank Ltd. |

| Karur Vysya Bank Ltd. |

| Kotak Mahindra Bank Ltd. |

| Lakshmi Vilas Bank |

| Nainital Bank Ltd. |

| SBM Bank (Mauritius) Ltd. |

| South Indian Bank Ltd. |

| Tamilnad Mercantile Bank Ltd. |

| The Federal Bank Ltd. |

| Yes Bank |