Post Office Monthly Income Account is a remarkable scheme by the post office where the investor can enjoy an interest of Rs 9300 per month on an investment of Rs 15 Lakhs. Investments are accepted in increments of INR 1000/-. The maximum allowable investment is INR 9 lakh in a single account and INR 15 lakh in a joint account. An individual’s maximum investment in the Monthly Income Scheme (MIS), including their share in joint accounts, is limited to INR 9 lakh. In joint accounts, the share of each individual is calculated equally among all joint holders in each joint account.

What is the Post Office Monthly Income Account?

A Monthly Income Account is a small savings scheme of the Post Office that gives secure and high interest rates on your investment. Under this scheme, investments are accepted in increments of INR 1000/-. The maximum allowable investment is INR 9 lakh in a single account and INR 15 lakh in a joint account. An interest rate of 7.4% will be payable monthly. To be precise you will get Rs 64 in every Rs 10,000 invested.

Let’s illustrate this with an example. Mr. Krishna Nand Upreti, recognizing his son’s job search challenges, opted to open a joint account with him, investing Rs 15 lakh from his gratuity. As per the earlier mentioned details, every Rs 10,000 invested yields Rs 62. Therefore, the Rs 15 lakh investment would generate a monthly return of Rs 9,300. This amounts to an annual interest of Rs 1,11,600, providing sufficient financial support for Mr. K. N. Upreti’s son while he pursues his dream job. Now, let’s delve into the specifics of the scheme.

| Post Office Monthly Income Account 2024 Key Highlights | |

| Post Office Monthly Income Account Launch Date | December 01, 2011 |

| Post Office Monthly Income Account Official Website | MIS Official Website |

| Post Office Monthly Income Account Objective | To provide secure investment options for the citizens of India |

| Post Office Monthly Income Account Minimum Investment | Rs 1000 |

| Post Office Monthly Income Account Maximum Investment | Rs 9 Lakh (Individual) Rs 15 Lakh (Joint Account) |

| Post Office Monthly Income Account Interest Rate | 7.4% (2024) |

| Post Office Monthly Income Account Age Limit | No Limit |

| Post Office Monthly Income Amount Maturity | 5 Years |

| Post Office Monthly Income Account Mode of Application | Online/Offline |

| Post Office Monthly Income Account Helpline Number | 1800 266 6868 |

Post Office Monthly Income Account Benefits

- Assured Interest: MISs provide a guaranteed interest rate, set by the government and revised quarterly. This ensures a reliable return on your investment following government guidelines.

- Tax Benefits: By investing in MISs, you can avail of tax deductions under Section 80C of the Income Tax Act, allowing you to save up to Rs. 1.5 lakh in taxes annually.

- Liquidity: Despite the 5-year lock-in period, MISs can be encashed before maturity if a valid reason exists.

- Security: Backed by the government, MISs offer a secure investment. Even in the unlikely event of government payment defaults, your investment remains protected.

- No Penalty for Premature Encashment: While there is no penalty for premature encashment of MISs, early withdrawal results in a reduction of interest earned before the maturity date.

- Collateral for Loans: MISs can serve as collateral for loans, enabling you to secure a loan from a bank or financial institution using your MIS investment.

Post Office Monthly Income Account Eligibility Criteria

- The MIS scheme is available to all Indian citizens.

- Individuals must be at least 18 years old to initiate an MIS account.

- Joint accounts are allowed, enabling a maximum of three adults to be joint account holders.

- Minors aged 10 and above have the autonomy to independently establish an MIS account in their name.

- For minors below the age of 10, a guardian must initiate an MIS account on their behalf.

Post Office Monthly Income Account Documents Required

To commence the application process for the MIS scheme at a post office, specific documents need to be furnished. The requisite documentation comprises

- Proof of Identity: Acceptable forms encompass a passport, PAN card, driver’s license, voter ID, or any other government-issued identification.

- Proof of Address: This can be validated through a utility bill, bank statement, or any document indicating the applicant’s current address.

- Photograph: A recent passport-size photograph is mandatory for the application.

- Completed MIS Application Form: Obtainable from any post office, this form is essential for the application process.

- Cash or Cheque: The desired investment amount in MIS must be provided in either cash or cheque.

- Guardianship Certificate (In Case of a Minor): If the MIS account is being opened on behalf of a minor, a guardianship certificate must be submitted.

- Nominee Details: Information about the nominee(s) is required, specifying individuals entitled to the MIS proceeds in the event of the account holder’s demise.

It is crucial to emphasize that the account should be initiated at a convenient post office, as subsequent visits may be necessary for depositing funds, encashing certificates, and effecting account modifications.

Post Office Monthly Income Account Financial Account

Investments can be made in multiples of INR 1000/-. The maximum allowable investment is INR 9 lakh in a single account and INR 15 lakh in a joint account. In the case of a joint account, each holder is considered to have an equal share. An individual’s total investment in the Monthly Income Scheme (MIS), including their portion in joint accounts, cannot exceed INR 9 lakh. To determine an individual’s share in a joint account, each joint holder is deemed to have an equal stake in the account.

| Type of Account | Maximum Limit |

| Single Account (Adult) | Rs. 9 Lakh |

| Joint Account (A and B) | Rs. 15 Lakh |

Post Office Monthly Income Account How to Apply 2024 (Offline)?

To apply for the Monthly Income Account (MIS) scheme offline in 2024, follow these steps:

- Visit the nearest post office and procure the MIS Application Form.

- Alternatively, download the MIS Application Form PDF from the official website of the Department of Post (DOP).

- Complete the MIS application form with utmost care. The form is available at any post office.

- Provide self-attested copies of the necessary KYC documents, including proof of identity, proof of address, and a recent photograph.

- Make the investment payment using cash, cheque, or demand draft.

- The post office will issue an MIS Certificate upon completion of the application process.

Post Office Monthly Income Account How to Apply 2024 (Online)?

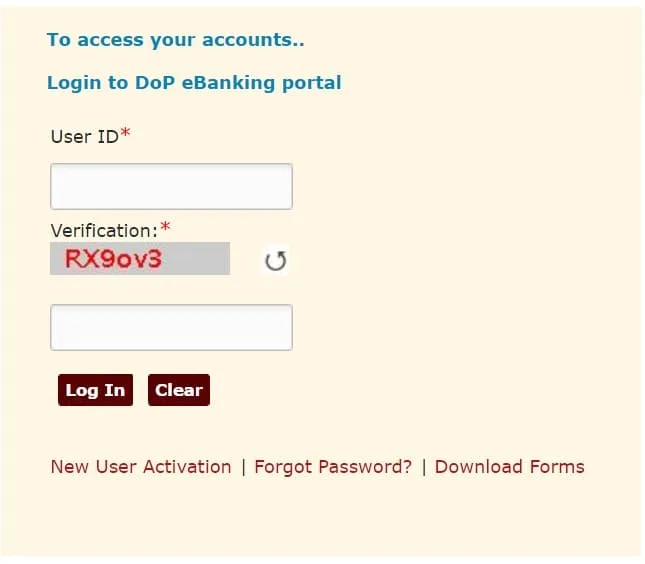

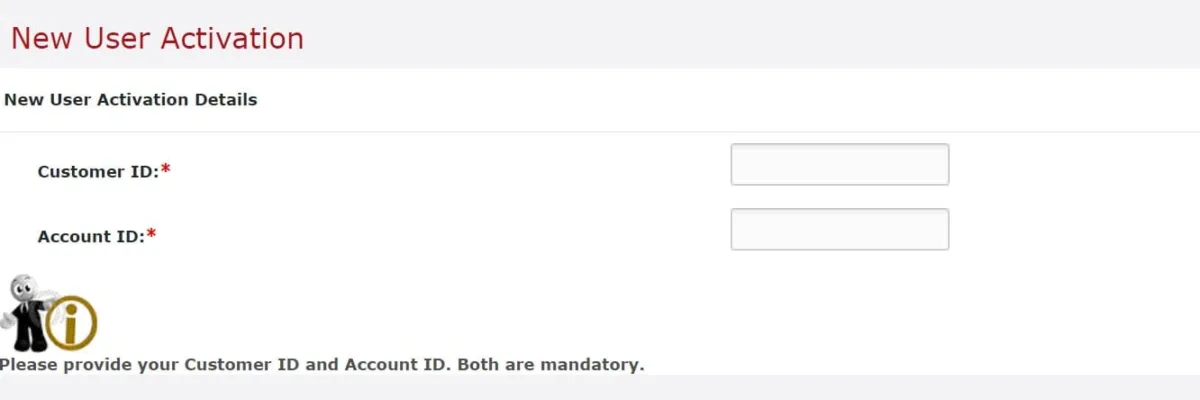

- Access the net banking portal of the Department of Posts (DOP) and log in.

- Navigate to ‘General Services‘ and opt for ‘Service Requests.’

- Select ‘New Requests’ and then choose ‘MIS Account – Open an MIS Account (For MIS).’

- Input the deposit amount and designate the debit account linked to the PO savings account.

- Carefully review the terms and conditions by clicking on ‘Click Here’ and subsequently confirm your acceptance.

- Provide the transaction password and click ‘Submit.’

- Retrieve and download the deposit receipt.

- Log in again and proceed to the ‘Accounts’ section to examine the specifics of your MIS account.

Post Office Monthly Income Account Interest Rate

- Interest will be payable every month, starting from the date of account opening and continuing until maturity.

- If the account holder does not claim the monthly interest, it will not accrue any additional interest.

- In the event of any excess deposit made by the depositor, the surplus amount will be refunded, and only the PO Savings Account interest will apply from the account opening date to the refund date.

- Interest can be obtained through auto credit into the savings account held at the same post office or through ECS. For Monthly Income Scheme (MIS) accounts at CBS Post Offices, monthly interest can be credited to a savings account at any CBS Post Offices.

- It is important to note that interest earned is taxable in the hands of the depositor.

| Duration (Quarter) | MIS Interest Rate (Per Annum) |

| 1st January 2024 – 31st March 2024 | 7.40% |

| 1st October 2023 – 31st December 2023 | 7.40% |

| 1st April 2023 – 30th June 2023 | 7.40% |

| 1st January 2023 – 31st March 2023 | 7.10% |

| 1st October 2022 – 31st December 2022 | 7.10% |

| 1st April 2020 – 30th September 2020 | 6.60% |

| 1st January 2020 – 31st March 2020 | 7.60% |

| 1st October 2019 – 31st December 2019 | 7.60% |

| 1st July 2019 – 30th September 2019 | 7.60% |

| 1st January 2019 – 31st March 2019 | 7.70% |

Premature Closure of the MIS Account

- No withdrawals are permitted within the first year from the date of deposit.

- If the account is closed between 1 and 3 years from the date of account opening, a deduction of 2% from the principal will be applied, and the remaining amount will be disbursed.

- For account closure between 3 and 5 years from the date of account opening, a deduction of 1% from the principal will be deducted, with the remaining amount being paid.

- Premature closure of the account is possible by submitting the prescribed application form along with the passbook at the relevant Post Office.

Pledging of the MIS Account

You can pledge or transfer an MIS as security, by submitting a prescribed application form at the concerned Post Office supported by an acceptance letter from the pledgee.

Transfer/pledging can be made to the following authorities.

- The President of India/Governor of the State.

- RBI/Scheduled Bank/Co-operative Society/Co-operative Bank.

- Corporation (public/private)/Govt. Company/Local Authority.

- Housing finance company.

Transfer of the MIS Account from one person to another

One can transfer the MIS from one person to another on the following conditions.

- On the death of an account holder to nominee/legal heirs.

- On the death of the account holder to the joint holder(s).

- On order by the court.

- On pledging of account to the specified authority.

Post Office Monthly Income Amount FAQs

What is the Monthly Income Amount Scheme in the Post Office?

A Monthly Income Account is a small savings scheme of the Post Office that gives secure and high interest rates on your investment. Under this scheme, investments are accepted in increments of INR 1000/-. The maximum allowable investment is INR 9 lakh in a single account and INR 15 lakh in a joint account. An interest rate of 7.4% will be payable monthly. To be precise you will get Rs 64 in every Rs 10,000 invested.

What is the maximum amount one can invest in the MIS Scheme?

The maximum allowable investment is INR 9 lakh in a single account and INR 15 lakh in a joint account.

What is the interest rate under the MIS Scheme?

An interest rate of 7.4% will be payable monthly. To be precise you will get Rs 64 in every Rs 10,000 invested.