Kisan Vikas Patra (KVP) was launched in 1988 by India Post, it was designed as a savings certificate scheme to promote long-term savings, particularly among farmers. However, in 2011, concerns about the potential misuse of illegal financial activities led to the temporary discontinuation of KVP by the Government of India. Recognizing the need for a secure savings instrument with safeguards against misuse, Kisan Vikas Patra was reintroduced in 2014 with modifications to its features, including the introduction of a lock-in period. This move aimed to enhance the integrity of the scheme and restore public confidence in its use as a reliable investment option.

In this article, we will talk about the “Kisan Vikas Patra” in detail. In case of any doubt, you can comment us your query. Over the years, KVP has played a crucial role in encouraging a culture of thrift and financial discipline, contributing to the financial inclusion and empowerment of individuals across the country.

What is Kisan Vikas Patra?

Kisan Vikas Patra stands as a government-backed investment initiative catering to individuals seeking a secure, long-term financial strategy devoid of risks. This scheme ensures the doubling of the invested amount within 10 years, currently achievable in just 115 months with a 7.5% interest rate. Originally introduced in 1988 as a small savings program targeted at farmers, the scheme’s nomenclature reflects its agricultural focus. However, over time, it has garnered widespread popularity, and today, any eligible individual can partake in the Kisan Vikas Patra, provided they meet the scheme’s criteria. This scheme has no maximum limit on investment, however, one must invest a minimum of Rs 1000 to invest in this scheme.

Let’s look at the Kisan Vikas Patra highlights to know about the scheme in a better way.

| Kisan Vikas Patra 2023 Highlights | |

| Kisan Vikas Patra Launch Date | 1988. Discontinued in 2011Re-introduced in 2014 |

| Kisan Vikas Patra Official Website | India Post Official Website |

| Kisan Vikas Patra Objective | To double the investment in 115 months |

| Kisan Vikas Patra Interest Rate (Oct – Dec 2023) | 7.5% |

| Who can open | a single adult Joint Account (up to 3 adults) a guardian on behalf of a minor or behalf of a person of unsound mind a minor above 10 years in his name. |

| Kisan Vikas Patra Minimum Investment | Rs 1000 |

| Kisan Vikas Patra Maximum Investment | No maximum limit |

| Kisan Vikas Patra Maturity Period | Depends on the Interest Rate. Currently, it is 9 Years and 7 months |

| How many accounts can be opened under one’s name? | No limit |

| Kisan Vikas Patra Helpline Number | 1800 266 6868 (Toll-Free Number) – India Post |

Kisan Vikas Patra Objectives

The primary objective of KVP is to encourage long-term savings, particularly among farmers. Investors purchase certificates at specified denominations, and the invested amount grows over a predetermined period, making it an attractive option for those looking for a secure savings instrument.

Kisan Vikas Patra has played a crucial role in promoting a savings culture and financial inclusion in India, making it a significant component of the country’s savings landscape.

Kisan Vikas Patra Benefits

There are various benefits of Kisan Vikas Patra. Some of them are listed below.

Guaranteed Returns: Kisan Vikas Patra offers guaranteed returns on your investment. The scheme doubles your money in a fixed period, which is typically around 113 months. Right now with 7.5%, it is 115 months.

Accessibility: Kisan Vikas Patra is widely accessible as it can be opened at post offices and designated banks across India. This makes it a convenient savings option for individuals who may not have access to other financial institutions.

No Maximum Limit: With such good interest return, there is no maximum limit too which makes this scheme investment-worthy. This allows individuals to invest as per their needs and wants.

Low Risk: Kisan Vikas Patra is considered a low-risk investment as it is backed by the Government of India. This assures that the invested amount will be returned with the promised returns.

No Income Tax Deduction: While the interest earned on Kisan Vikas Patra is taxable, no tax deduction is available at the time of investment. This can be beneficial for individuals who want to invest their surplus funds without considering tax implications.

Transferable: Kisan Vikas Patra is transferable from one person to another, allowing individuals to transfer their investments to family members or other beneficiaries.

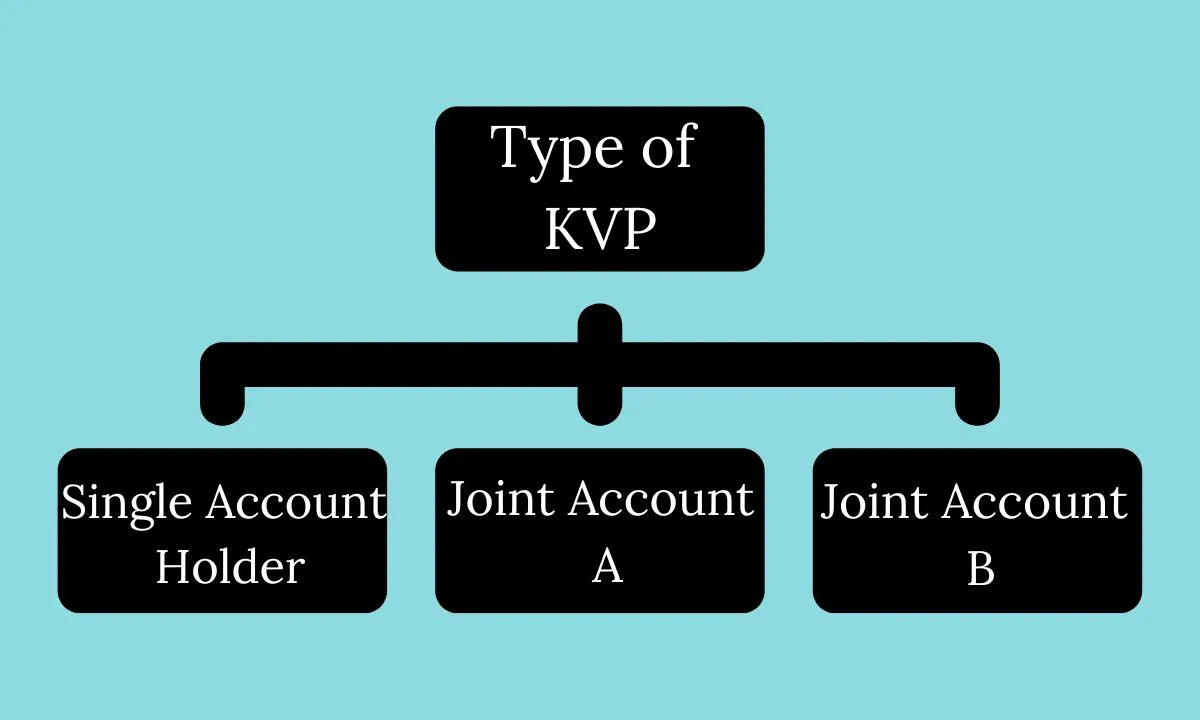

Types of Kisan Vikas Patra

As shown above, the KVP Scheme accounts are of three types.

Single holder type – In this account, an adult is the owner of the KVP certification provided by the Post Office/Bank. This certification can be availed on behalf of a minor as well. He will be issued the minor certification under his name only.

Joint A type – In the Joint A type of account, two people, both of whom are adults, can open the account provided, the certification will be done in the name of one account holder only. At the time of maturity, both account holders would receive the payout. However, In case of death, only one would be entitled to receive the same.

Joint B type – In Joint B type accounts, a KVP certification is issued in the name of two adult individuals. At the time of maturity, either of the two account holders or the survivor would receive the maturity amount, unlike in Joint A-type accounts.

Maturity Period of Kisan Vikas Patra

In Kisan Vikas Patra, the maturity period is prescribed by the Ministry of Finance from time to time as applicable on the date of deposit. Right now as per the current rate of interest, the maturity period is stated as 115 months.

Kisan Vikas Patra in Banks

KVP accounts are very popular in the Post Office but do you know what? You can open a Kisan Vikas Patra account in banks as well. The government has permitted to opening of the Kisan Vikas Patra bank account in the 12 public sector banks. Along with this, 4 private sector banks are also given a nod to open a KVP account. Here are some lists of Public and Private banks in which you can open your bank account.

Public Sector Banks

| Name of the Bank | Address |

| Bank of Baroda | Central Office, P.O. Box No. 10046, 9th Floor, Baroda Corporate Centre, Bandra Kurla Complex, Bandra (East), Mumbai-400 051. |

| Bank of India | Head Office, Star House, C-5, G-Block, Bandra Kurla Complex, Bandra (East), Mumbai-400 051 |

| Bank of Maharashtra | Head Office, Lokmangal, 1501, Shivaji Nagar, Pune-411 005. |

| Canara Bank | Head Office, 112, J.C. Road, P.B. No. 6648, Bangalore-560 002. |

| Central Bank of India | Head Office, Chandramukhi, Nariman Point, Mumbai-400 021. |

| Indian Bank | Head Office, 31, Rajaji Road, Chennai-600 001 |

| Indian Overseas Bank | Central Office, 763, Anna Salai, P.B. No. 3765, Chennai-600 02. |

| Punjab National Bank | Head Office, Plot No 4, Sector-10,Dwarka New Delhi-110 066. |

| Punjab & Sind Bank | Head Office, Bank House, 21, Rajendra Place, New Delhi-110 008. |

| Union Bank of India | Head Office, 239, Vidhan Bhavan Marg, Nariman Point, Mumbai-400 021. |

| UCO Bank | Head Office, 10, B.T.M. Sarani, Brabourne Road, Calcutta-700 001. |

| State Bank of India | Central Office, State Bank Bhavan, Madam Cama Road, Mumbai-400 021 |

Private Sector Banks

These are the four private sector banks in which you can open your Kisan Vikas Patra account.

| Name of the Bank | Address |

| ICICI Bank | Mumbai |

| Axis Bank | Wadia International Centre, Pandurang Budhkar Marg, Worli, Mumbai – 400 025. |

| HDFC Bank | Mumbai |

| IDBI Bank | IDBI Tower, WTC Complex, Cuffe Parade, Colaba, Mumbai 400005. |

How to apply for Kisan Vikas Patra Online?

Unfortunately, there is no way you can open a KVP Account online. You have to visit the nearest branch of your desired post office/bank. This is a drawback of this scheme as one cannot open a KVP account in the comfort of his home.

How to Apply for Kisan Vikas Patra Offline?

- To open a KVP account, visit your nearest Post Office/Bank of your choice.

- Ask for Form 1 and very carefully fill out the application form.

- In case you are assisted by an agent, another form 1A is required to be filled.

- Attest any KYC Documents such as Aadhar Card, PAN Card Passport, Voter’s ID, Driving License, and more.

Post Office – Download Kisan Vikas Patra Application Form [PDF]

Bank of Baroda – Download KISAN VIKAS PATRA Application Form

Union Bank Of India – Download the KISAN VIKAS PATRA Application Form

Kisan Vikas Patra Eligibility Criteria

To avail of the advantages of the Kisan Vikas Patra 2023 scheme, adherence to the stipulated eligibility criteria is imperative. The comprehensive list of eligibility requirements for Kisan Vikas Patra 2023 is outlined below:

- Residency Requirement: Applicants must be residents of India.

- Age Criteria: Individuals must be at least 18 years old to qualify.

- Minor Applicants: In the case of minors, a guardian can apply on their behalf. Minors aged 10 years and above have the option to independently open an account under the scheme.

Document required for Kisan Vikas Patra Scheme

Here are the documents needed at the time of opening a Kisan Vikas Patra account.

- Form A application – It must be carefully filled and duly submitted to an India Post Office branch/other specific banks.

- Form A1 (In case the application is extended through an agent).

- Any one of the KYC documents like an Aadhaar Card, PAN card, Passport, Voter’s ID, Driving License

After submitting the above documents, the post office/bank will generate a KVP Certificate to you. Keep this certificate with you as you have to produce the same at the time of maturity.

What if Kisan Vikas Patra is lost?

Although such important documents should be preserved with care, however, under any circumstance if you lose your KVP certificate, you can ask for a duplicate one. There will be some charges for that (Rs 50 at the post office). You will get your duplicate KVP Certificate at the counter.

Premature Closure of Kisan Vikas Patra

In case of need, you can encash your KVP Certificate after two and a half years or 30 months from the date of issue. In this case, no penalty will be levied on you, however, if you decide to withdraw the KVP certificate before the completion of one year, there will be a penalty as per instructions. Also, you will not get any interest in it.

For the premature closure of the account, you have to fill out the FORM-3 given to you by the post office/bank or online.

Kisan Vikas Patra Interest Rate History

The government has released the KVP interest rates for the October to December 2023 quarter. The interest for October to December 2023 has remained the same i.e. 7.5%. In KVP, your money doubles at the time of maturity. The maturity and the rate of interest are decided by the government.

| Year Duration | Interest Rate | Maturity Period |

| Oct- Dec 2023 | 7.5% | 115 months |

| July-Sept 2023 | 7.5% | 115 months |

| Apr- June 2023 | 7.5% | 115 months |

| Jan-Mar 2023 | 7.2% | 120 months |

| Oct-Dec 2022 | 7% | 123 months |

| July-Sept 2022 | 6.9% | 124 months |

| Apr- June 2022 | 6.9% | 124 months |

| Jan-Mar 2022 | 6.9% | 124 months |

How to transfer Kisan Vikas Patra Certificate ?

Transfer of a Kisan Vikas Patra can be done in two ways. You can either transfer a KVP account from one person to another or from one branch to another branch. Let’s look at both conditions one by one.

Case 1: Transfer from One Person to Another

To transfer the KVP certificate from one person to another, you need to submit a written letter to your Post Office. Transfer can be done as follows

- From one owner to the combined owners

- From combined owners to the name of one of the owners

- Transfer from the name of the deceased to his or her heir

- From the owner to a judge of law and also to other individuals as ordered by a Law Court

Case 2: Transfer from One Post Office to Another

The KVP certificate can also be transferred from one post office to another post office. You just need to submit a handwritten consent to the officer at the post office where it is officially generated.

Nomination in the KVP Account

It is essential to make a nomination while opening a KVP account. This way, after you, your nominee can get the deposit without any hassle. You can make a nomination by filling out a FORM C provided to you by your bank/post office. You have to fill out all the necessary information about the nominee so that in case of death, the nominee can claim the KVP Certificate.

In case you missed filling out a nominee form at the time of opening a KVP account, you can do it now by asking for FORM C at the counter or submitting it to the postal or bank person who registered the certificate on your behalf.

In case of Death of the Account Holder Before the Maturity Date

In case of the death of the account holder before the maturity date, the nominee can choose to either close the account or opt to continue the scheme until maturity. If the nominee decides to close the account before maturity, he/she will get the deposit account and interest levied on it till the time it was there. Please note that there is a common misconception that upon the death of the holder, a full maturity amount will be given to the nominee even if the maturity period is not over.

Kisan Vikas Patra FAQs

Is Kisan Vikas Patra a good investment?

KVP is indeed a good investment if you are looking for a long-term risk-free investment. In Kisan Vikas Patra, the government guarantees to double your deposit in a certain time. Currently, the time is 115 months (7.5%)

Is Kisan Vikas Patra still available?

Yes, Kisan Vikas Patra is still available at your nearest post office/bank. You can visit your nearest post office/bank to open a KVP account. All the information regarding the scheme is given in the article in detail.

Is Kisan Vikas Patra safe?

As this scheme is backed by the government, it is the most safe investment one can make with one’s money. At the official notification itself, the government has asked us to invest our money and relax as it is the most secure form of investment.

Is Kisan Vikas Patra tax free?

Although the amount that is withdrawn after maturity is exempted from tax deduction source, the KVP scheme is not exempted from section 80C.

Is Kisan Vikas Patra available in banks?

Yes, KVP is available in 12 public sector banks as well as selected private sector banks. To see the complete list, please read the table above.

Is Kisan Vikas Patra under 80C?

No. Kisan Vikas Patra is not exempted under 80C, however, no tax deduction will be done post maturity in KVP.

What if KVP is lost?

If you have lost your KVP certificate, there is nothing to worry about. You just have to visit your Post Office/Bank and ask for a new one. There will be some charges levied to issue a duplicate one and you will get a new KVP Certificate.