RISE Together Scheme 2024: Jammu & Kashmir is endowed with a predominantly youthful demographic, with approximately 69% of the population being under the age of 35. To facilitate the comprehensive implementation of various youth engagement and outreach initiatives and to prioritize the interests and empowerment of the youth in policy-making, the government of the Jammu & Kashmir Union Territory has introduced a groundbreaking initiative known as Mission Youth. Under this initiative, the youth will be able to generate employment not for himself but for others as well. Hence, contributes to the nation. Schemes like the Young Innovators Program, SAHYTA Program, and Spurring Entrepreneurship Initiative among others are to help the youth take their future and the nation’s future towards prosperity.

RISE Together Scheme is one such initiative that empowers youth to efficiently do community-based entrepreneurship, fostering job creation, and income generation, and cultivating a sense of social service. In this article, we are going to talk about the RISE Together Scheme initiative in detail. We will also talk about the RISE Together Scheme apply online, RISE Together Scheme Scheme PDF, RISE Together Scheme Eligibility, and more

What is the RISE Together Scheme 2024?

RISE Together scheme is an initiative by the Mission Youth to provide financial assistance, especially to unemployed youth aged between 18 and 35 years with a minimum education qualification of the 12th class. The maximum financial assistance of Rs 20 lakh divided into subsidy amount and loan amount will be provided to the youth to start an eligible new business.

The initiative is dedicated to the introduction and advancement of community-oriented entrepreneurship in Jammu and Kashmir. It aims to offer strategic and financial support to energized and driven youth. The program’s vision is to efficiently promote community-based entrepreneurship, fostering job creation, and income generation, and cultivating a sense of social service among the emerging young entrepreneurs in the region of Jammu & Kashmir. Let’s talk about the scheme in detail.

| RISE Together Scheme 2024 Key Highlights | |

| RISE Together Scheme 2024 Launch Date | Not Specified |

| RISE Together Scheme Official Website | Mission Youth Portal |

| RISE Together Scheme Objective | To offer strategic and financial support to energized and driven youth. |

| RISE Together Scheme Beneficaires | Unemployed Youth of J and K |

| RISE Together Scheme Financial Assistance | Upto Rs 20 Lakh |

| RISE Together Scheme Age Limit | 18 and 35 years, |

| RISE Together Scheme Subsidy Limit | Upto 10% of Project Cost or a minimum of Rs 2.5 Lakh rupees |

| RISE Together Scheme Loan Amount | Upto Rs 17.5 Lakh |

| RISE Together Scheme Mode of Application | Online |

| RISE Together Scheme Helpline Number | 8447804864 |

RISE Together Scheme Objective 2024

- Cultivate Community-Oriented Entrepreneurship in Jammu and Kashmir.

- Integrate Youth Livelihood Programs with the broader socio-economic development of society.

- Provide essential guidance and financial assistance to empower youth in establishing model Community-Oriented Enterprises.

- Offer end-to-end strategic support, covering production to marketing, for dynamic and motivated youth in Jammu and Kashmir.

- Establish Economic Units that contribute to the collective prosperity of society.

- Coordinate resources and expertise through collaborative efforts with all stakeholders.

- Introduce the concept of the ‘RISE Together Scheme’ based on an integrated and forward-looking growth model, emphasizing collective advancement.

RISE Together Scheme Activities to be Covered

The Rise Together initiative aims to foster Community Entrepreneurship in Jammu and Kashmir, striving to generate new employment opportunities for the youth while promoting inclusive development within local social networks. The indicative, though not exhaustive, list of activities covered by the program includes

- Mechanized Dairy Units

- Automated Sheep Farms

- Departmental Stores

- Indigenous Raw Material-Based Manufacturing Units

- Wayside Amenities and Facilitation Centers in Tourist Circuits

- Sound and Light Recreational Facilities

- Smart Teaching-Learning Facilities

- Supply and Distribution Network for Retail Food/Non-Food Products

- Commercial Training Institutes

- Any other activity deemed necessary to promote self-reliance and inclusive social development.

Ladli Beti Scheme 2024| Rs 6.5 Lakhs to be Gifted on the Birth of Girl Child

RISE Together Scheme Benefits

- Beneficiaries under the scheme can avail financial assistance up to ₹20.00 lakh, consisting of an upfront subsidy component provided by Mission Youth (a minimum of ₹2.5 lakh or 10% of the project cost) and a loan offered by the bank (equivalent to 70% of the project cost, up to ₹17.50 lakh).

- To complement this assistance, the remaining 20% of the project cost must be self-financed or self-arranged by the beneficiary youth group as margin money to access the financial aid provided by the scheme.

- It is important to note that the special subsidy allocated for repayment under the scheme is capped at an aggregate of ₹5.0 lakh per case.

RISE Together Scheme Project Identification

The selection of projects for funding under the program will be based on their economic potential and addressing localized facility gaps. Proposals seeking assistance in the program will undergo evaluation by an inter-sectoral expert committee of Mission Youth, considering both economic viability and localized facility gaps.

Mission Youth will identify projects to be undertaken under the program at the commencement of each financial year.

RISE Together Scheme Financial Assistance

Mission Youth will contribute its share towards the repayment of the Loan Component under the Scheme, following the given schedule:

| RISE Together Scheme Repayment Status | ||

| Year Of Repayment | Contribution by Mission Youth towards EMIs | Contribution by Beneficiary towards EMIs |

| First Year | 60% | 40% |

| Second Year | 50% | 50% |

| Third Year | 35% | 65% |

| Fourth Year | 20% | 80% |

| Fifth Year | 0% | 100% |

- The scheme enables eligible Youth Groups to access financial assistance up to ₹20.00 lakh, inclusive of the upfront subsidy component provided by Mission Youth under the program.

- Mission Youth, J&K, will offer a special upfront incentive (subsidy) of ₹2.5 lakh or 5% of the project cost (whichever is minimum) as part of the scheme.

- The Lending Bank will provide a loan facility equivalent to 75% of the project cost or ₹17.50 lakh, whichever is lower.

- The remaining project cost must be self-financed or self-arranged by the beneficiary youth group as Margin Money to avail of Financial Assistance under the scheme.

- The Bank will determine the financing facility based on its standard assessment procedure, and Mission Youth will not be accountable for any default on the part of the beneficiaries.

- Prepayment or takeover by another bank or financial institution will not be permitted at any point during the agreed loan tenure.

- The special subsidy provided for Repayment under the scheme is capped at an aggregate of ₹5.0 lakh per case.

- For subsequent periods, the special repayment subsidy will be granted only upon submission of necessary documents, including bank statements, income tax statements, and certificates by DLTF, confirming the sustainability of the activity at the end of each repayment year.

- The Bank will require a minimum possible collateral security for cases sponsored under the program.

| RISE Together Financial Contribution | |

| Mission Youth Contribution Front End Subsidy | 2.5 Lakh rupees or 5% of the Project cost (whichever is lower) |

| Bank Loan Contribution | 17.5 Lakh Rupees ( Repaid by Beneficiary and Mission Youth) |

| Beneficiary Contribution | Whatever is Remaining |

RISE Together Scheme Eligibility Criteria

- To qualify for consideration, individuals must be residents of Jammu and Kashmir and registered with Mission Youth, J&K.

- Financial assistance under the scheme will only be extended to Youth Groups comprising a minimum of three members. Eligible groups must have members aged between 18 and 35 years, possessing a minimum qualification of 12th standard.

- The Chief Executive Officer of Mission Youth retains the authority to relax educational qualification criteria for deserving candidates on a case-by-case basis, provided there is proper justification.

- Preference will be given to youth groups registered as Self-Help Groups, Registered Societies, or Registered Trusts. None of the group members must previously benefited from any self-employment or similar government-sponsored schemes.

- A police certification verifying the character antecedents of all group members is a prerequisite. Additionally, applicants must not have defaulted on any loans with banks or financial institutions, and individuals who have availed themselves of loan facilities under government-sponsored schemes are ineligible.

- Furthermore, beneficiaries must be unemployed, a status that must be certified by the competent authority.

RISE Together Scheme Documents Required

- Domicile Certificate or Ration Card

- Aadhaar Card

- Date of Birth Certificate issued by the competent authority

- Matriculation Certificate

- Unemployment certificate (Only necessary for new business applicants)

- Project report detailing the intended activity to be financed.

RISE Together Scheme Apply Online

You can apply for the RISE Together scheme through the Mission Youth Portal which has other schemes as well for skill development, livelihood, and educational purposes. Here is the step-by-step process to follow for applying for the RISE Together. Mission Youth invites proposals from interested youth annually.

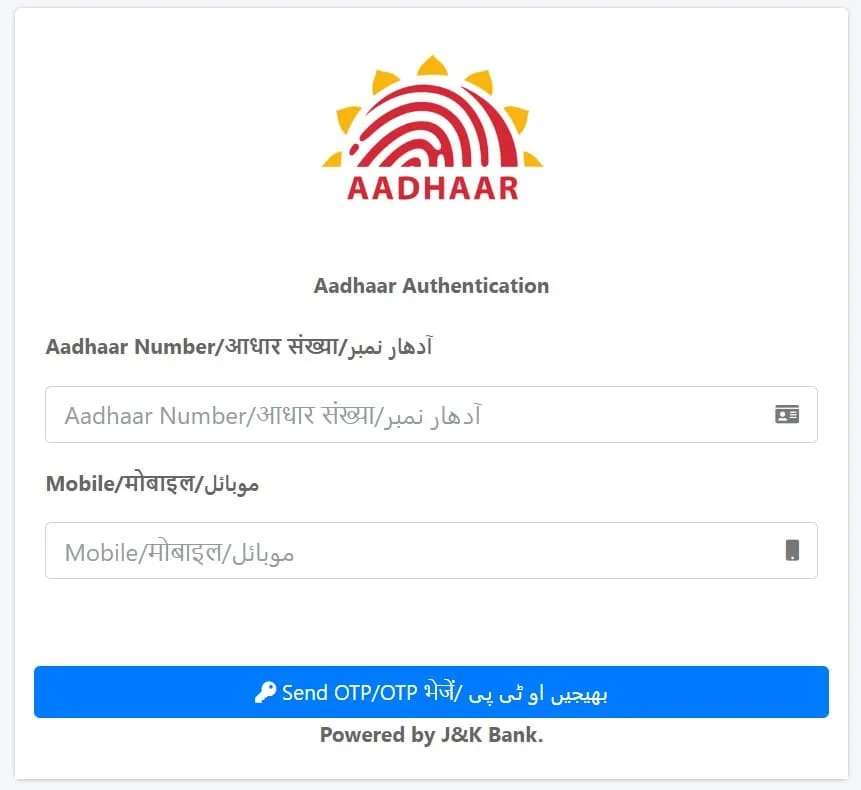

- Applicants are required to visit the Mission Youth Portal first or they can click on the RISE Together link directly.

- Now you need to click on the “Apply for the scheme” tab.

- This will redirect you to a new page where you can log in using your Aadhaar credentials and mobile number.

- After that, you will have to fill in all the required information asked in the portal.

- The Assessment Process is scheduled to be completed by the end of each financial year, and the shortlisted proposals will be notified in April of each year.

- Upon selection, the chosen Youth Groups will receive essential counseling. Subsequently, the selected groups are expected to submit a detailed project report (DPR), encompassing all significant aspects of the proposed activity.

- The DPRs submitted will undergo evaluation by a Technical Committee, to be constituted by the Chief Executive Officer of Mission Youth. Only those DPRs deemed satisfactory by the Technical Committee will be considered for assistance under the program.

- To ensure the effective execution of the planned interventions, the concerned Youth Groups will undergo pre-sanction training.

RISE Together Scheme Funding Process

- Upon completion of the prescribed training capsule, eligible Youth Groups will receive financial assistance based on specified eligibility conditions in the scheme.

- Financial assistance will be granted up to 80% of the project cost, as per the submitted project plan and estimates, with a maximum limit of ₹20.0 lakh, including the loan component. The remaining 20% of the project cost must be self-financed or arranged by the Youth Group.

- Cases approved by the Technical Committee will be forwarded to the Lending Bank for the disbursement of the loan component according to the specified schedule in the Detailed Project Report (DPR).

- Mission Youth will release the upfront subsidy amount immediately to facilitate the Youth Group in executing their plan.

- After the loan component disbursement by the Bank, Mission Youth will deposit 12 pre-dated cheques with the lending Bank to cover its committed Matching Share of Equated Monthly Installments (EMIs) for the loan repayment.

- The same procedure will be followed annually for the first four years of loan repayment.

- After successful completion of the loan tenure, the beneficiary Youth Group/Enterprise shall contribute a minimum of 10% of its Net Profit towards community welfare activities as decided by Mission Youth.

- The contributed amount will be utilized by the concerned Local Governance Unit (Panchayat/Municipal Body) in consultation with Mission Youth.

- In case of deviation from the intended purpose, Mission Youth may initiate legal proceedings against the beneficiaries under relevant legal provisions.

- Selected youth must furnish an indemnity bond attested by a First Class Judicial Magistrate, ensuring the sanctioned amount is used for the specified purpose, no member holds a job without repayment, and no previous financial assistance has been availed under any government scheme.

- A commitment to contributing a minimum of 10% of Net Profit towards social welfare activities decided by Mission Youth from time to time is also required.

RISE Together Scheme FAQs

What is the purpose of the Rise Together scheme?

The scheme aims to introduce and develop community-oriented entrepreneurship in Jammu & Kashmir.

Who is eligible for the Rise Together scheme?

Any domicile of Jammu & Kashmir registered with Mission Youth, J&K, is eligible. Additionally, only Youth Groups with a minimum of 3 members aged 18 to 35, holding at least a 12th standard qualification, are eligible for financial assistance under the scheme.

What is the Funding Pattern of the scheme?

Eligible Youth Groups under the scheme can avail financial assistance up to ₹20.00 lakh, including an upfront subsidy provided by Mission Youth. The financial assistance amounts to 80% of the project cost, based on the submitted project plan and estimates, with a maximum limit of ₹20.0 lakh.

What is the Eligibility for applying for this scheme?

Any domicile of Jammu & Kashmir, registered with Mission Youth, J&K, is eligible. Additionally, Youth Groups with a minimum of 3 members aged 18 to 35, holding at least a 12th standard qualification, qualify for financial assistance under the scheme.

What is the objective of the Scheme?

The scheme aims to foster Community Oriented Entrepreneurship in Jammu & Kashmir and introduce the innovative concept of ‘Rise Together’ based on an integrated and projectivized growth model.

What activities are covered under the scheme?

The scheme encompasses any activity that promotes self-reliance and inclusive social development.