Pradhan Mantri Suraksha Bima Yojana (PMSBY) is an insurance scheme that aims to provide affordable and accessible personal accident insurance coverage to all segments of society. In this article, we will delve into the details of the Pradhan Mantri Suraksha Bima Yojana, its features, benefits, eligibility criteria, and more.

What is Pradhan Mantri Suraksha Bima Yojana?

Pradhan Mantri Suraksha Bima Yojana (PMSBY) is a government-backed insurance scheme that was launched by the then finance minister Shri Arun Jaitley in his budget speech in 2015. It was later formally introduced by PM Modi. The scheme aims to provide affordable accidental insurance coverage to the economically weaker sections of society. It is part of the government’s financial inclusion program and aims to increase insurance penetration in the country.

PMSBY is an Accident Insurance Scheme that offers an insured sum in case of Death, Partial/ Full disability. It is a one-year cover, renewable from year to year. You can avail of this scheme through Public Sector General Insurance Companies (PSGICs) and other General Insurance companies with necessary approvals and tie up with Banks / Post offices for this purpose.

Pradhan Mantri Suraksha Bima Yojana Details

| Pradhan Mantri Suraksha Bima Yojana Key Highlights 2023 | |

| Pradhan Mantri Suraksha Bima Yojana launch date | May 9, 2015 |

| Pradhan Mantri Suraksha Bima Yojana Official Website | Click Here |

| Pradhan Mantri Suraksha Bima Yojana launched by | Ministry of Finance |

| Pradhan Mantri Suraksha Bima Yojana is related to | Accidental Insurance |

| Pradhan Mantri Suraksha Bima Yojana objective | Is to provide affordable accidental insurance coverage to the economically weaker sections of society. |

| Pradhan Mantri Suraksha Bima Yojana insured Amount | Rs 2 Lakh |

| Pradhan Mantri Suraksha Bima Yojana insured premium | Rs 20 per annum |

| Pradhan Mantri Suraksha Bima Yojana Age Limit | 18-70 Years |

| Pradhan Mantri Suraksha Bima Yojana Helpline Number | 1800-180-1111 / 1800-110-001 |

Pradhan Mantri Suraksha Bima Yojana Eligibility Criteria

Before you apply for the Pradhan Mantri Suraksha Bima Yojana, it is imperative to check the Pradhan Mantri Suraksha Bima Yojana eligibility. Here is the complete PMSBY eligibility criteria list.

- Any person between 18 and 70 years is eligible for this scheme.

- He/She must be a citizen of India

- Must have a bank/ post office account and be willing to auto-debit the premium from his/ her account.

- Anyone who can pay a premium of Rs 20 per annum which will be auto debited every year. In case you have a PM Jan Dhan Yojana account, you need not open another account, this scheme will be linked to a PMJDY account.

Pradhan Mantri Suraksha Bima Yojana Benefits

Upon subscribing to the PMSBY scheme, you are entitled to the following benefits.

| Types of Benefits | Amount of Sum Insured | |

| 1 | Accidental Death | 2 Lakh |

| 2 | Total and irrecoverable loss of both eyes or loss of use of both hands or feet or loss of sight of one eye and loss of use of hand or foot | 2 Lakh |

| 3 | Total and irrecoverable loss of sight of one eye or loss of use of one hand or foot | 1 Lakh |

Documents Required for Pradhan Mantri Suraksha Bima Yojana?

You need to produce your proof of identity (KYC) which can be either an AADHAAR card or Electoral Photo Identity Card (EPIC) or MGNREGA card Driving License or PAN card or Passport.

You would also need Aadhaar linked Active Bank savings Account Details.

What is the duration of the cover and how much do I have to pay?

This PMSBY Yojana will cover you for a one-year period stretching from June 01 to May 31 of every year. You have to pay a premium of Rs 20/ year (Previously it was Rs 12 per annum). Please note that the premium would be reviewed based on annual claims experience.

Under what circumstances can my assurance be terminated?

There are certain events that can cause the termination of the assurance of the PMSBY member. No benefit will become payable to him/her thereafter. The following events are provided below.

1. On attaining 70 years of age.

2. In case your account got closed with the Bank/ Post office due to insufficiency of balance. It will keep the insurance in force.

3. In case the subscriber has more than one account for PMSBY with LIC or another insurer.

4. In case insurance cover is ceased due to insufficient balance on the due date or due to exit from the scheme.

Trivia:

Earlier the PMSBY premium per year for the scheme was Rs12 per subscriber. It was revised in 2022. PMJJBY renewal happened almost 07 years post-launch.

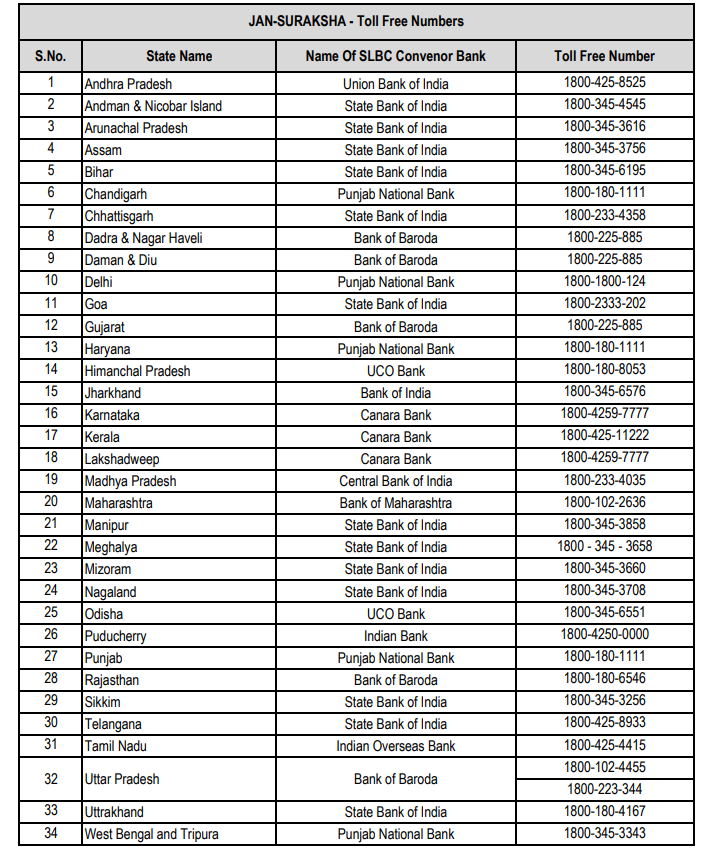

In Case of any Query regarding PMSBY where should I call?

In case of any query or doubt, you can call on the PMSBY toll-free number provided by the government. The same has been listed below.

State wise toll-free number – https://jansuraksha.gov.in/files/STATEWISETOLLFREE.pdf

National Toll-Free Number – 1800-180-1111 / 1800-110-001

How to Apply for PMSBY Online/Offline?

You can apply for the PMSBY scheme through both online and offline modes, however, for online, you must have an internet banking facility. Let’s have a look at how you can apply for the PMSBY scheme.

Pradhan Mantri Suraksha Bima Yojana Apply Online

You can only open a PMSBY account online using the Net banking facility. Here are a few steps you can follow to apply online for the PMSBY scheme

- Login into your Internet banking account and search for PMSBY on the dashboard.

- You have to fill in some basic/ required and Nominee details in the application form.

- After filling in all the required details., click on the submit button.

- You also have to give consent to auto debit of premium from the account and submit the form.

Through Offline Mode:

You can enroll in PMSBY offline by visiting your bank. You can visit the official site https://jansuraksha.gov.in/Forms-PMSBY.aspx and download the PMSBY form.

Here are some direct links through which you can download the form

PMSBY application form (English)

PMSBY application form (Hindi)

After downloading that application form, fill in all the required details and submit them to the bank attached with the required documents.

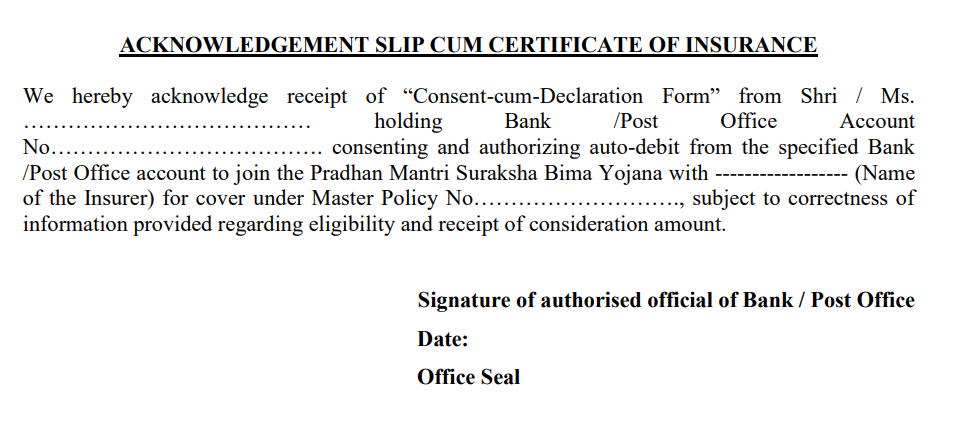

Once it is successfully submitted, don’t forget to collect an Acknowledgement Slip Cum Certificate of Insurance. It will look like below.

How to Claim for PMSBY Online/Offline?

In case of accidental death of the subscriber, his/her nominee or legal heir ( in case of no nominee) can claim the insured amount within 30 days of death. For that, you have to fill out a PMSBY claim form ( can be downloaded from the official website of Jan Suraksha or can download from the link provided below.

Download PMSBY Claim form (English)

Download PMSBY Claim form (Hindi)

The PMSBY form comprises of subscriber’s basic details such as Name: (2) Address: (3) Bank / post office account number: (4) Name of Village /Town / City———————– Name of District————— (5) Name of State———————–PIN Code———————– (6) Day, date, and time of accident: (7) Place of occurrence: (8) Nature of accident3 : (9) Date of death: (10) Cause of death/disability 4 (please specify): (11) Type of Disability (Total permanent or partial permanent): (12) Document attached as proof of permanent disability5 / death 6 : (13) Aadhaar number (Optional): (14) Income-tax Permanent Account Number (PAN) (Optional)

Also, in Part 2 of the form, the nominee’s basic details would be required like:

- Name of the nominee:

- Age of nominee:

- In case the nominee is a minor, name of the appointee

- Relationship of the nominee/claimant with the deceased:

- Contact mobile number:

- Contact email address:

- Contact address:

- Details of the nominee/appointee/claimant (as the case may be):

- Particulars of the bank account into which the claim amount is to be remitted:

(a) Account number: (b) Name of bank: (c) Branch IFSC Code: (2) Aadhaar number7 (Optional): (3) Income-tax PAN7 (Optional): (4) KYC documents attached as proof of identity:

Documents required to be attached to the PMSBY claim form

Here are some required documents that need to be attached to the PMSBY Claim Form

- Proof of permanent disability due to accident or death due to the accident of the insured member, as the case may be

- Aadhaar and PAN number of the insured member and claimant7 (Optional)

- KYC documents in respect of the nominee/appointee/claimant (as the case may be)

- First two pages of passbook, or bank/post office account statement showing account details, or canceled cheque of the account of the nominee/appointee/claimant (as the case may be)

- Proof of death of nominee in case of nominee predeceases the insured member

- Proof of being a legal heir, in case the claimant is other than the insured member/nominee/appointee

- Advance receipt for discharge of claim, duly filled in and signed

Documents required in case of Permanent Disability

You need to produce certain proof in support of the permanent disability, those proofs are the following

FIR or Panchnama, along with

(a) Disability certificate issued by the Civil surgeon and

(b) Hospital record supporting the same.

How to Download a PMSBY Certificate Online – SBI?

In order to download the PMSBY Certificate, you need to visit the official website of the bank where you have a savings bank account. If you have just applied for the PMSBY scheme, you need to wait for 1 to 2 months as this amount is taken by the bank to process and generate the PMSBY certificate. Here is the step-by-step on how to download a PMSBY certificate using SBI (for other banks, the process is the same).

- Visit the SBI Official Website: Open your web browser and go to the official website of the State Bank of India

- Login to your Account: If you have an SBI account, log in using your username and password. If you don’t have an account, you may need to create one or access the PMSBY portal through your existing bank account.

- Navigate to the Insurance Section: Once you are logged in, navigate to the “Insurance” section on the website. This might be under the “Services” or “Insurance” tab, depending on the layout of the website.

- Select PMSBY: In the insurance section, look for the Pradhan Mantri Suraksha Bima Yojana (PMSBY) option and click on it.

- Download Certificate: Within the PMSBY section, there should be an option to download the certificate. Click on this option.

- Enter Details: You might need to enter your policy number, date of birth, or other relevant details to authenticate your identity and policy information.

- Download PDF: After providing the required information, the system should generate your PMSBY certificate in PDF format. Once generated, there will be an option to download the PDF certificate. Click on it to start the download.

- Save the Certificate: Choose a location on your computer or device where you want to save the downloaded certificate. You can give it a meaningful name for easy reference.

- Open and Verify: Locate the downloaded PDF certificate on your computer and open it using a PDF reader. Verify that all the information on the certificate is accurate and matches your policy details.

- Print or Save: Depending on your needs, you can either print the certificate or save it digitally for future reference.

Pradhan Mantri Suraksha Bima Yojana FAQs

What is Pradhan Mantri Suraksha Bima Yojana policy?

Pradhan Mantri Suraksha Bima Yojana (PMSBY) is an insurance scheme that aims to provide affordable and accessible personal accident insurance coverage to all segments of society.

What is the benefit of Pradhan Mantri Suraksha Bima Yojana in English?

Low Cost: Affordable premiums for accident coverage.

Accident Coverage: Financial support in case of accidental death or disability.

Family Security: Lump-sum payment to the nominee on the insured’s accidental death.

Disability Support: Payment for permanent disability due to accidents.

Easy Enrollment: Simple sign-up process through bank accounts.

Broad Coverage: Available for individuals aged 18-70.

Renewable: Yearly renewal for continuous coverage.

No Medical Checkup: No health exams are needed for enrollment.

Government Backing: Supported by the Indian government for reliability.

Does PMSBY cover natural death?

Yes. Pradhan Mantri Suraksha Bima Yojana covers accidental death insurance of Rs 2,00,000.

What is the age limit for the PM insurance scheme?

The Pradhan Mantri Suraksha Bima Yojana age limit is 18 to 70 years of age.

How do I claim a PMSBY claim?

In case of accidental death of the subscriber, his/her nominee or legal heir ( in case of no nominee) can claim the insured amount within 30 days of death. For that, you have to fill out a PMSBY claim form ( can be downloaded from the official website of JanSuraksha or can download from the link provided below.

Download PMSBY Claim form (English)

Download PMSBY Claim form (Hindi)

What is the amount of death claim in PMSBY?

In the Pradhan Mantri Suraksha Bima Yojana (PMSBY), the amount of the death claim is ₹2,00,000 (Rupees two lakh). This lump-sum payment is provided to the nominee or legal heir in the unfortunate event of the insured’s death due to an accident.

What is the grace period for PMSBY?

The grace period for the Pradhan Mantri Suraksha Bima Yojana (PMSBY) is 30 days. This means that if the premium for the scheme is not paid on the due date, there is a 30-day window during which the premium can still be paid to ensure continued coverage.