In New Delhi, there have been recent protests by government employees advocating for the reinstatement of the “Old Pension Scheme,” and this movement has gained support from the opposition party. The call for a return to the old pension scheme is gaining momentum, with several states, including Rajasthan, Chhattisgarh, Jharkhand, Punjab, and Himachal Pradesh, already announcing their intention to shift back to the Old Pension Scheme (OPS). In April, the Union finance ministry established a committee led by Finance Secretary TV Somanathan to examine the pension issue. This committee’s task is to assess whether any modifications are necessary in the National Pension System (NPS) framework to enhance pension benefits while also ensuring fiscal responsibility.

According to a report in a reputable publication, some states have recently proposed a new plan on this matter. Let’s talk about the “Old Pension Scheme” in detail.

What is the Old Pension Scheme (OPS)?

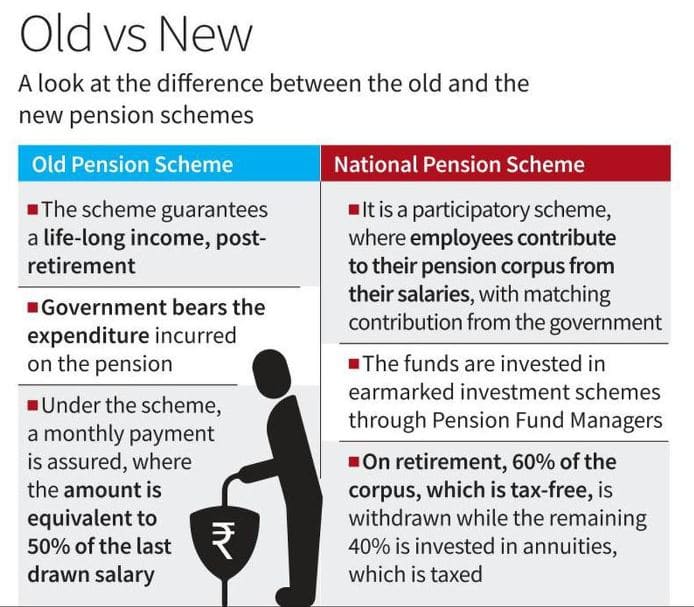

The Old Pension Scheme (OPS) was a retirement benefit program that provided lifelong income security to eligible employees. Under this scheme, employees were entitled to receive a pension amount determined by a predetermined formula, which was equivalent to 50% of their last drawn salary. Additionally, they benefited from the regular revision of Dearness Relief (DR) twice a year. Importantly, there were no deductions from the salary of employees enrolled in OPS.

Furthermore, the Old Pension Scheme also included provisions for the General Provident Fund (GPF), which was available to all government employees in India. This fund allowed government employees to contribute a certain percentage of their salary, and the total accumulated amount over their employment tenure was paid out to them at the time of retirement.

Notably, the financial burden of providing pensions under this scheme was borne by the government. However, the Old Pension Scheme was discontinued in 2004.

Old Pension Scheme History

The tradition of providing pension payments to retired employees has a historical presence in Colonial India dating back to 1881. The Old Pension Scheme (OPS) has its origins in the era of British rule when the Royal Commission, also known as the Lee Commission, in 1924 recommended that recruits serving in India should receive half of their salary during active service as a pension after retirement. This recommendation laid the foundation for pension benefits for government employees in India during the pre-independence period. The adoption of the Government of India Act in 1935 further solidified the provisions related to pension benefits for government employees. It’s worth noting that the Old Pension Scheme has its roots in this colonial legacy.

Benefits of the Old Pension Scheme

Employees who joined central or state services prior to January 1, 2004, were entitled to receive pension payments as a source of lifetime income security following their retirement, which typically occurred at the age of 58, in most cases. This pension benefit was a recognition of the valuable services government employees provided during their often lengthy tenures, which spanned over three decades in many instances. The monthly amount disbursed as a Superannuation Pension was determined based on the number of years served and the average salary over the last 10 months before retirement.

It’s important to note that Gratuity and Provident Fund payments were provided as lump sums at the time of retirement.

Old Pension Scheme Challenges

Unfunded Pension Liability:

One of the primary concerns with the Old Pension Scheme (OPS) was that it lacked a dedicated corpus specifically designated for pension obligations. As a result, there was no continuous fund that could grow over time and be utilized for pension payments. While the Government of India’s budget allocated funds for pensions on an annual basis, there was no clear long-term strategy for sustaining these payments in the future.

Unsustainability:

OPS also faced sustainability issues for several reasons. Firstly, pension liabilities continued to increase over time because pensioners’ benefits were adjusted annually, similar to the salary increases of current employees. This included adjustments for indexation and “dearness relief.”

Secondly, improved healthcare facilities contributed to increased life expectancy, leading to longer periods of pension payments. These factors combined to create a substantial pension burden on both the Union and State Governments.

Also Read: Krishi Rin Portal 2023 Launched: All You Need to Know

Present Beneficiaries:

Currently, members of the Indian Armed Forces and the Central Armed Police Forces are still entitled to the Old Pension Scheme (OPS), which provides them with a service pension following their retirement.

Members of Parliament (MPs) and Members of Legislative Assemblies (MLAs) also continue to enjoy the advantages of the Old Pension Scheme, receiving a monthly income along with various other benefits. This privilege remains in place even if they serve a single tenure of five years until their demise.

Additionally, judges who have completed twelve years of service are eligible to receive a defined benefit pension under OPS, ensuring them a lifetime income post-retirement.

Old Pension Scheme Conclusion

Under this proposal, states are advocating for a guaranteed pension that is tied to the minimum level of pay, rather than being based on the last salary earned, as was the case with the old pension scheme. While this would result in a lower pension amount, it would provide assurance to the pensioners.

In comparison, the Old Pension Scheme (OPS) was a defined benefit scheme where government employees received 50 percent of their last drawn salary as a pension. On the other hand, the National Pension System (NPS) defines contributions made by employees but not the benefits they will receive.

A different model, previously discussed in this publication, explored the possibility of combining elements from both the old pension scheme and the new pension scheme. Under this framework, there would be both a “defined contribution” by employees and “defined benefits.”

Considering the electoral cycle, there is a chance that some adjustments may be made to define both employee contributions and benefits, influenced by political considerations that could override economic rationale. However, any structure aiming to provide assured returns, even if they are lower than those offered by OPS, would shift the responsibility of fulfilling these “defined benefits” onto the governments.

Vishwakarma Yojana 2023 | Upto 2 Lakh Loan for Artisans and Craftsman

Mera Bill Mera Adhikar Scheme 2023 | GST Reward Scheme To Launch on September 01, 2023,