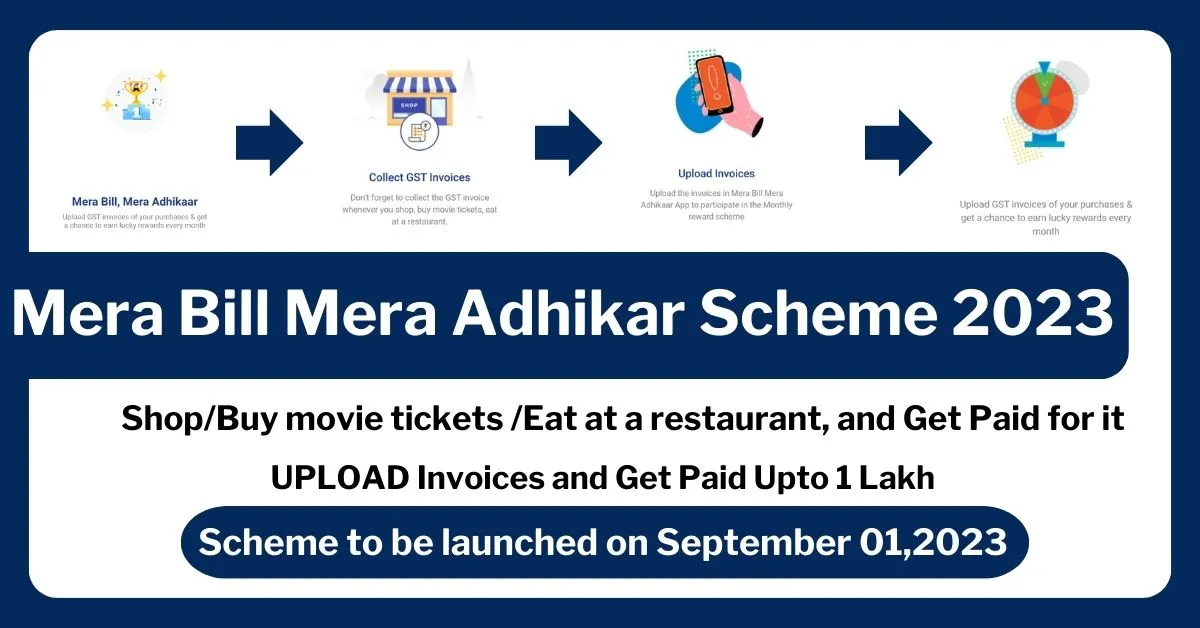

Next time whenever you shop, buy movie tickets, or eat at a restaurant, Ask for the bill as it can give you Cash. Yes! you heard it right, The Indian Government is now giving cash prizes for uploading GST invoices on their App from September 01. Therefore, don’t forget to collect the GST invoices and upload them to the “Mera Bill Mera Adhikar” mobile app. In this article, we are going to talk about the recently launched scheme called “Mera Bill Mera Adhikar”.

What is the Mera Bill Mera Adhikar Scheme?

In partnership with State Governments, the Indian Government is launching the ‘Mera Bill Mera Adhikar’ program. This initiative encourages customers to ask for invoices for their purchases, aiming to create a cultural change and make it a norm to demand proper bills.

This program, set to start on September 1, 2023, is a big step towards transparency in financial transactions and empowering consumers. It promotes the habit of requesting bills, aiming to establish a responsible spending culture.

The ‘Mera Bill Mera Adhikar’ scheme, created by the Central Board of Indirect Taxes and Customs (CBIC), aims to build consumer confidence during purchases and emphasizes the importance of genuine invoices. This will lead to a more transparent economy.

Mera Bill Mera Adhikar Scheme Key Highlights

| Mera Bill Mera Adhikar scheme Key highlights | |

| Mera Bill Mera Adhikar scheme Launch Date | August 24, 2023, |

| Mera Bill Mera Adhikar scheme Official Website | Web.merabill.gst.gov.in |

| Mera Bill Mera Adhikar scheme Objective | To bring a cultural and behavioral change in the general public to ‘Ask for a Bill’ as their right and entitlement. |

| Mera Bill Mera Adhikar scheme Cash Prize Amount | Monthly and Quarterly(10,000 to 1 Crore) |

| Mera Bill Mera Adhikar scheme Monthly Draw Date | 15th of every month |

| Mera Bill Mera Adhikar scheme minimum invoice amount | Rs 200 |

| Mera Bill Mera Adhikar scheme Maximum number of invoices per month | 25 invoices |

| Mera Bill Mera Adhikar scheme under which Ministry | Ministry of Finance |

| Mera Bill Mera Adhikar scheme mode of application | Online only. Through Google Play Store, IOS as well as Web Portal |

| Mera Bill Mera Adhikar scheme Helpline Number | FAQs and Help Section available in App |

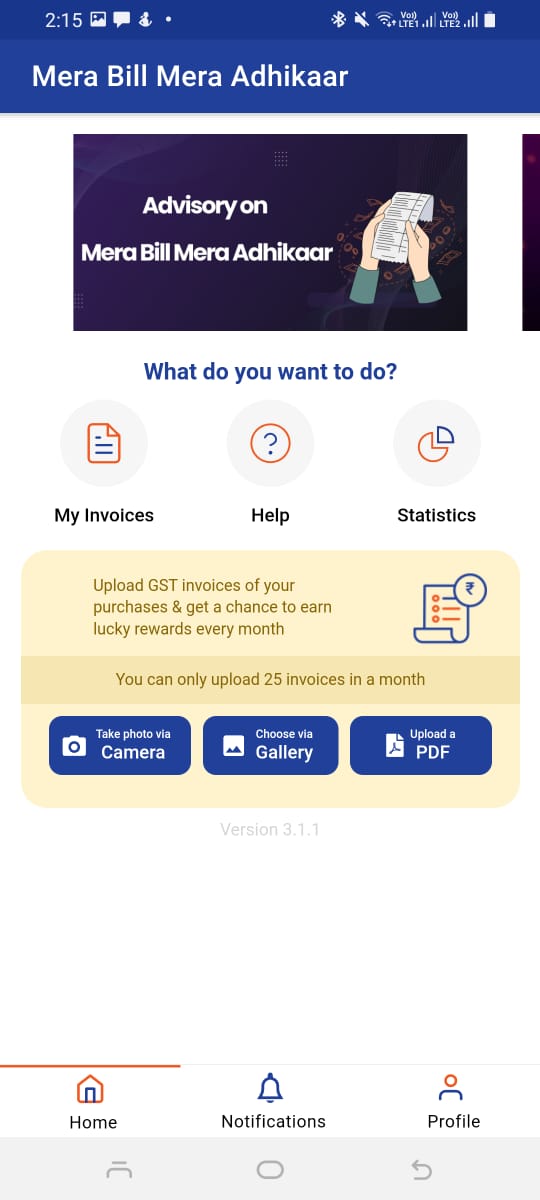

Therefore, the government is now giving away prizes for uploading the GST in the Mera Bill Mera Adhikar Mobile App”. In this app, you can upload the GST invoices through Camera, Gallery, or even the PDF.

Mera Bill Mera Adhikar Scheme Cash Prizes

At the heart of this scheme lies a compelling incentive for consumers to demand invoices for their transactions. The range of cash prizes on offer spans from ₹10,000 to an impressive ₹1 crore. These prizes will be distributed through monthly and quarterly draws, adding an element of excitement and gratification to participation. The framework of the scheme ensures that individuals have the opportunity to secure substantial cash rewards by simply requesting valid invoices during their transactions. The minimum eligible amount for invoices to qualify for the lucky draw is set at Rs. 200.

| Frequency | No. of Prizes | Prize Money in Rs |

| Monthly | 800 | 10,000 ( Ten Thousands) |

| 10 | 10,00,000 ( 10 Lakh) | |

| Quarterly(Bumper Draw) | 2 | 1,00,00,000 ( 1 Crore) |

Mera Bill Mera Adhikar Eligibility Criteria

The ‘Mera Bill Mera Adhikar’ initiative encompasses all invoices issued by suppliers registered under the Goods and Services Tax (GST). This inclusive approach ensures that a wide array of transactions fall within the purview of the scheme. Initial beneficiaries of this pioneering incentive program will be consumers from six States and Union Territories: Assam, Gujarat, Haryana, Puducherry, Daman & Diu, and Dadra & Nagar Haveli.

Vishwakarma Yojana 2023 | Upto 2 Lakh Loan for Artisans and Craftsman

Leveraging Technology:

In the era of digitalization, technology plays a pivotal role in facilitating such schemes. To this end, the government has developed the ‘Mera Bill Mera Adhikar’ mobile app, accessible on both iOS and Android platforms. This app provides an effortless platform for consumers to upload their invoices, making them eligible for the prize draws. Uploaded invoices must include essential details like the seller’s GSTIN (Goods and Services Tax Identification Number), invoice number, payment amount, and tax particulars to be considered valid.

Promoting Responsible Consumer Behavior:

At its core, the ‘Mera Bill Mera Adhikar’ scheme seeks to instigate a positive shift in consumer conduct. By motivating individuals to seek legitimate invoices, the scheme encourages accountability, curtails tax evasion, and bolsters the formal economy’s growth. Moreover, the initiative strengthens the government’s strides in streamlining GST procedures and augmenting revenue collection.

Mera Bill Mera Adhikar Important Points

- The scheme will launch on September 1, 2023.

- Initially, it will be a pilot in Assam, Gujarat, Haryana, Puducherry, Dadra Nagar Haveli, and Daman & Diu.

- All B2C invoices from GST registered suppliers in these regions are eligible.

- Invoices with a minimum value of Rs. 200 can enter the lucky draw.

- Invoices can be uploaded on the ‘Mera Bill Mera Adhikaar’ mobile app (IOS, Android) or web portal ‘web.merabill.gst.gov.in’.

- All Indian residents can participate regardless of their location.

- Individuals can upload a maximum of 25 invoices per month for the lucky draw.

- Each uploaded invoice gets an Acknowledgement Reference Number (ARN) for prize draws.

- Random draws occur regularly (monthly/quarterly) for uploaded invoices.

- The monthly draw includes invoices uploaded by the 5th of the following month.

- Quarterly draws consider invoices of the last three months till the 5th of the bumper draw month.

- Duplicate, inactive, or fake GSTIN invoices will be rejected.

- Winners receive alerts through SMS/app/web notifications.

- Winners must provide their PAN number, Aadhar Card, and Bank Account Details within 30 days for prize transfer.

- The pilot scheme runs for 12 months.

At the time of uploading the invoice, you will be required to provide the following details:

| S.No. | Particulars |

| 1 | GSTIN of supplier |

| 2 | Invoice Number |

| 3 | Invoice Date |

| 4 | Invoice Value |

| 5 | State/UT of the customer |

Mera Bill Mera Adhikar Mobile App

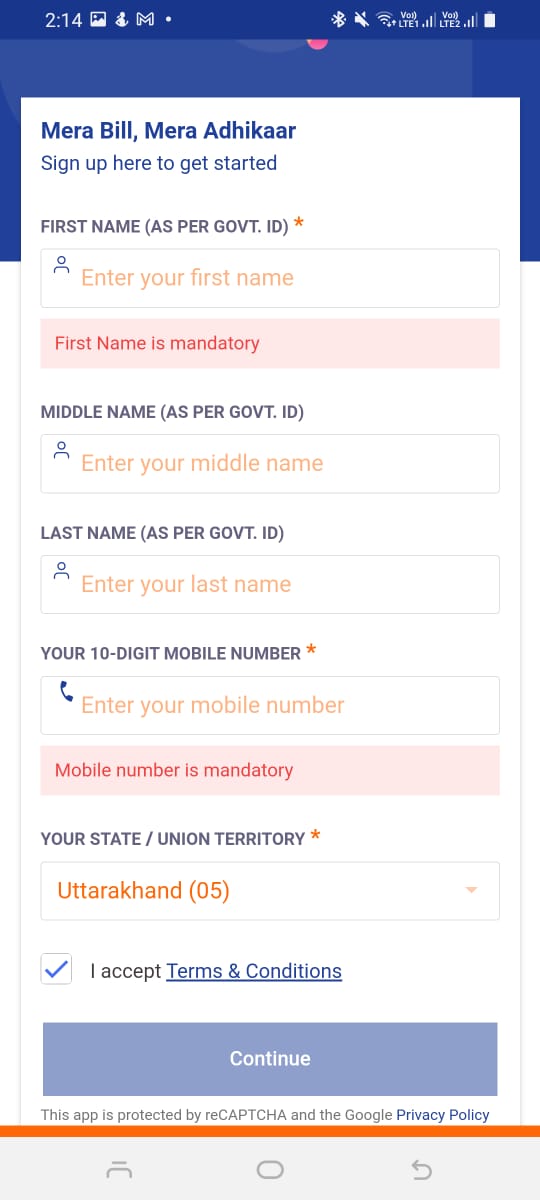

In order to take advantage of the scheme, you have to download the “Mera Bill Mera Adhikar Mobile App” from the Google Play Store. You can also download it from iPhone. If you want to take the benefit of the scheme, it is mandatory to download the Mobile App. Here is the step-by-step process of the Mera Bill Mera Adhikar mobile apps.

- Visit the Google Play Store and search for “Mera Bill Mera Adhikar Mobile App”. You can also download it from the Apple Store.

- After downloading the application, click on “OPEN”.

- You will be asked for LOGIN or SIGNUP in the app.

- Here you have to fill in all the personal details for example: Name, Mobile Number, and State you belong to.

- After that, you have to fill in the OTP you will get in your mobile number.

- After signing up, you will be able to take the benefit of the scheme right away. (Please note that you will be able to take benefit of the scheme only on or after September 01, 2023.

Understanding the Goods and Services Tax (GST) in Detail

In the realm of taxation, the Goods and Services Tax (GST) stands as a significant landmark in India’s economic landscape. Introduced in 2017, GST has revolutionized the way goods and services are taxed in the country, replacing the complex web of multiple indirect taxes. For students studying in schools, and colleges, and those preparing for competitive examinations, understanding GST is not only crucial for academic purposes but also for gaining insights into the broader economic framework of the nation.

Introduction to GST

The Goods and Services Tax is a comprehensive indirect tax levied on the supply of goods and services throughout India. It subsumes a plethora of previous taxes like excise duty, service tax, value-added tax (VAT), and more. GST operates on the principle of ‘One Nation, One Tax,’ creating a unified market for goods and services across the country.

Key Concepts Simplified:

Tax Structure: GST is categorized into two main components: Central Goods and Services Tax (CGST) and State Goods and Services Tax (SGST), levied by the central and state governments, respectively. Additionally, there is the Integrated Goods and Services Tax (IGST) for inter-state transactions.

Tax Slabs: GST is divided into different tax slabs to ensure a balanced taxation system. The four primary slabs include 5%, 12%, 18%, and 28%. Essential items like food grains and medical supplies generally fall under lower tax slabs, while luxury goods and services attract higher rates.

Input Tax Credit (ITC): GST introduces the concept of Input Tax Credit, which allows businesses to set off the tax they have already paid on inputs against the final tax liability. This mechanism prevents the cascading effect of taxes and promotes transparency.

Composition Scheme: Small businesses can opt for the composition scheme, which provides them with simplified compliance and a lower tax rate. However, businesses under this scheme cannot claim Input Tax Credit.

Exempted Goods and Services: Certain items like educational services, healthcare, and basic food items are exempted from GST to ensure affordability and accessibility to all sections of society.

Impact on the Economy:

Simplified Taxation: GST replaced multiple layers of taxes, reducing complexities and streamlining the taxation process. This simplification has eased the compliance burden on businesses.

Boost to GDP: The unified market created by GST has facilitated smoother inter-state trade, leading to increased economic activities and a positive impact on the Gross Domestic Product (GDP) of the nation.

Reduced Tax Evasion: GST’s transparent framework and the Input Tax Credit mechanism have helped curb tax evasion and improve tax collection efficiency.

Promotion of Make in India: By promoting the manufacturing sector through lower taxes on raw materials and inputs, GST has contributed to the government’s ‘Make in India’ initiative.

Conclusion:

In a rapidly evolving economic landscape, understanding the Goods and Services Tax (GST) is not only a requirement for academic excellence but also a necessity for informed citizenship. Students stand to gain from comprehending the nuances of this significant taxation reform, from its impact on the economy to its relevance in competitive examinations. As India’s tax framework continues to adapt, students who grasp the essence of GST are better equipped to navigate the complexities of the modern economic world.

Mera Bill Mera Adhikar Scheme FAQs

Who is eligible for the Mera Bill Mera Ghar Scheme Draw?

All Indian residents are eligible for the Mera Bill Mera Adhikar Scheme, except those specifically excluded by the Government.

What type of invoices are acceptable for the Mera Bill Mera Adhikar Scheme?

They only consider invoices in the B2C (Business to Consumer) category that are either issued to or received from end-users.

How will one know if he won?

You will be informed through SMS and notification if you will win the draw in the Mera Bill Mera Adhikar Scheme.

Can I upload the Petrol Bill in the mobile app?

Petrol bills are not included since they are not subjected to GST.

Can I upload the LPG bill for the home cylinder in the Mera Bill Mera Adhikar Mobile App?

Yes, B2C LPG bills are eligible for the scheme.

Do I need to provide a physical copy of the bill if I emerge as the winner?

Yes, you have to produce the physical copy of the bill in case you win the cash prize in the draw.

What documents are required to claim the cash prize under the scheme?

Winners need to submit their valid identification, the original uploaded bill, and any other necessary government documents as specified by the government when needed.