On September 19, 2023, the Government of India introduced a significant initiative aimed at benefiting farmers nationwide the Krishi Rin Portal. This portal is set to streamline the process of obtaining loans through the Kisan Credit Card, making it more accessible to farmers. This portal was jointly inaugurated by Finance Minister Nirmala Sitharaman and Agriculture Minister Narendra Singh Tomar. It is designed to facilitate farmers in securing subsidized loans, particularly those holding Kisan Credit Cards. In this article, we will provide comprehensive information about the Kisan Rin Portal and the Kisan Credit Card Scheme. To learn more, please continue reading this article till the end.

What is the Krishi Rin Portal?

In an effort to provide convenient access to subsidized loans for farmers across the country, the Krishi Rin Portal for 2023 has been officially launched. Finance Minister Nirmala Sitharaman and Agriculture Minister Narendra Singh Tomar jointly inaugurated this portal on September 19, 2023. The primary objective of the Kisan Rin Portal is to facilitate the acquisition of subsidized loans through the Kisan Credit Card program. Through this portal, banks will be able to extend loans directly to farmers at their residences, utilizing the Kisan Credit Card as the medium.

The Kisan Loan Portal is expected to expedite the disbursal of loans sanctioned under the Kisan Credit Card Scheme, ensuring that funds reach farmers promptly. This online platform will empower farmers to access crucial loan-related information from the comfort of their homes.

| Krishi Rin Portal 2023 Key Highlights | |

| Krishi Rin Portal 2023 Launched Date | September 19, 2023, |

| Krishi Rin Portal 2023 Official Website | Click Here |

| Krishi Rin Portal Objective | To provide financial assistance to farmers in comfort from their home.To simplify the process for farmers to access subsidized loans. |

| Krishi Rin Portal Loan Amount | Rs 3 Lakh |

| Krishi Rin Portal 2023 Interest Rate | 7% per annum |

| Krishi Rin Portal Age Limit | 18-75 years |

| Krishi Rin Portal 2023 Tenure | 5 Years |

| Krishi Rin Portal Helpline Number | Click Here |

Krishi Rin Portal Objective

The primary aim behind the introduction of the Farmer Loan Portal by the Central Government is to simplify the process for farmers to access subsidized loans. The Kisan Rin Portal allows farmers to conveniently access comprehensive details about loan allocation, interest rebate claims, and scheme utilization from the comfort of their homes. Furthermore, this portal enables banks to disburse loans directly to the residences of farmers, enhancing accessibility and convenience.

Krishi Rin Portal Components

As per the Agriculture Ministry’s statement, the Kisan Rin Digital Platform offers a comprehensive range of services, including monitoring the progress of Krishi Loan disbursement, handling interest subvention claims, and tracking scheme utilization. This platform facilitates a seamless connection with banks, enhancing the efficiency and focus of agricultural lending. Additionally, it streamlines the registration process for banks participating in agricultural loan programs.

The Kisan Rin Portal (KRP) is a collaborative effort involving the Ministry of Agriculture and Farmers’ Welfare (MoA&FW), the Department of Financial Services (DFS), the Department of Animal Husbandry & Dairying (DAH&D), the Department of Fisheries (DoF), the Reserve Bank of India (RBI), and the National Bank for Agriculture and Rural Development (NABARD). KRP is set to bring about a transformative change in the accessibility of credit services offered through the Kisan Credit Card (KCC). Additionally, it will assist farmers in accessing subsidized agricultural credit through the Modified Interest Subvention Scheme (MISS).

The KRP portal functions as a centralized hub, providing a comprehensive overview of farmer information, details about loan disbursements, claims for interest subvention, and the progress of scheme utilization. Through seamless integration with banks, this innovative portal facilitates proactive policy measures, strategic guidance, and adaptable improvements to ensure more targeted and efficient agricultural credit services and the optimal utilization of interest subvention benefits.

Ghar-Ghar KCC Abhiyaan: Door-to-Door KCC Abhiyan

The launch of the “Ghar-Ghar KCC Abhiyaan,” or the “Door to Door KCC Campaign,” signifies a significant milestone. It highlights the Ministry of Agriculture and Farmers’ Welfare’s unwavering dedication to ensuring comprehensive financial inclusion for all farmers. This campaign aims to guarantee that every farmer can readily access credit facilities that support their agricultural activities, and it is scheduled to run from October 1, 2023, to December 31, 2023.

The Ministry of Agriculture and Farmers’ Welfare has conducted thorough cross-referencing of the data of existing Kisan Credit Card (KCC) account holders with the PM KISAN database. This process has helped identify individuals who are both KCC account holders and beneficiaries of the PM KISAN scheme. Additionally, it has identified PM KISAN beneficiaries who do not currently possess KCC accounts. This campaign plays a pivotal role in reaching out to those PM KISAN beneficiaries without KCC accounts and aims to maximize the number of eligible PM Kisan beneficiaries who have access to KCC Accounts.

The aim of KCC Ghar Ghar Abhiyaan is to connect around 1.5 crore beneficiaries who are not yet connected to KCC scheme.

WINDS Portal Initiative

The government is set to introduce the WINDS Portal Initiative, aimed at delivering significant advantages to farmers. A recently unveiled handbook detailing the Weather Information Network Data System (WINDS) underscores the government’s commitment to this endeavor.

India’s Agriculture Minister, Narendra Singh Tomar, has highlighted that the primary goal of the WINDS portal is to provide farmers with timely and accurate weather information. Through this portal, farmers will have access to crucial weather-related data, enabling them to make informed decisions about their crops’ well-being and safety.

What is Kisan Credit Card (KCC) Yojana

The Kisan Credit Card Yojana is an initiative launched by the Government of India with the primary goal of providing low-interest loans to farmers. This scheme offers loans to farmers at interest rates ranging from 3 to 4 percent. Farmers can utilize these loans for various purposes such as purchasing agricultural equipment, conducting farming activities, or addressing other agricultural-related expenses. Kisan Credit Card holders are assigned a fixed credit limit that can be employed for a wide range of farming needs.

The Kisan Credit Card Scheme is administered by the Government of India to enhance the financial security of farmers and facilitate their access to loans. It is implemented through various financial institutions, including commercial banks, small finance banks, and cooperative societies. The KCC encompasses financial support for postharvest expenditures, consumption requirements, and credit needs for agricultural and allied activities.

Kisan Credit Card Scheme Loan Amount

| Loan Purpose | Calculation for Limit |

| First Year (Single Crop) | Scale of finance for the crop x Extent of area cultivated. Add 10% for post-harvest/household/consumption needs. Add 20% for repairs and maintenance. Include crop, accident, health, and asset insurance. |

| Second & Subsequent Years (Single Crop) | First-year limit + 10% for cost escalation (2nd to 5th year) + Term loan for five years. |

| Multiple Crops (Same Pattern) | First-year limit based on proposed crops + 10% for cost escalation (2nd to 5th year). Adjust if the cropping pattern changes. |

| Term Loan for Investments | Decide based on asset costs, existing activities, and repayment capacity. |

| Maximum Permissible Limit (MPL) | Short-term limit for 5th year + Estimated term loan requirement = Kisan Credit Card limit. |

Nationwide Kisan Credit Card Account Holders 7.35 Crore

According to a statement from the Central Government, as of March 30, there are approximately 7.35 crore Kisan Credit Card account holders across the country. These account holders collectively have a sanctioned fund limit totaling Rs 8.85 lakh crore. Government data also indicates that agricultural loans worth Rs 6,573.50 crore have been disbursed at reduced interest rates during the current financial year from April to August. To extend the benefits of the Kisan Credit Card, nonselected KCC holders have been identified under the PM Kisan Yojana.

Benefits of Kisan Rin Portal:

The Kisan Rin Portal offers several advantages to farmers:

1. Facilitates Subsidized Loans: This portal simplifies the process for farmers to access subsidized loans through the Kisan Credit Card program.

2. Efficient Loan Disbursement: Kisan Rin Portal expedites the release of loan amounts sanctioned under the Kisan Credit Card scheme, ensuring that funds reach farmers swiftly and effectively.

3. Convenient Access to Loan Information: Farmers can conveniently access loan-related information from the comfort of their homes through this online portal.

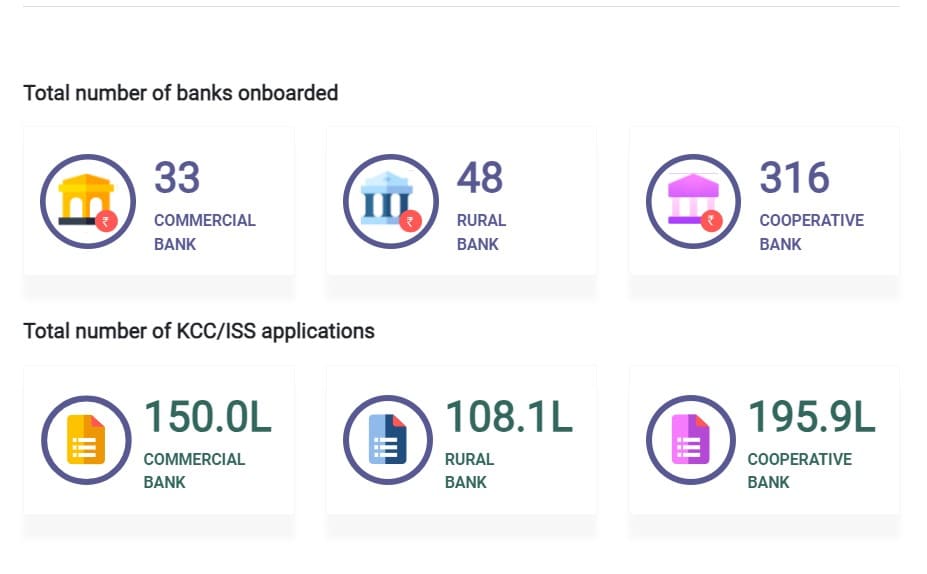

Kisan Rin Portal Eligible Lenders

Lending institutions eligible to participate in the Kisan Credit Card program include:

i. Public Sector Banks (PSBs)

ii. Private Sector Scheduled Commercial Banks

iii. Small Finance Banks (SFBs)

iv. Computerized Primary Agricultural Credit Societies (PACS) affiliated with Scheduled Commercial Banks (SCBs)

v. Regional Rural Banks (RRBs)

vi. Rural Cooperative Banks (RCBs), which encompass State Cooperative Banks and District Central Cooperative Banks (DCCBs).

| S.No. | Eligible | Maximum Limit |

| 1 | For cultivation of crops and Post harvest expenses | ₹ 3 lakh |

| 2 | For allied activities related to Animal husbandry, Dairy, Fisheries, Lac cultivation, Mulberry cultivation, Sericulture and Bee keeping etc. | ₹ 2 lakh |

Documents Required for Kisan Credit Card Application:

To apply for a Kisan Credit Card, the following documents are typically needed:

1. Aadhar Card: Proof of identity.

2. PAN Card: For income assessment and taxation purposes.

3. Address Proof: Document confirming the farmer’s residential address.

4. Farmer’s Land Ownership Certificate: Proof of land ownership or land rights.

5. Farm Map: A map detailing the farmer’s land and its layout.

6. Passport Size Photo: A recent photograph of the farmer.

7. Income Certificate: Document verifying the farmer’s income.

8. Bank Account Statement: To demonstrate financial history and transactions.

9. Mobile Number: Contact information for communication and alerts.

Please note that specific document requirements may vary by region and lending institution. It’s advisable for farmers to check with their respective banks or financial institutions for precise documentation details when applying for a Kisan Credit Card.

Krishi Rin Portal How to Apply Online

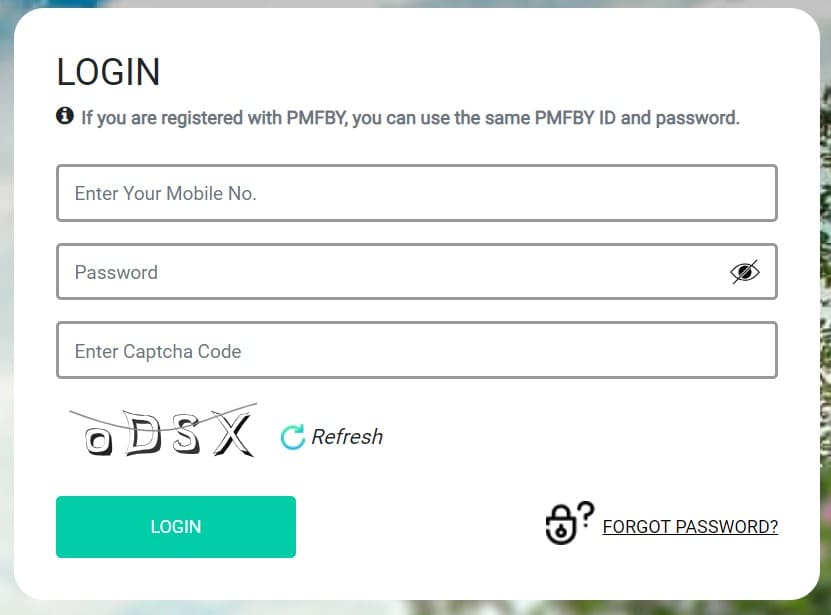

In order to log in to the Kisan Rin Portal, you need to apply and visit the official website.

After that, you have to put your mobile number and password along with a captcha on the screen.

Krishi Rin Portal 2023 FAQs

When is the Krishi Rin Portal launched?

The Krishi Rin Portal was launched on September 19, 2023, by Finance Minister Nirmala Sitaraman and Agriculture Minister Narendra Singh Tomar.

How much loan one can apply for under the Krishi Rin Portal?

A maximum of Rs 3 Lakh can be availed through the Kisan Credit Card Scheme at 4% per annum.