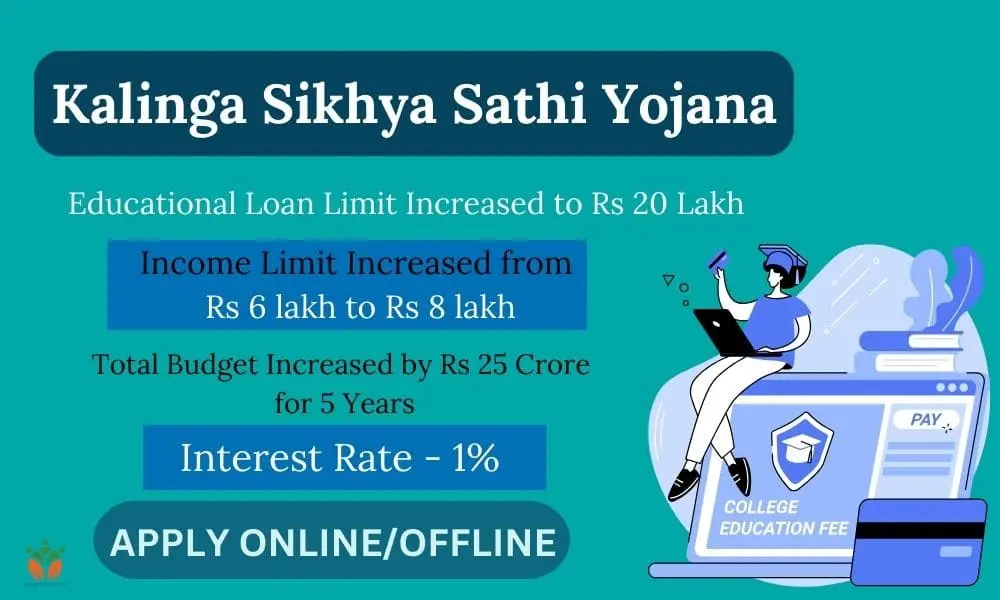

On September 30, 2023, the Government of Odisha announced that Odisha government’s Higher Education department plans to raise the maximum loan amount under the Kalinga Sikhya Sathi Yojana from Rs 10 lakh to Rs 20 lakh starting in the academic session of 2023-24. Additionally, the income limit for parents eligible for this education loan subsidy scheme, which was introduced in 2016-17, will be increased from Rs 6 lakh to Rs 8 lakh. This loan scheme will benefit students studying both within the state and abroad. However, students who are already benefiting from the interest subsidy under this scheme will not be affected by these changes.

In this article, we are going to learn about the scheme in detail. I am certain that by the end of the article, you won’t have any problem regarding the scheme.

What is Kalinga Sikhya Sathi Yojana?

The “Kalinga Sikhya Sathi Yojana” which is often termed as Odisha Government loan scheme is an Educational Loan Scheme established by the Department of Higher Education, Government of Odisha. This initiative was inaugurated by the Honorable Chief Minister of Odisha, Shri Naveen Patnaik, on June 27, 2016. The primary aim of the scheme is to alleviate the financial burden on parents of students aspiring for higher education. Under this program, students can avail of a maximum educational loan of ₹20,00,000 ( earlier it was Rs 10,00,000)

Applicants are required to pay a nominal interest rate of only 1% on the loan amount, with the remainder of the interest being subsidized by the Government of Odisha through the Higher Education Department. This scheme encompasses a wide range of courses, including medicine, engineering, law, management, and more.

Kalinga Sikhya Sathi Yojana Key Highlights

| Kalinga Sikhya Sathi Yojana 2023 Key Highlights | |

| Kalinga Sikhya Sathi Yojana Launch Date | June 27, 2016, |

| Kalinga Sikhya Sathi Yojana Official Website | Click Here |

| Kalinga Sikhya Sathi Yojana Objective | To alleviate the financial burden on parents of students aspiring for higher education |

| Kalinga Sikhya Sathi Yojana Minimum Loan Amount | No Limit |

| Kalinga Sikhya Sathi Yojana Maximum Loan Amount | ₹20,00,000 ( earlier it was Rs 10,00,000) |

| Kalinga Sikhya Sathi Yojana Interest Rate | ZERO during the moratorium period, followed by 1 % per year for five years |

| Kalinga Sikhya Sathi Yojana Income Limit | Rs 8 lakh |

| Kalinga Sikhya Sathi Yojana Budget 2023-28 | Rs 25 Crore (Additional) |

| Kalinga Sikhya Sathi Yojana Helpline | Click Here |

Kalinga Sikhya Sathi Yojana Objective

The objective of the Kalinga Sikhya Sathi Yojana is to alleviate the financial burden on parents of students who wish to pursue higher education. This scheme aims to provide affordable educational loans to students, enabling them to access quality education and pursue their academic aspirations without significant financial stress.

Kalinga Sikhya Sathi Yojana Benefits

1. Maximum Loan Amount: According to the scheme’s guidelines, students can receive a maximum educational loan of ₹20,00,000.

2. No Minimum Loan Amount: The scheme does not specify a minimum loan amount, allowing individuals to borrow any sum up to ₹20,00,000.

3. Repayment Period: The repayment period ranges up to 10 years for loans up to ₹15,00,000 and up to 15 years for loans of ₹20,00,000.

4. Low-Interest Rate: Applicants are only required to pay a 1% interest rate on the loan amount, with the remainder of the interest being covered by the Government of Odisha through the Higher Education Department.

5. Extended Moratorium Period: Unlike standard education loans, the KSSY provides interest subvention during the repayment period, including the moratorium period after the completion of the course. This is highly advantageous for students.

Note: The specific terms and conditions of the loan will be determined by individual scheduled banks, and loan applications will be processed according to their respective rules and regulations.

Kalinga Sikhya Sathi Yojana Eligibility Criteria

To make sure that you can avail the benefit of the Kalinga Sikhya Sathi Yojana, you must check the complete Kalinga Sikhya Sathi Yojana eligibility. Here is the complete list of Kalinga Sikhya Sathi Yojana eligibility criteria that you must fulfill in order to take advantage of the scheme.

1. Residency Requirement: The student must be a resident or domicile of the state of Odisha.

2. Income Limit: The annual family income of the applicant should not exceed ₹8,00,000.

3. Financial Need: This scheme is open to economically disadvantaged students who aspire to pursue higher education.

4. No Duplicate Benefits: Applicants should not already be receiving similar benefits from any other government or institution for the same educational purpose.

5. Approved Courses: The eligible courses for this scheme include Management, Integrated Law, Engineering, and Medicine, provided they are offered by educational institutions in India established either by Acts of Parliament or State Legislature, or institutions recognized by relevant statutory bodies.

| Kalinga Sikhya Sathi Yojana Eligibility Criteria | |

| Kalinga Sikhya Sathi Yojana Education Loan Amount – Rs 20,00,000 | |

| Kalinga Sikhya Sathi Yojana Income Limit – Rs 8,00,000 | |

| The student must be a resident or domicile of the state of Odisha. | |

| Applicants should not already be receiving similar benefits from any other government-approved Schemes | |

| Approved Courses: Management, Integrated Law, Engineering, and Medicine |

Kalinga Sikhya Sathi Yojana Moratorium Period

The moratorium period for the Kalinga Sikhya Sathi Yojana extends throughout the repayment period, including the period following the completion of the student’s course. This means that students benefit from financial assistance in the form of interest subvention not only during their studies but also during the moratorium period after finishing their course.

Kalinga Sikhya Sathi Yojana Required Documents

1. Aadhar Card

2. Passport Size Photograph

3. PAN Card

4. Educational Certificates, including previous qualification mark sheets, and proof of admission into a technical/professional course.

5. Residential Certificate issued by authorities below the rank of Tahasildar and Additional Tahasildar.

6. Income Certificate issued by authorities below the rank of Tahasildar and Additional Tahasildar, or a self-certified copy of the Income Tax return.

7. Bank Passbook

Download the Kalinga Sikhya Sathi Yojana Documents Required PDF

How to Apply for Kalinga Sikhya Sathi Yojana

You can apply for the Kalinga Sikhya Sathi Yojana through online and offline mode as given in the official website. In case you want to apply for Kalinga Sikhya Sathi Yojana online, you have visit the official website and do as they say step by step. In order to apply offline, you can only di so by visiting your preferred bank branch you will be assisted the same. We have provided both cases so that you can easily apply for the same.

Kalinga Sikhya Sathi Yojana Online Apply

In order to apply for the Kalinga Sikhya Sathi Yojana online, one must follow the step-by-step registration process. Here we have provided a detailed application process for the Kalinga Sikhya Sathi Yojana. By following these steps you won’t have any problem regarding the same. In case you encounter any problem online, you can just type Kalinga Sikhya Sathi Yojana online apply Odisha and we will contact you and will try to help you.

Online Registration:

1. Go to the official website of Vidya Lakshmi.

2. At the top right of the webpage, click on “Register.”

3. Carefully read the provided instructions and declaration. Select the checkbox to agree.

4. On the following page, complete all the mandatory fields, including First name, Middle name, Last name, Mobile number, Email ID, Password, and Captcha Code. Then, click “Submit.”

Upon successful registration, your login details will be shown on the confirmation page, and they will also be sent to your registered Mobile Number and Email ID.

Application:

1. Visit the official website of Vidya Lakshmi

2. Click “Student Login” at the top right of the webpage and log in using the credentials sent to your Email ID or Mobile Number.

3. On the subsequent page, click “Apply for Scholarship.” You will be directed to the Online Application Form.

4. Fill in all the mandatory fields and upload the required documents with the specified file type and filesize.

5. Click “Submit.” On the following page, you will receive an Application Reference ID, confirming the successful submission of your application. Make sure to save this ID for future reference and to track the status of your application.

Kalinga Sikhya Sathi Yojana Application Process (Offline)

Here is the step-by-step application process at the bank that you need to follow in order to apply for the scheme.

1. Begin by visiting your nearest bank branch.

2. Approach the inquiry window and request the “Kalinga Sikhya Sathi Yojana” application form.

3. Thoroughly complete the application form by providing all the necessary details.

4. Attach all the required documents to the application form, ensuring that they are self-attested.

5. Submit the completed application form to the bank, and be sure to obtain a receipt for your submission.

Kalinga Sikhya Sathi Yojana Banks List

Here is the complete list of the banks that are eligible to provide loans under Kalinga Sikhya Sathi Yojana.

| SL No | Bank Name |

| 1 | Allahabad Bank |

| 2 | Andhra Bank |

| 3 | Bank of Baroda |

| 4 | Bank of India |

| 5 | Bank of Maharashtra |

| 6 | Bharatiya Mahila Bank |

| 7 | Canara Bank |

| 8 | Central Bank |

| 9 | Central Bank of India |

| 10 | Dena Bank |

| 11 | IDBI Bank |

| 12 | Indian Bank |

| 13 | Indian Overseas Bank |

| 14 | Oriental Bank of Commerce |

| 15 | Punjab & Sind Bank |

| 16 | Punjab National Bank |

| 17 | State Bank of Bikaner & Jaipur |

| 18 | State Bank of Hyderabad |

| 19 | State Bank of India |

| 20 | State Bank of Mysore |

| 21 | State Bank of Travancore |

| 22 | Syndicate Bank |

| 23 | UCO Bank |

| 24 | Union Bank of India |

| 25 | United Bank of India |

| 26 | Vijaya Bank |

| 27 | Axis Bank Ltd |

| 28 | Bandhan Bank |

| 29 | City Union Bank |

| 30 | DCB |

| 31 | Federal Bank |

| 32 | HDFC Bank |

| 33 | ICICI Bank |

| 34 | IndusInd Bank |

| 35 | Karnataka Bank |

| 36 | Karur Vysya Bank |

| 37 | Kotak Mahindra Bank |

| 38 | Laxmi Vilas Bank |

| 39 | Standard Chartered Bank |

| 40 | The South Indian Bank Ltd |

| 41 | Yes Bank |

| 42 | Orissa State Co-op. Bank |

Offline Application Form (SBI)

Offline Application Form (UCO Bank)

Important Note to Professional College Students with Education Loans Obtained after April 1, 2016:

If you are a student pursuing a professional course and have obtained an education loan from a bank after April 1, 2016, please take note that you have the opportunity to convert your loan into the “Kalinga Sikhya Sathi Yojana.”

Here are the advantages:

1. Your post-moratorium interest rate can be reduced to just 1%.

2. The terms for repaying the interest will be adjusted in a way that shortens the overall loan repayment period after you complete your course.

You can take advantage of these benefits by promptly contacting your Branch Manager for further details and assistance.

Kalinga Sikshya Sathi Yojana FAQs

What is Kalinga Sikshya Sathi Yojana (KSSY)?

Kalinga Sikshya Sathi Yojana is an educational loan scheme designed to assist students pursuing higher education, particularly in professional or technical courses at recognized universities and institutions.

What are the eligibility criteria for Kalinga Sikshya Sathi Yojana?

– To benefit from KSSY, students must:

– Be residents of Odisha.

– Have an annual family income of less than 6 lakhs.

– Not be availing similar benefits from other governments or institutions.

– Be enrolled in courses like Management, Integrated Law, Engineering, or Medicine in recognized educational institutions.

What documents are needed to apply for an education loan under Kalinga Sikshya Sathi Yojana?

– You’ll need:

– Educational certificates, including proof of admission.

– Residential certificate issued by authorities below the rank of Tahasildar.

– Income certificate issued by authorities below the rank of Tahasildar or a self-certified copy of your Income Tax return.

How can eligible students apply for Kalinga Sikshya Sathi Yojana?

Eligible students can apply through the Vidyalakshmi portal or offline by contacting the relevant bank’s Branch Manager directly.

When did the Kalinga Sikshya Sathi Yojana scheme become effective?

KSSY started from the financial year 2016-17. Students who obtained fresh education loans from banks for academic purposes on or after April 1, 2016, are eligible for this benefit.

What are the maximum and minimum loan amounts under the Kalinga Sikshya Sathi Yojana?

There’s no minimum loan amount specified. Students can get a maximum of 20 lakh rupees as an educational loan under this scheme.

What is the moratorium period under Kalinga Sikshya Sathi Yojana?

The moratorium period for the Kalinga Sikhya Sathi Yojana extends throughout the repayment period, including the period following the completion of the student’s course. This means that students benefit from financial assistance in the form of interest subvention not only during their studies but also during the moratorium period after finishing their course.

What is the actual interest rate for loan recipients?

During the moratorium period, no interest repayment is required. After this period, students will pay only 1% interest per annum on the loan amount. The remaining interest will be covered by the Government of Odisha, Higher Education Department.

When do students need to start repaying the loan?

Loan repayment begins after the moratorium period ends.

Which banks are part of the Kalinga Sikshya Sathi Scheme?

There are a total of 42 banks in the list of Kalinga Sikshya Sathi Yojana. You can find the list of participating banks on the official website or you can find the complete list in the above article.

Which courses are covered under the Kalinga Sikshya Sathi Yojana?

KSSY covers recognized Technical/Professional Courses in India, including courses offered by institutions established by Acts of Parliament, Indian Institutes of Management (IIMs), and other institutions set up by Central/State Governments.

Is there any special provision for reserved category students?

While there’s no differential interest rate, KSSY offers opportunities for ST, SC, and girl students to benefit from interest subvention.