Small and Medium Enterprises (SMEs) often require loans to fuel their growth and expansion. Access to financing is crucial for SMEs, as it enables them to invest in technology, infrastructure, and workforce, leading to increased productivity and competitiveness. Loans play a pivotal role in helping SMEs navigate through challenges such as working capital constraints and market fluctuations. Additionally, obtaining financial assistance allows these enterprises to explore new markets, develop innovative products or services, and upgrade their existing operations. Acknowledging this, the Arunachal Pradesh Government has launched the “Deen Dayal Upadhyaya Swavalamban Yojana”. In this article, we are going to learn about the scheme in detail. In case of any query, you can either comment or mail us the same.

What is Deen Dayal Upadhyaya Swavalamban Yojana?

For SMEs, loans serve as a lifeline, providing the necessary capital to seize business opportunities, enhance operational efficiency, and contribute significantly to economic development by fostering entrepreneurship and job creation.

The State Government of Arunachal Pradesh has introduced the Deen Dayal Upadhyaya Swavalamban Yojana, a startup loan scheme. Through this initiative, the government is offering financial support in the form of subsidies on loans provided to startups. Till now, more than 500 startups have benefitted from the scheme.

Under this program, individuals aspiring to establish small and medium enterprises with a project cost ranging from above Rs. 10.00 lakhs to Rs. 50.00 lakhs are eligible for a substantial 40% front-ended capital investment subsidy. It’s important to note that the project cost excludes expenses related to land and building. This provision is designed to incentivize and support entrepreneurs in the specified project cost range, encouraging the development and growth of small and medium enterprises.

The subsidy aims to alleviate the financial burden on beneficiaries, fostering a conducive environment for the establishment and expansion of businesses within the specified financial parameters.

Please Note: Front-ended subsidy means beneficiaries receive an upfront subsidy credited to their loan account in the initial stages of any business activity.

| Deen Dayal Upadhyaya Swavalamban Yojana Key Highlights | |

| Deen Dayal Upadhyaya Swavalamban Yojana Launch Date | April 16, 2017, |

| Deen Dayal Upadhyaya Swavalamban Yojana Official Website | DDUSY Official Website |

| Deen Dayal Upadhyaya Swavalamban Yojana Objective | To provide loan at a subsidized rate to Small and Medium Enterprises/Startup |

| Deen Dayal Upadhyaya Swavalamban Yojana Budget 2023-24 | Rs 200 Crore |

| Deen Dayal Upadhyaya Swavalamban Yojana Loan Amount | Rs 10.00 lakhs up to Rs. 50.00 lakhs |

| Deen Dayal Upadhyaya Swavalamban Yojana Beneficiary | Residents of Arunachal Pradesh |

| Deen Dayal Upadhyaya Swavalamban Yojana Interest Rate | 3.25% to 3.50%, above the EBLR (currently at 7.55%). |

| Deen Dayal Upadhyaya Swavalamban Yojana Enterpreniaurs Contribution | Minimum of 10% to 30% of the project cost |

| Deen Dayal Upadhyaya Swavalamban Yojana Subsidy % | 30% to 50% |

| Deen Dayal Upadhyaya Swavalamban Yojana Front End Loan Limit | 40% |

| Deen Dayal Upadhyaya Swavalamban Yojana Mode of Application | Online |

| Deen Dayal Upadhyaya Swavalamban Yojana Helpline Number | Toll-Free Number – 1800-345-3600 (10:00 AM – 06:00 PM)Landline Number – 0360-2212433 (10:00 AM – 06:00 PM) |

Deen Dayal Upadhyaya Swavalamban Yojana Objectives

The primary objective of the Deen Dayal Swavalamban Yojana is to incentivize unemployed youths to obtain affordable capital for establishing their entrepreneurial ventures. This scheme aims to promote and facilitate the establishment of startups by providing them with financial assistance, thereby fostering economic empowerment and encouraging entrepreneurship among the youth in the state.

Deen Dayal Upadhyaya Swavalamban Yojana Sectors Covered

Sectors covered under the scheme include:

- Food-processing units in agriculture, horticulture, and allied sectors, encompass packaging, cold chain, cold storage, and bamboo production.

- Traditional textile weaving, with support for modernizing traditional looms and acquiring new ones for initiating new weaving units.

- Eco-tourism, which includes homestays and support for tour operators.

- Establishment of small-scale manufacturing units, service centers, and diagnostic centers.

Preference is given to unemployed youths with degrees or diplomas in Tourism and hospitality, ITI, or other technical fields like Fabrication, IT, Mobile repairing, and Motor Garage operations.

Private doctors receive priority for opening medical clinics and diagnostic centers in Border CD blocks, with the condition that clinical fees are set at a reasonable rate.

Deen Dayal Upadhyaya Swavalamban Yojana History

The inception of the AP Deen Dayal Swavalamban Yojana Scheme can be traced back to 2017 when the state government introduced the 2023 plan as part of its comprehensive “Arunachal Vision 2030” vision paper. Named in honor of Deen Dayal Upadhyaya, a prominent Bharatiya Janata Sangh leader and theorist advocating a holistic humanist development approach, the initiative aligns with his vision.

The Deen Dayal Swavalamban Yojana 2023 draws inspiration from the national government’s Startup India initiative but is tailored to address the specific needs and objectives of the state. The Planning and Investment Division of the state government, in collaboration with various banks and financial institutions, oversees the implementation of this initiative.

Deen Dayal Upadhyaya Swavalamban Yojana Type of Finance

Dropline Overdraft, Cash Credit, Term Loan, or a combination of these facilities will be provided based on the customer’s specific requirements. For both Fund-Based and Non-fund-based facilities, individual exposure limits may be approved for the units. Non-Fund Based facilities may be sanctioned at the discretion of the authority based on their best judgment.

In the case of Dropline Overdraft, the Drawing Power (DP) will be determined either according to the Stock Statement or the DP as per the original Dropline level, whichever is lower. The DP can be adjusted or reinstated to the actual level upon the availability of sufficient DP, as indicated by the Stocks and Book Debt Statement. This approach ensures flexibility and responsiveness to the financial needs of the units, with adjustments made in accordance with the evolving financial conditions.

Deen Dayal Upadhyaya Swavalamban Yojana Eligibility Criteria

The DDUSY Scheme 2023 imposes specific eligibility criteria and document requirements for prospective participants. To qualify for the program, applicants must adhere to the following criteria and provide the necessary documentation:

- Aspiring participants should be unemployed individuals who are permanent residents of Arunachal Pradesh.

- Possession of a valid Aadhaar card and PAN card is mandatory for eligibility.

- Applicants are required to have an active bank account with one of the designated banks or financial institutions.

- A well-formulated business strategy or project report for the proposed venture is essential.

- Individuals should not have availed themselves of any additional subsidies or loans from either the state or federal governments in the past.

Deen Dayal Upadhyaya Swavalamban Yojana Documents Required

In conjunction with their online application for the DDUSY program, applicants are required to submit the following documents:

- PAN card and Aadhaar card

- Details of the bank account

- Comprehensive project report or business plan

- Certificate of formation or registration (if applicable)

- Certificate of GST registration (if applicable)

- Land allocation order or leasing agreement, if applicable

- No Objection Certificate (NOC) from the local government, if required

- Quotation for machinery or equipment, if applicable

- Degree or diploma certificate, if applicable

- Certificate of medical registration, if applicable

Deen Dayal Upadhyaya Swavalamban Yojana Loan Amount

As part of the Deen Dayal Upadhyaya Swavalamban Yojana, the State Government is offering financial support through subsidies on startup loans. The primary objective of this scheme is to incentivize unemployed youth to access low-cost capital for initiating entrepreneurial ventures.

Within this framework, a provision has been established for a 40% front-ended capital investment subsidy for entrepreneurs looking to establish small and medium enterprises with project costs ranging from Rs. 10.00 lakhs to Rs. 50.00 lakhs.

The loan amount is set at 30% to 50% of the total project cost.

Entrepreneurs must contribute a minimum of 10% to 30% of the project cost as their own contribution. Priority will be given to those who contribute a higher proportion.

Additionally, women entrepreneurs can avail themselves of an extra 5% interest subsidy annually, provided they do not default and become Non-Performing Assets (NPA). The initiative aims to empower aspiring entrepreneurs, especially women, by facilitating access to capital and fostering sustainable business growth.

Deen Dayal Upadhyaya Swavalamban Yojana Application Process

To apply for the Deen Dayal Upadhyaya Swavalamban Yojana (DDUSY) Scheme 2023 online and track your application, follow these steps:

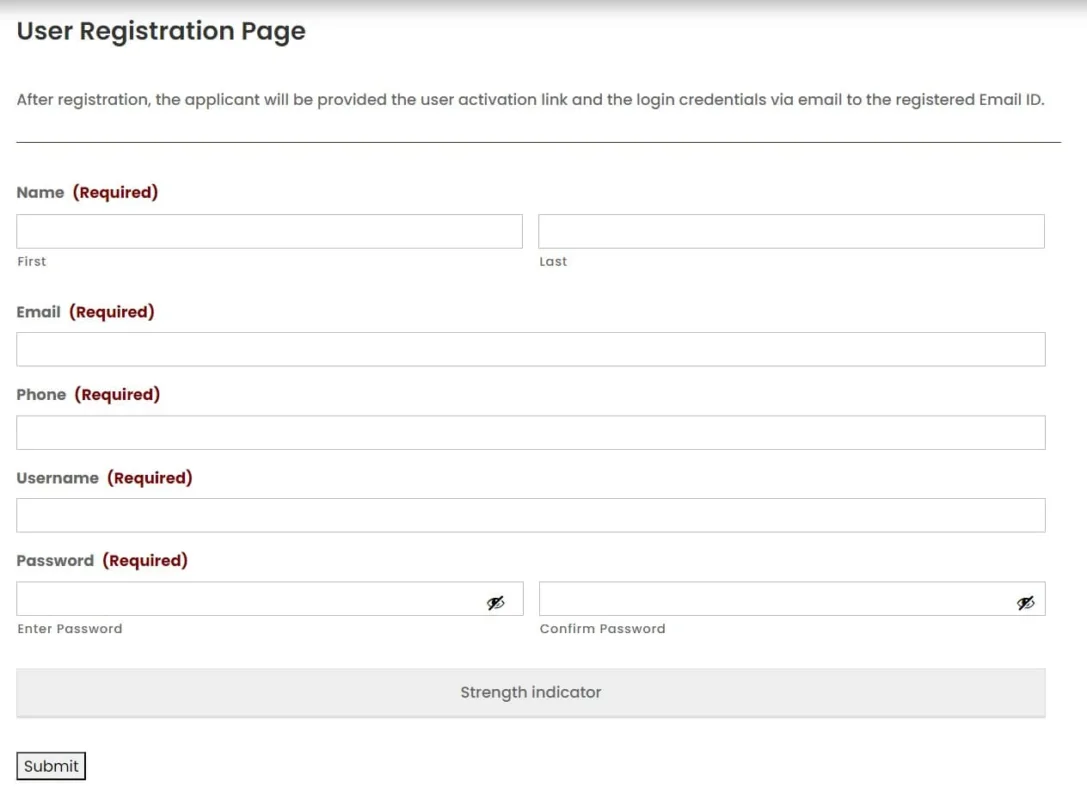

- Visit DDUSY’s Official Website and click on the “Apply Now” button.

- Complete the user registration form with your details such as name, email, phone number, username, and password. An email containing a user activation link and login credentials will be sent to your registered email address.

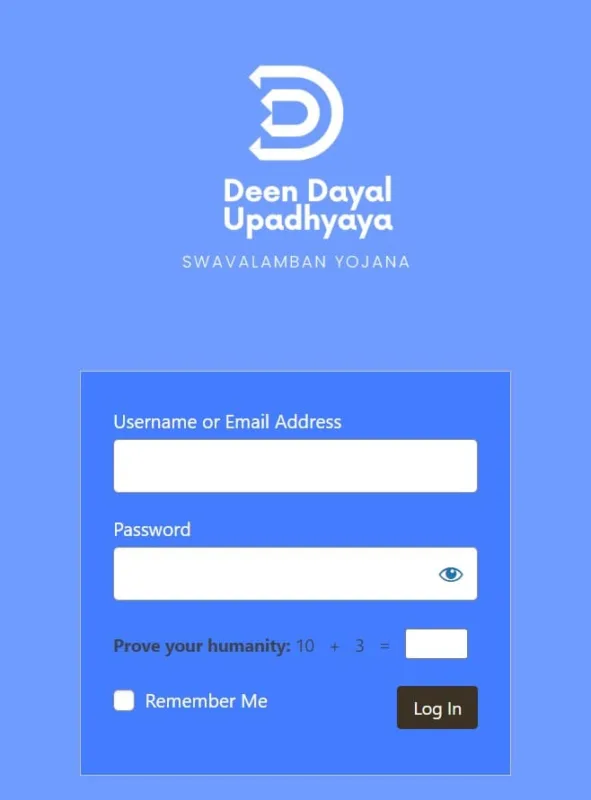

- Log in using your username and password to access your account. The dashboard will display options like “Fill out the DDUSY Form,” “Track Your Application,” “Guidelines,” “Frequently Asked Questions,” etc.

- Choose “Fill out the DDUSY Form” and complete the online application form, providing personal information, project details, bank information, document uploads, etc. The website may include a video tutorial on form completion. Refer to the website’s document checklist and key instructions for additional guidance.

- After verifying all the information, submit your application form. An email will be sent confirming your application ID and status.

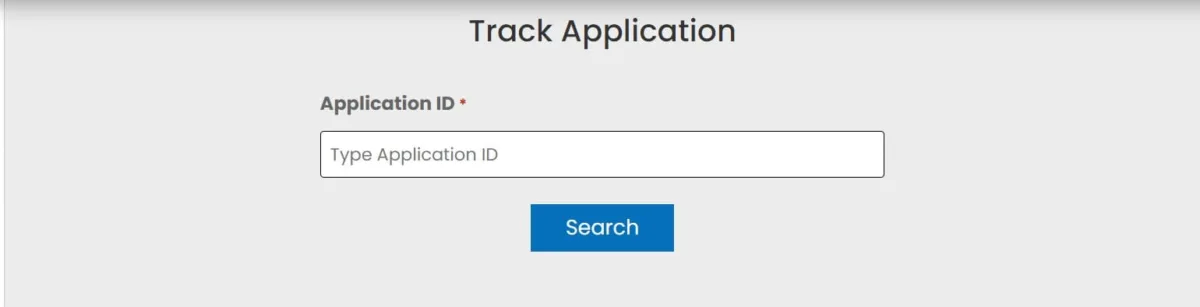

- Track the status of your application by selecting “Track Your Application” and entering your application ID. For any inquiries or concerns about your application, you can contact the state government’s Planning and Investment Division.

Deen Dayal Upadhyaya Swavalamban Yojana Track Application Status

In order to track whether your loan application is accepted or not, you need to follow certain steps and those are.

- Visit the DDUSY Official website.

- Click on the “Menu” tab.

- There you will find a tab called “Track my DDUSY Application 2023”

- After that, you will be redirected to the new page where you can enter your “Application ID”

- After following that, you will get to know your Application status.

Deen Dayal Upadhyaya Swavalamban Yojana FAQs

What is the “Deen Dayal Upadhyaya Swalamban Yojana?

The Deen Dayal Swavalamban Yojana, a startup loan scheme, was introduced by the State Government of Arunachal Pradesh. This initiative provides financial assistance in the form of subsidies on startup loans, with the primary objective of encouraging unemployed youths to access low-cost capital for establishing entrepreneurial ventures. The scheme was announced in the Budget speech of the Finance Minister in March 2017, emphasizing the promotion of entrepreneurship among unemployed youth through formal banking channels. The operation of the scheme extends to all branches of scheduled commercial banks across the State.

What is the interest rate charged under the Deen Dayal Upadhyaya Swalamban Yojana?

The interest rate may vary slightly between banks. For example, the State Bank of India (SBI) charges a rate between 3.25% to 3.50%, above the EBLR (currently at 7.55%).

What subsidy is available from the Government of Arunachal Pradesh under DDUSY?

The Government of Arunachal Pradesh provides a 40% front-ended capital investment subsidy. Additionally, women entrepreneurs receive an extra 5% interest subvention annually, with the condition that the loan remains non-performing.

What is the front-ended capital subsidy?

Front-ended subsidy means beneficiaries receive an upfront subsidy credited to their loan account in the initial stages of any business activity.

What is the margin money/contribution required to set up a unit under Deen Dayal Swalamban Yojana?

Entrepreneurs need to contribute a minimum of 10% to 30% of the project cost as margin money/own contribution. Preference is given to those contributing a higher proportion.

How are applications under DDUSY processed?

Applications submitted through the web portal are scrutinized by the District Planning Officer, followed by a CIBIL score check by the District Lead Bank Manager. Approved applications undergo an interview and presentation before the District Level Screening Committee. The selected proposals then undergo field verification, and if found viable, are recommended to the bank for loan extension.

I want a loan for projects up to 10 lakhs. Can I apply for the loan under DDUSY?

Loans up to Rs. 10.00 Lakhs are sanctioned under the Mudra Scheme by banks. You can apply for the PM Mudra Yojana by visiting the official website.

How can one receive handholding support under the Deen Dayal Upadhyaya Swalamban Yojana?

Arunachal Pradesh Innovation and Investment Park (APPIP) in Itanagar, under the Finance, Planning & Investment Department, provides resources and expertise for startups and new ventures. Startups under DDUSY can seek support and guidance from APPIP.

Which lending institution provides the loan, and how much is provided to eligible beneficiaries? What is the required contribution?

The loan under Swalamban Yojana can be obtained from any branch of Scheduled Commercial Banks in the state. The loan covers 30% to 50% of the project cost, excluding the cost of land and building. Entrepreneurs need to contribute 10% to 30% of the project cost, with preference given to those contributing a higher proportion.

Is plantation activity eligible under the scheme?

No, only additional activities aimed at setting up a unit under Agri-Horti & allied activities are eligible.

Also Read: [Revised] Mukhya Mantri Shramik Kalyan Yojana 2023: Welfare Scheme for Workers of Arunachal