Just like “Mera Bill Mera Aadhikar”, the Uttarakhand Government also has a similar scheme called “Bill Lao Inaam Paao” to foster trust among consumers when making purchases and underscore the significance of authentic receipts, ultimately promoting a more transparent economy. Under this scheme, the Government will pay exciting prizes worth lakhs of rupees. In this article, we will discuss the “Bill Lao Inaam Paao” Scheme in detail. I am certain that you don’t have any doubt left regarding the same.

What is Bill Lao Inaam Paao Yojana?

Many sellers tend to avoid providing proper bills to evade GST, and similarly, customers often do not insist on receiving bills. This behavior directly affects tax collection and government revenue. Acknowledging this, the Uttarakhand government has launched Bill Lao Inaam Paao. Bill Lao Inaam Paao is a GST Reward Bill Scheme launched on September 01, 2022, to reward people of Uttarakhand upon uploading a bill. This was done to encourage people to buy from authentic shops and to curb people from buying things from unauthentic marketplaces. Under this scheme, citizens in the state will have the opportunity to receive rewards through a mega draw, encouraging everyone to participate.

As stated on the BLIP website, the Uttarakhand Department of Commercial Taxes firmly holds the view that Information Technology should be harnessed to usher in an era of digital governance, with the goal of streamlining processes, enhancing transparency, delivering relevant, high-quality, and timely information to all stakeholders, and offering services efficiently and cost-effectively. Therefore, the Bill Lao Inaam Paao scheme has been launched which is the GST Reward Bill Scheme.

| Bill Paao Inaam Paao 2023 Key Highlights | |

| Bill Lao Inaam Paao 2023 Launch Date | September 01, 2022, |

| Bill Lao Inaam Paao 2023 Official Website | Click Here |

| Bill Lao Inaam Paao Objective | To foster trust among consumers when making purchases and underscore the significance of authentic receipts. |

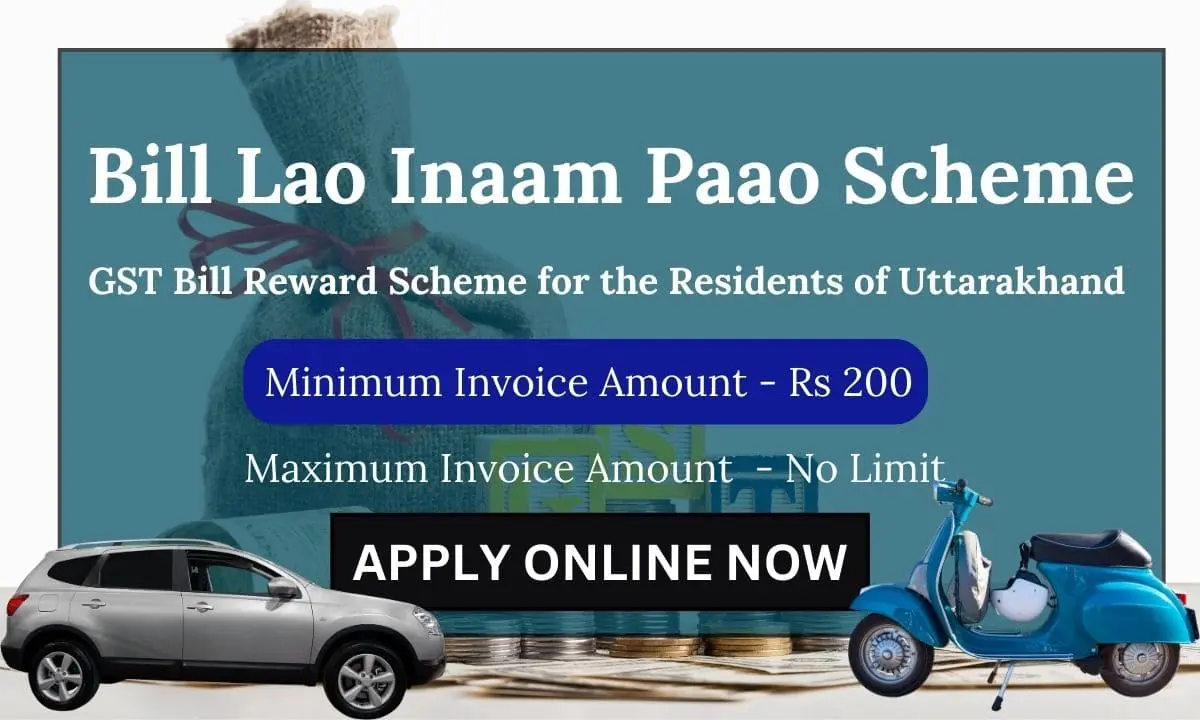

| Bill Lao Inaam Paao Minimum Invoice Amount | Rs 200 |

| Bill Lao Inaam Paao Beneficiaries per month | 1500 |

| Bill Lao Inaam Paao Awards | Mobile, Smart Watch, Earphones or Earpods |

| Bill Lao Inaam Paao Lucky Draw Duration | Monthly and Annually |

| Bill Lao Inaam Paao Helpline Number | 1800 120 122 277 |

Bill Lao Inaam Paao Winning Prizes

Bill Lao Inaam Paao will offer various prizes every month and mega prizes in a year. On May 15, 2023, Uttarakhand’s State Tax Commissioner, Iqbal Ahmed, announced the extension of the ‘Bill Lao Inam Pao’ scheme until November 2023. Additionally, the state government has removed the requirement for bills to be non-branded, and now bills for branded products will also be eligible for inclusion in the scheme.

A series of grand lucky draws will take place for bills that have been uploaded between September 1, 2022, and November 30, 2023. The fortunate winners will have the chance to receive appealing prizes, such as cars, motorcycles, laptops, and smart TVs.

Consumers will earn points for each bill they upload, which can be redeemed in the form of rewards, cashback, and discount coupons. Here is the complete list of the prizes one will get upon winning the lucky draw every month.

| S.No | Awards |

| 01 – 500 | Mobile |

| 501 – 1000 | Smart Watch |

| 1001 – 1500 | Earphones or Earpods |

It’s worth noting that GST bills from online purchases are not eligible for participation in this scheme. Only bills for goods and services obtained directly from vendors are eligible for inclusion in the scheme, and these bills should be uploaded using the BLIP app. Given below is the list of prizes you will get at the end of November 2023.

| S.No | Award | Number of People |

| 01 to 18 | Four Wheeler/Car | 18 |

| 19 to 38 | Two Wheeler (200 to 350 CC) | 20 |

| 39 to 88 | Electric Scooter | 50 |

| 89 to 188 | Laptop | 100 |

| 189 to 388 | Smart TV (32 inch) | 200 |

| 389 to 888 | Tab | 500 |

| 889 to 1888 | Microwave | 1000 |

Bill Lao Inaam Paao Eligibility Components

The Bill Lao Inaam Pao Scheme will exclusively accept GST bills from the following types of businesses:

- Sweet shops

- Restaurants

- Dry fruit vendors

- Ready-made clothing stores

- Fabric retailers

- Saree shops

- Salons and beauty parlors

- Gaming parlors

- Laundry service providers

- Non-branded footwear sellers

- Artificial jewelry stores

- Invoices issued by composition dealers

Please Note:

In the context of the Bill Bring Reward Scheme, GST bills from the following types of establishments and items will not be eligible:

- GST bills for items purchased online through e-commerce platforms like Amazon, Flipkart, Myntra, Meesho, etc.

- GST bills from multinational and national food chains, such as McDonald’s, Domino’s, KFC, Subway, Café Coffee Day, Costa Coffee, Pizza Hut, HaldiRam, Burger King, Dunkin’, and Sagar Ratna.

Bill Lao Inaam Paao Important Points

- This incentive program is commonly referred to as the GST Customer Reward Scheme.

- The invoices issued by composition dealers are also eligible for participation in this program.

- To qualify for the scheme, the total amount on a GST bill must exceed Rs 200.

- Only GST bills issued after September 1, 2022, will be considered valid for this initiative.

- On a regular basis, 1500 individuals will be chosen through a lucky draw as recipients of the rewards.

- It is essential to securely retain a copy of the invoice uploaded to the app and be prepared to furnish it upon request.

- In the event of any disputes, the decision of the Tax Commissioner will be deemed final.

- If a trader fails to provide a GST bill when requested, consumers can file a complaint by calling 1800120122277.

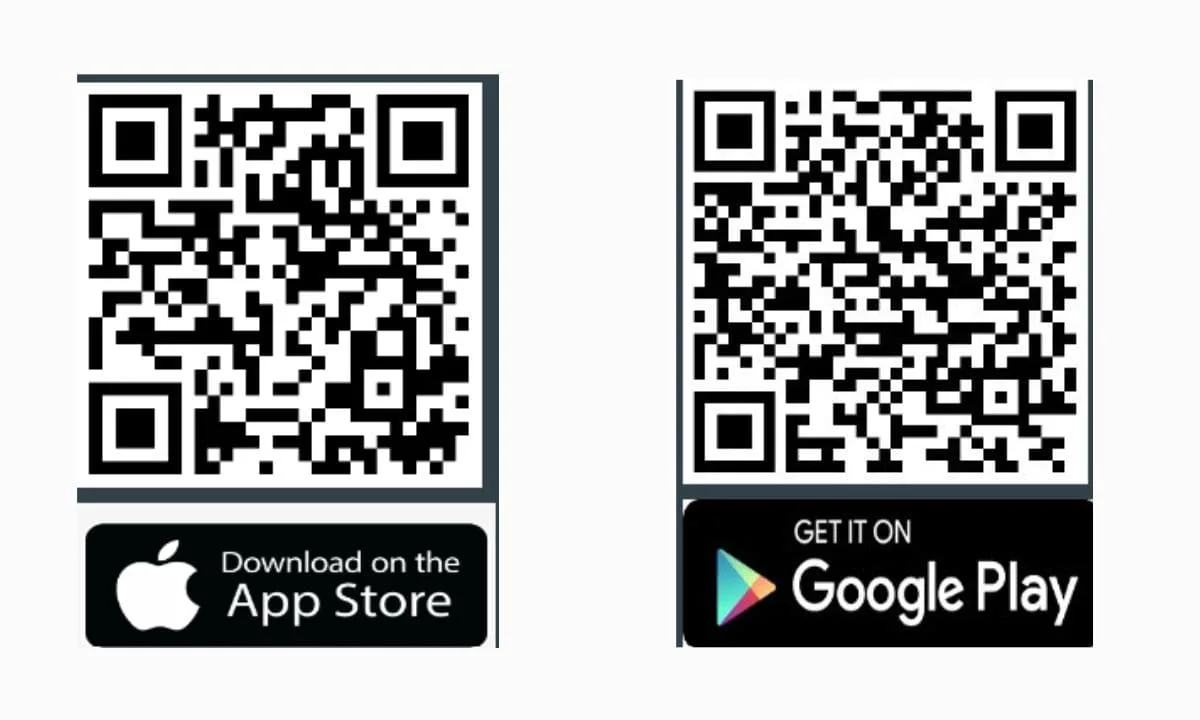

Bill Lao Inaam Paao Download the Mobile App

In order to take advantage of the scheme, you need to download the BLIPUK App. You can download this application on iPhone as well as Android. To assist you with this, you can scan the following QR codes.

You can also download the same by clicking on the following links.

Click Here to Download the BLIPUK App for Android

Click Here to Download the BLIPUK App for iPhone

Bill Lao Inaam Paao Eligibility Criteria

It is essential to be eligible for the Bill Lao Inaam Pao Scheme before you think of taking advantage of the same. Here are the complete eligibility criteria

- You must be a resident of Uttarakhand.

- This scheme is exclusively available to customers who fulfill their GST payment obligations.

Bill Lao Inaam Paao Document Requirements

In order to take advantage there are certain documents that you need to produce if you win the prize.

- Aadhar Card or any Photo ID that proves your identity

- Address Proof: This is to check if you are a resident of Uttarakhand

- Hard Copy of GST bill that won the prize. This is important to have a hard copy of the GST Bill because you have to produce the bill when asked upon redeeming your prize.

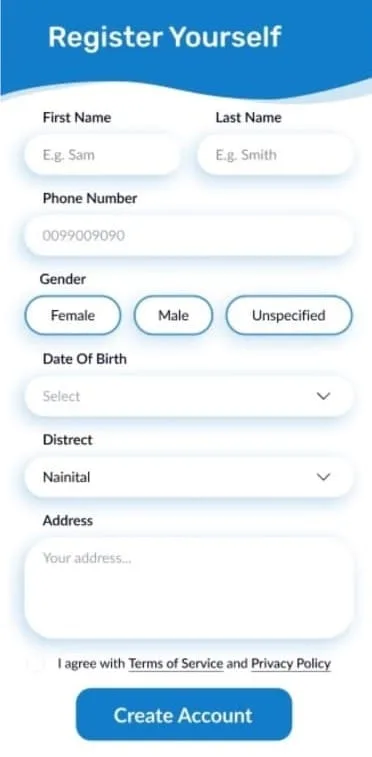

Bill Lao Inaam Pao Application Process

To participate in the Bill Lao Inam Pao Scheme, prospective applicants must follow these steps:

- Begin by downloading the Bill Lao Inam Pao Scheme mobile app.

- Once the app is installed, applicants should proceed to register by providing the following information:

- Name

- Date of birth

- Gender

- Mobile number

- District

- Address

- Upon completing the registration details, clicking the “Register” button will complete the registration process.

- Subsequently, the applicant must log in using their registered mobile number.

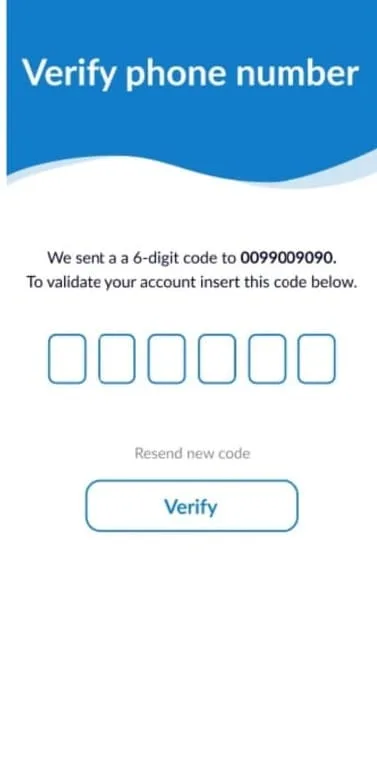

- The app will verify the mobile number through an OTP (One-Time Password) verification process.

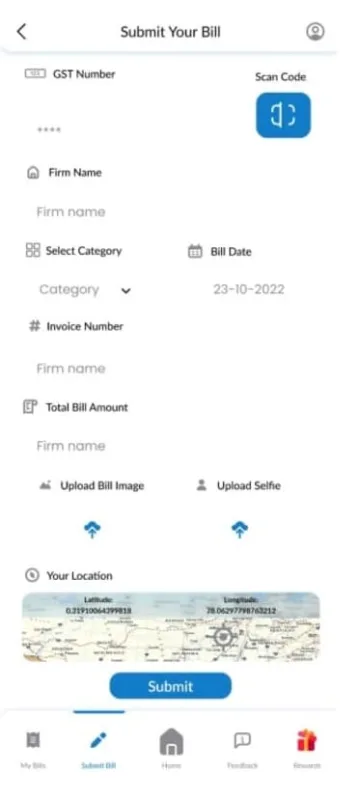

- Once the app is accessible, the next step is to upload a GST bill.

- Details of each GST bill should be accurately filled out, and then click on the “Submit” button.

- If selected as a recipient, the applicant will receive a notification via SMS.

Bill Lao Inaam Pao FAQs

What is the Bill Lao Inaam Pao Scheme?

Bill Paao Inaam Paao is a GST Reward Bill Scheme launched on September 01, 2022, to reward people of Uttarakhand upon uploading a GST bill. Under this scheme, citizens in the state will have the opportunity to receive rewards through a mega draw, encouraging everyone to participate.

What is the maximum amount one will get by winning the Bill Lao Inaam Pao Scheme?

There is no cash prize under this scheme, however, prizes worth lakhs will be provided under this scheme. For more details please refer to the article.

What is the minimum invoice amount of the GST bill allowed under the Bill Lao Inaam Pao scheme?

A minimum invoice amount of Rs 200 is eligible to be uploaded under the Bill Lao Inaam Pao scheme.

How many people per month will get the prize under the Bill Lao Inaam Pao scheme?

A total of 1500 people will be awarded under the Bill Lao Inaam Pao scheme. The list will be released at the end of the month.

If I purchase anything from the online website. Can I upload that bill on the app?

Unfortunately no. The online invoices are not eligible under this scheme. You have to purchase from the offline store.

Can I upload the B2B Bill on the app under the Bill Lao Inaam Pao scheme?

NO. Only B2C bills are eligible under the Bill Lao Inaam Pao scheme.

What should I do after winning the prize under the Bill Lao Inaam Pao scheme?

You will have to produce the necessary documents only then you will be able to get the prize.

How will I know that I have won the prize under the Bill Lao Inaam Pao scheme?

You will be contacted by the authority on your registered mobile number by SMS where you will find out your winning prize.

Similar Schemes:

Mera Bill Mera Aadhikar Scheme: GST Reward Scheme

Mukhyamantri GST Bill Puraskar Yojana 2023 | Rajasthan Govt to Give 1,00,00,000 as a Prize