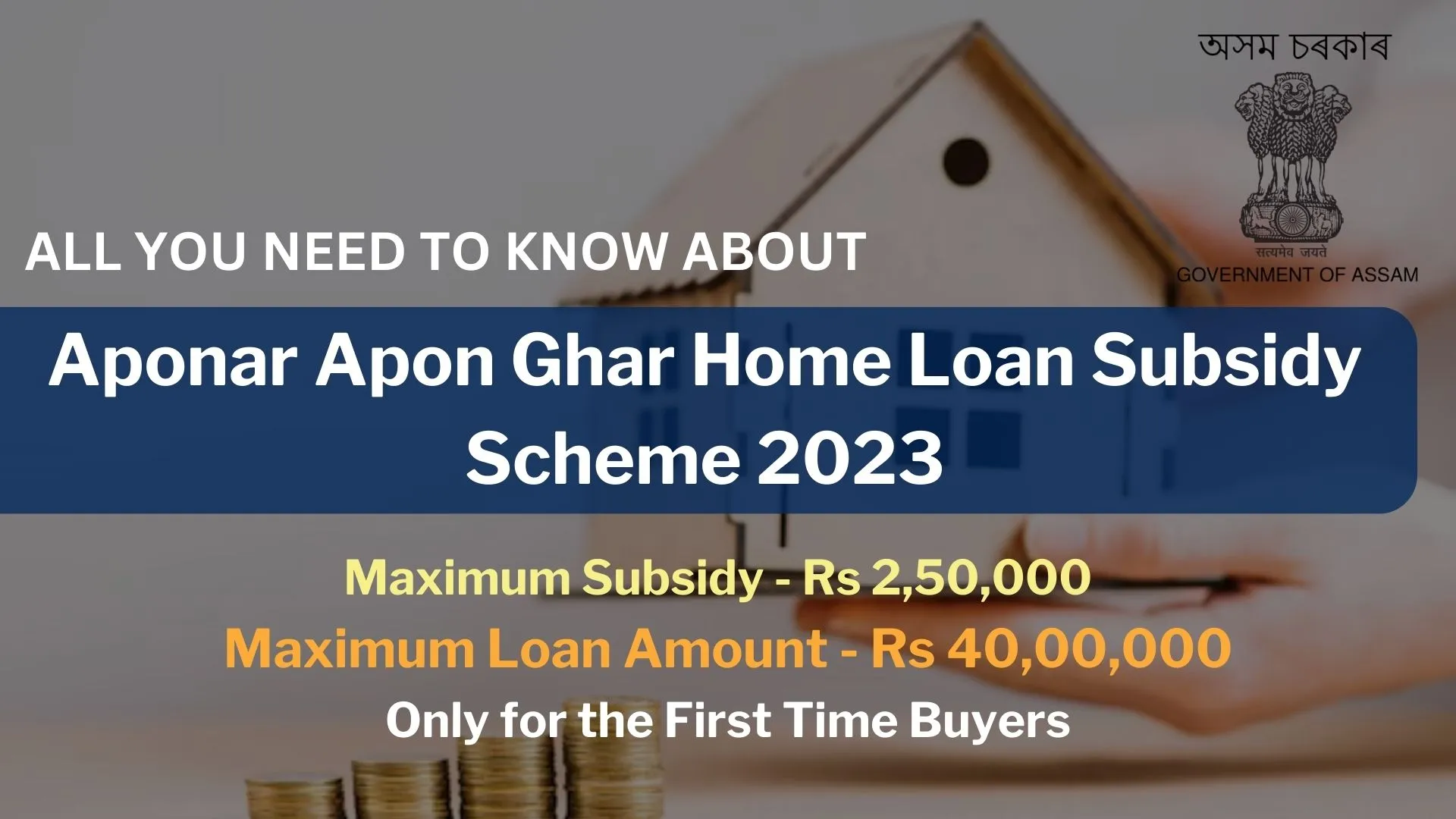

The Government of Assam is inviting online applications for the Aponar Apon Ghar Home Loan Subsidy Scheme. Under this scheme, the citizen of the state will get a subsidized amount of a maximum of 2.5 lakhs on up to Rs 40 Lakh. In this article, we will learn about the scheme in detail. By the end of the article, you won’t have any doubt left regarding the scheme.

What is Aponar Apon Ghar Home Loan Subsidy Scheme?

Aponar Apon Ghar Home Loan Subsidy Scheme is a home loan subsidy scheme by the state of Assam. Under this scheme, the permanent resident of the state will get a maximum of 2.5 lakh subsidy on up to Rs 40 Lakh loan. This housing loan subsidy is exclusively available to individuals buying their first house and who haven’t utilized loans through the prior Apun Ghar Scheme. Now, individuals have the option to apply for the Aponar Apon Ghar Scheme online by completing a registration/application form, verifying the subsidy amount, and providing all necessary details.

Through the Aponar Apon Ghar home loan subsidy scheme in Assam, all candidates will be eligible for home loans with reduced interest rates. This initiative is a continuation of the earlier Polar Apon Ghar Home Loan Subsidy Scheme from 2016-17.

About Polar Apon Ghar Home Loan Subsidy Scheme 2016

Under the Apun Ghar home loan program, the state government had been offering a 3.5% interest subsidy to government employees on home loans up to Rs. 15 lakh, repayable over a 20-year period.

Aponar Apon Ghar Home Loan Subsidy Scheme Key Highlights

| Aponar Apon Ghar Home Loan Subsidy Scheme 2023 Key Highlights | |

| Aponar Apon Ghar Home Loan Subsidy Scheme Launch Date | 2020 |

| Aponar Apon Ghar Home Loan Subsidy Scheme Launched by | Government of Assam |

| Aponar Apon Ghar Home Loan Subsidy Scheme Official Website | https://assam.gov.in/ |

| Aponar Apon Ghar Home Loan Subsidy Scheme Objective | To provide “Housing for All” till 2022. Now it has been extended to 2024. |

| Aponar Apon Ghar Home Loan Subsidy Scheme Subsidized Amount | Maximum 2,50,000 |

| Aponar Apon Ghar Home Loan Subsidy Scheme Loan Amount | Maximum 40,00,000 |

| Aponar Apon Ghar Home Loan Subsidy Scheme Helpline Number | Yet to be launched |

Aponar Apon Ghar Home Loan Subsidy Scheme Objective

- Enhance Homeownership: Enable individuals, especially first-time buyers, to realize their homeownership dream.

- Reduce Financial Burden: Offer subsidized home loans with lower interest rates to make housing more affordable.

- Inclusivity: Target those who haven’t availed loans from the previous Apun Ghar Scheme, ensuring broader access.

- Simplify Application: Introduce an online application process for convenient and streamlined submissions.

- Continuity: Build upon the Polar Apon Ghar Scheme’s foundation to extend housing support.

- Economic Boost: Stimulate real estate activities, job creation, and related industries.

- Social Stability: Foster a sense of belonging and stability within communities.

- Long-term Investment: Encourage asset-building and wealth creation through homeownership.

Aponar Apon Ghar Home Loan Subsidy Scheme Benefits

- The scheme offers subsidized home loans, making owning a home more financially achievable.

- Beneficiaries enjoy subsidized interest rates on their home loans, reducing the overall cost of borrowing.

- The scheme is only for individuals who haven’t availed of loans under the previous Apun Ghar Scheme, giving them an opportunity to benefit.

- An online application process simplifies and speeds up the application procedure for greater convenience.

- The scheme stimulates real estate activities, job creation, and associated industries, contributing to economic growth.

- By facilitating homeownership, the scheme fosters stability and a sense of community belonging.

- Homeownership is an avenue for asset-building and long-term financial security.

- The benefits of stable housing extend to improved living standards and overall well-being.

- The scheme empowers individuals to take steps towards securing their own homes and financial futures.

Aponar Apon Ghar Home Loan Subsidy Scheme Eligibility Criteria

- Applicants need to be permanent residents of Assam.

- Applicants should secure housing loans from Scheduled Commercial Banks, Regional Rural Banks, or the Assam Cooperative Apex Bank within the state.

- The combined family income from all sources must not exceed Rs. 20 lakhs.

- The sanctioned housing loan amount must be greater than Rs. 5 lakhs and must have been approved by the bank on or after 1 April 2019.

- Individuals who have already availed of benefits under the Apon Ghar scheme are not eligible.

- Loan accounts must not fall under Non-Performing Assets (NPA) status.

- The property in question should mark the composite family’s first home.

Aponar Apon Ghar Home Loan Subsidy Scheme Documents Required

Before applying for the scheme online, you must check the documents that are required to apply for theAponar Apon Ghar Home Loan Subsidy Scheme scheme online. Here is the complete list of Aponar Apon Ghar Home Loan Subsidy Scheme documents that will be required.

- Residence Proof of Assam State

- Proof of Identity

- Income Certificate

- Bank Account Details

- Passport Size Photograph

- Latest Salary Slips

- Statement of Salary Account for the Past Six Months

- No Dues Salary From the Existing Banker if the Salary is Credited in Other Than SBI Account

- Proof of Being in Service for a Minimum of Five Years

- Statement of Personal Assets and Liabilities in Bank’s Format

- Documents Evidencing the Ownership of Land

Aponar Apon Ghar Home Loan Subsidy Scheme Subsidy Amount

The Government of Assam has released updated information regarding the scheme subsidized amount. The following table reflects the loan amount range and the maximum subsidy amount that one can get under this scheme.

| Aponar Apon Ghar Home Loan Subsidy Scheme Subsidy Amount | |

| Loan Amount | Subsidy Amount |

| Rs 5 Lakh to 10 Lakh | Rs 1 lakh |

| Rs 10 Lakh to 20 Lakh | Rs. 1.5 lakh |

| Rs 20 Lakh to 30 Lakh | Rs. 2 lakh |

| Rs 30 Lakh to 40 Lakh | Rs. 2.5 lakh |

Aponar Apon Ghar Home Loan Subsidy Scheme How to Apply Online

- Go to the official website and find the “Click here for Loan Subsidy” section.

- Click on “Aponar Apon Ghar (Home Loan Subsidy Scheme).”

- This takes you to the “Application for Release of Subsidy” page.

- Fill in all the required information. This includes your:

- Personal details: Name, Gender, Date of Birth, PAN Number, Email ID, Mobile Number, Address.

- Loan details: IFSC code of the loan branch, Bank Name, Branch Name, Account Number, Loan Amount, Loan Sanction Date, and Property Address.

- Upload the necessary documents: Proof of Land, Address Proof, and PAN Card.

- Review the Declaration, and then click “Save.”

To check the Application Status, please follow the steps below.

- Access the official website and locate the “Application Tracking” section at the bottom right of the page. Click on “Track.”

- On the following page, enter your Mobile Number along with either your Loan Account Number or Application Number, then click “Submit.”

Aponar Apon Ghar Home Loan Subsidy Scheme FAQs

When was the scheme launched?

The scheme was launched on April 01, 2019. This scheme was launched by the finance department of Assam.

Who is eligible for the Aponar Apon Ghar Home Loan Subsidy Scheme?

The scheme is aimed at benefiting citizens of Assam who lack proper housing.

How will the subsidy granted by this scheme be provided to the recipient?

The subsidy under this scheme will be disbursed to the beneficiary’s bank account.

Through which banks will the benefits of the Assam Aponar Apon Ghar Scheme be distributed to the beneficiaries?

The benefits of this scheme can be obtained through any bank authorized and acknowledged by the Assam government.