The Prime Minister’s Employment Generation Programme (PMEGP) functions as a credit-linked subsidy initiative under the administration of the Ministry of Micro, Small and Medium Enterprises (MSME). Its primary objective is to foster employment opportunities by facilitating the establishment of micro-enterprises within the non-farm sector, catering to both rural and urban areas. This program has received approval for continuation throughout the 15th Finance Commission cycle, covering the period from 2021-22 to 2025-26. PMEGP was created through the amalgamation of two pre-existing schemes, namely the Prime Minister’s Rojgar Yojana (PMRY) and the Rural Employment Generation Programme (REGP), both operational until March 31, 2008.

A substantial outlay of ₹13,554.42 Crore has been sanctioned for PMEGP throughout five Financial Years (2021-22 to 2025-26) to establish approximately 4,00,000 projects, resulting in the generation of 30,00,000 employment opportunities at an average of 8 persons per unit. Furthermore, each fiscal year will witness the upgrading of 1,000 units.

What is PMEGP 2024?

As mentioned above, the Prime Minister’s Employment Generation Programme has been amalgamated with two prior schemes, namely Prime Minister Rojgar Yojana (PMRY) and the Rural Employment Generation Programme (REGP), which operated in a similar fashion to foster youth employment. Initiated by the Government of India in collaboration with banks, PMEGP provides financial assistance for establishing new enterprises. The scheme has undergone modifications, increasing the maximum project cost from Rs 10 lakh to Rs 20 lakh for service units and from Rs 25 lakh to Rs 50 lakh for manufacturing units.

Business owners are required to invest only 5%-10% of the project cost, with the government offering a subsidy of 15%-35% based on specific criteria. Banks extend funds in the form of a Term Loan, Working Capital Loan (Cash Credit), and Composite Loan.

For the General Category, the bank sanctions 90% of the project cost, while for the Special Category, it is 95%. The credit from the bank ranges between 60-75% of the total project cost, with the remaining 15-35% provided as margin money subsidy under this scheme.

The loan options include term loans, working capital loans (cash credit facilities), or composite loans catering to both working capital and capital expenditures. The working capital component in manufacturing units cannot exceed 40% of the project cost, while for service/trading sector units, it is capped at 60% of the project cost.

| PMEGP 2024 Key Highlights | |

| PMEGP Launch Date | August 15, 2008 |

| PMEGP Official Website | PMEGP Official Website |

| Objective | To provide financial assistance to the youth of India. |

| Beneficiary | Unemployed Youth of India |

| Age Limit | Minimum 18 years of age |

| Income Limit | No Income Limit |

| Maximum Loan Amount | Manufacturing Sector – Rs 50 lakh Service Sector – Rs 20 lakh |

| Types of Sectors | Manufacturing SectorService Sector |

| Mode of Application | Online and Offline |

| PMEGP Helpline Number | Toll-Free Number |

PMEGP Objective 2024

- Facilitate financial support from banks for establishing new micro-enterprises/units.

- Generate employment in rural and urban areas by initiating self-employment micro-enterprises or projects.

- Enhance the income-earning capabilities of artisans and foster growth in rural and urban employment rates.

- Provide a platform for traditional artisans and unemployed individuals in both rural and urban regions to collaborate, creating opportunities for self-employment.

- Address rural-urban migration by offering stable and sustainable employment options, particularly for traditional artisans and unemployed youth engaged in seasonal or sporadic work.

PMEGP Benefits 2024

Funds Allocation under the PMEGP Scheme:

Margin Money Subsidy:

- Annual budget estimates will allocate funds for the disbursement of Margin Money (subsidy) for the establishment of new micro-enterprises/units.

- A portion of the funds from the Margin Money subsidy budget, specifically ₹100 Crores or as approved by the competent authority, will be designated each fiscal year for the subsidy disbursement aimed at upgrading existing PMEGP/REGP/MUDRA units.

Backward and Forward Linkages

- 5% of the total allocation under Budget Estimates for a Financial Year for PMEGP, or as approved by the competent authority, will be earmarked for Backward and Forward Linkages.

- Utilized for various activities such as awareness camps, monitoring meetings, workshops, exhibitions, bankers meetings, Entrepreneurship Development Programme (EDP) training, and other related initiatives.

Levels of Support under PMEGP:

For Setting up New Micro-enterprises (Units)

- Categories of Beneficiaries – General Category:

- Beneficiary’s contribution (of project cost): 10%

- Rate of Subsidy (of project cost): 15% for Urban Areas, 25% for Rural Areas.

- Categories of Beneficiaries – Special Category (SC, ST, OBC, Minorities, Women, Ex-Servicemen, Transgenders, Differently abled, NER, Aspirational Districts, Hill and Border areas, etc.):

- Beneficiary’s contribution (of project cost): 05%

- Rate of Subsidy (of project cost): 25% for Urban Areas, 35% for Rural Areas.

- Note: Maximum project cost eligible for Margin Money subsidy – ₹50,00,000 (Manufacturing sector), ₹20,00,000 (Business/Service sector).

| Prime Minister’s Employment Generation Programme | |||

| Categories of beneficiaries under PMEGP (for setting up of new enterprises) | Beneficiary’s contribution (of project cost) | Rate of Subsidy (of project cost) | |

| Area (location of project/unit) | Urban | Rural | |

| General Category | 10% | 15% | 25% |

| Special Category (including SC.ST, OBC Minorities Women Ex-Servicemen Transgenders, Differently-abled, NER, Aspirational Districts, Hill and Border areas(as notified by the Government) etc | 05% | 25% | 35% |

Second Loan for Upgradation of Existing PMEGP/REGP/MUDRA Units

- Categories of Beneficiaries: All Categories

- Beneficiary’s contribution (of project cost): 10%

- Rate of Subsidy (of project cost): 15% (20% in NER and Hill States).

- Note: Maximum project cost eligible for Margin Money subsidy for upgradation – ₹10,00,00,000 (Manufacturing sector), ₹25,00,000 (Business/Service sector).

- Additional Points:

- The balance amount (excluding own contribution) of the total project cost will be provided by Banks.

- If the project cost exceeds ₹10,00,00,000 or ₹25,00,000 for the Manufacturing and Service/Business sectors respectively, the banks may provide the balance amount without any government subsidy.

| Categories of beneficiaries under PMEGP (for setting up of new enterprises) | Beneficiary’s contribution (of project cost) | Rate of Subsidy (of project cost) |

| All Categories | 10% | 15% (20% in NER and Hill States) |

PMEGP Eligibility Criteria 2024

- Minimum age requirement: Applicant must be at least 18 years old.

- Educational qualification: Beneficiaries should have a minimum educational qualification of 8th standard pass.

- Support for new projects: Assistance is available exclusively for new projects.

- No income ceiling: There is no income ceiling for assistance in establishing projects under PMEGP.

- Mandatory EDP training: Beneficiaries must undergo mandatory Entrepreneurship Development Program (EDP) training to qualify for loan sanction and release.

For the upgradation of existing PMEGP/REGP/MUDRA units:

- Margin Money (subsidy) claimed under PMEGP must be successfully adjusted upon completion of the 3-year lock-in period.

- The first loan under PMEGP/REGP/MUDRA must be repaid within the stipulated time.

- The unit should be profit-making, demonstrate a good turnover, and exhibit the potential for further growth in turnover and profit through technology modernization/upgrading.

Reservation/Preference/Priority:

- Priority will be accorded to individuals affected by natural calamities or disasters in areas declared as “disaster-affected” under Section 2(d) of the Disaster Management Act, 2005, by the Ministry of Home Affairs.

PMEGP Exclusions 2024

The PMEGP program has specific eligibility criteria and restrictions for new enterprises (units):

- Ineligibility for Existing Units: Entities currently operating under PMRY, REGP, or any other Government of India or State Government scheme, and those that have already received government subsidies under any such program, are not qualified for participation.

- Family Limitation: Only one individual per family, including self and spouse, is eligible to receive financial assistance for initiating projects under PMEGP.

Negative List of Activities:

Certain activities are expressly prohibited under PMEG for the establishment of micro-enterprises, projects, or units

- Meat-Related Industry: Any business involved in the processing, canning, or serving of items made from slaughtered meat for human consumption is not permitted.

- Intoxicant Items: Production, manufacturing, or sale of intoxicant items such as Beedi, Pan, Cigar, Cigarette, etc., and any establishments like hotels or dhabas serving liquor are restricted.

- Tobacco Production: Activities related to the preparation or production of tobacco as raw materials are not allowed.

- Toddy Tapping: Tapping toddy for sale is prohibited.

- Agriculture and Plantation: Industries or businesses connected with the cultivation of crops or plantations, including Tea, Coffee, Rubber, Sericulture (Cocoon rearing), Horticulture, Floriculture, and Animal Husbandry, are not permitted. However, value addition in these areas is allowed under PMEGP. Off-farm or farm-linked activities associated with sericulture, horticulture, floriculture, etc., are also allowed.

- Local Government Restrictions: Activities prohibited by local government authorities, considering environmental or socio-economic factors, are not allowed under PMEGP.

Who can avail the PMEGP Loan?

- Business owners and entrepreneurs.

- Micro, Small, and Medium Enterprises (MSMEs).

- Self-help Groups (SHGs) and Charitable Trusts.

- Societies registered under the Societies Registration Act of 1860.

- Production Co-operative Societies.

PMEGP Documents Required

- Completed application form with passport-sized photographs.

- Comprehensive project report.

- Proof of applicant’s identity and address.

- Applicant’s PAN card, Aadhaar card, and VIII Pass certificate.

- Special category certificate, if applicable.

- Entrepreneur Development Programme (EDP) training certificate.

- Certificate for SC/ST/OBC/Minority/Ex-Servicemen/PHC status.

- Academic and technical course certificates, if applicable.

- Any additional documents requested by the Bank or NBFC.

PMEGP Steps to Apply Online

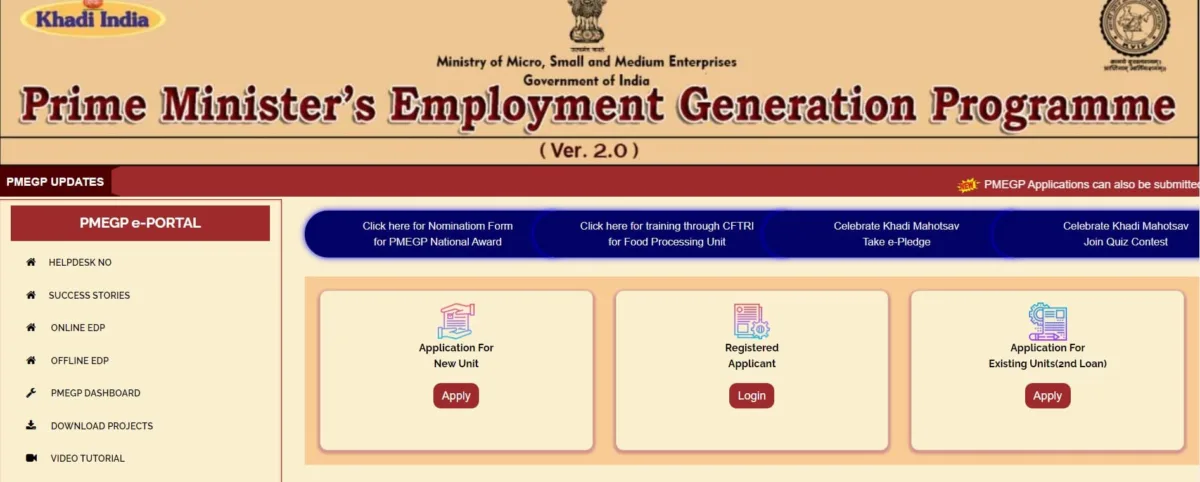

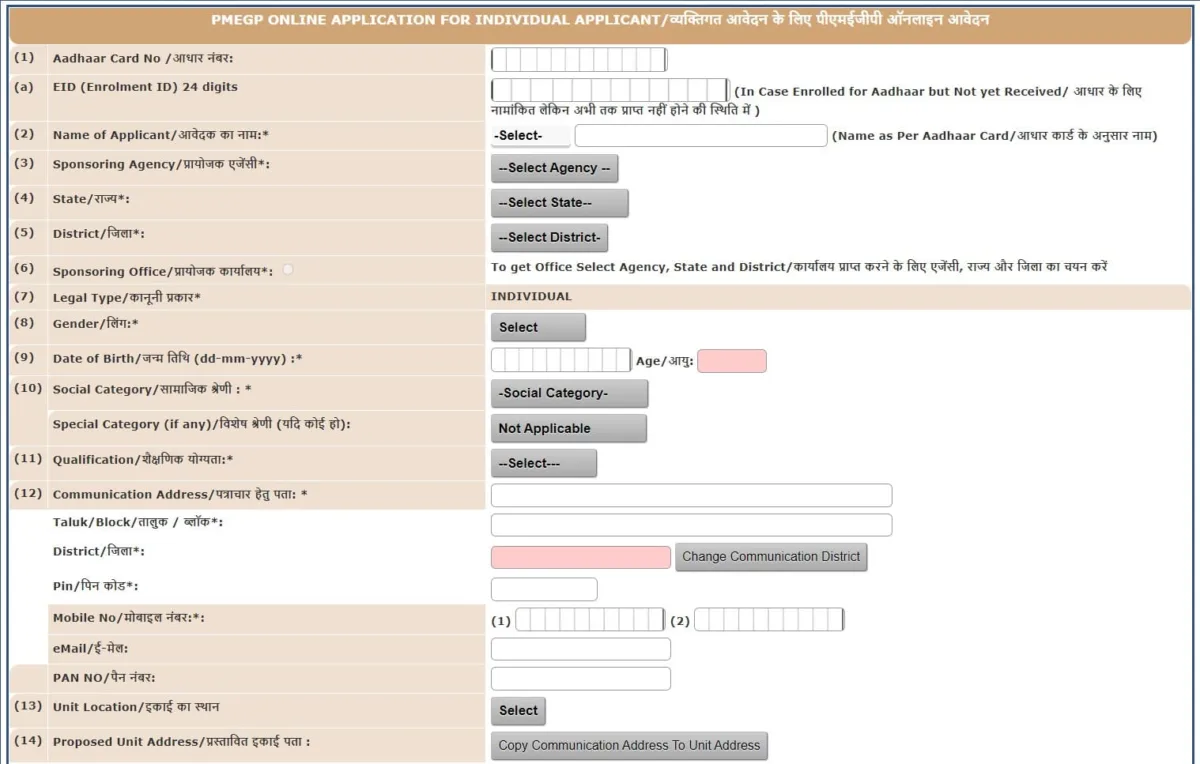

Application for New Unit:

- Go to the official website of the Prime Minister’s Employment Generation Programme (PMEGP).

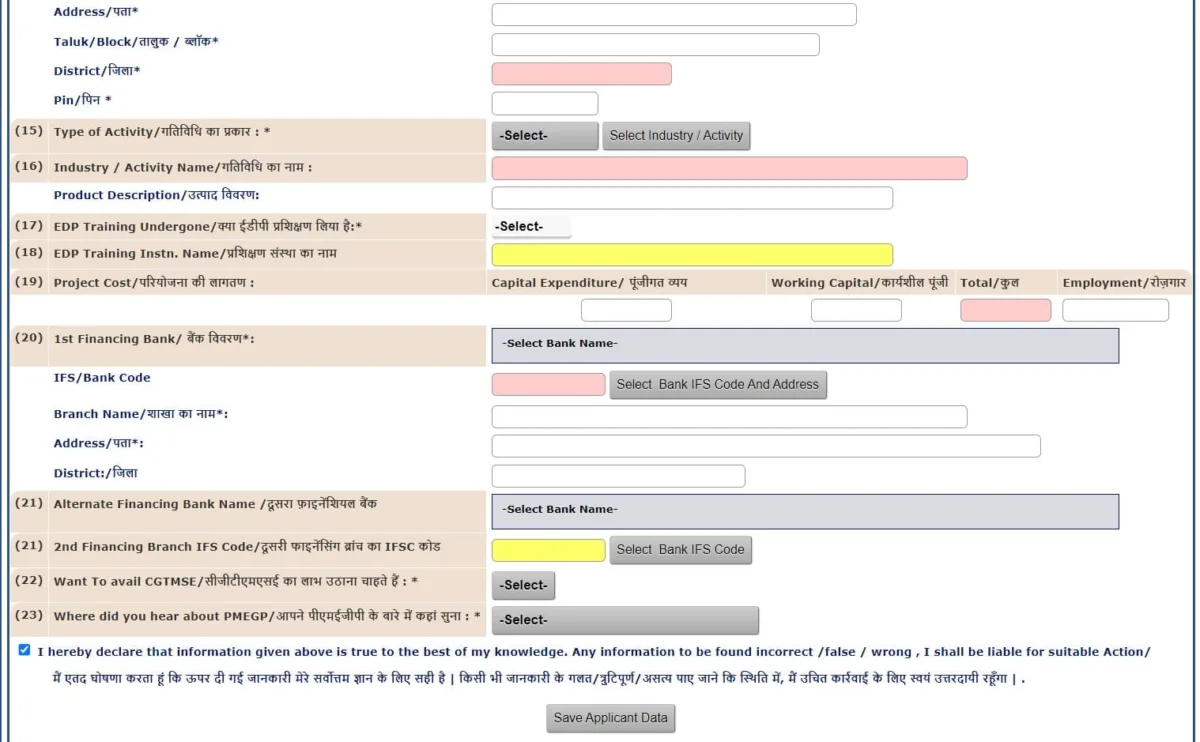

- Click the “Apply” button under the “Application for New Unit” tab.

- Provide all necessary details and save applicant data.

- Upload the required documents on the subsequent page and proceed for final submission.

Application for Existing Units (2nd Loan)

- Visit the official website of the Prime Minister’s Employment Generation Programme (PMEGP).

- Click the “Apply” button under the “Application for Existing Units (2nd Loan)” tab.

- Access the online application form.

- Complete the form, proceed to the next page, upload the required documents, and submit the application.

Login Form for Registered Applicant of Second Loan Subsidy for Upgrading of Existing Unit:

- Go to the official website of the Prime Minister’s Employment Generation Programme (PMEGP).

- Enter your User ID and Password, then click Log in.

PMEGP Steps to Apply Offline

- Complete the application form available at the Official Website of PMEGP

- Submit the duly filled original form to the relevant officers at KVIC/KVIB/DIC/Coir Board offices in the state.

- Upon submission, the applicant will receive an Acknowledgement Slip from the respective department’s KVIC/KVIB/DIC/Coir Board office.

PMEGP FAQs

What is the PMEGP Scheme, and what are its Objectives?

PMEGP, or Prime Minister’s Employment Generation Programme, is a credit-linked subsidy scheme by the Ministry of MSME, Government of India. Its primary objective is to generate employment opportunities by creating self-employment for unemployed youth and women entrepreneurs in rural and urban areas.

What is the Maximum Project Cost allowed under PMEGP?

The maximum project cost is Rs.25.00 lakhs for a manufacturing unit and Rs.10.00 lakhs for a service unit.

What constitutes the Component of Project Cost under PMEGP?

The Project Cost includes a Capital Expenditure Loan, one cycle of working capital, and 10% of the project cost as the contribution for the general category and 5% for the weaker section.

What is the Age Limit for PMEGP?

Any adult beneficiary above 18 years is eligible for financing under PMEGP.

Who is eligible to apply for the PMEGP scheme, and what is the Age Limit for applicants?

Any individual above 18 years of age can apply. The maximum age limit is 35 years for the general category and 40 years for SC/ST/OBC/PH/Women candidates.

Can I apply for the PMEGP scheme online?

Yes, you can apply for the scheme online through the KVIC portal. The process involves registering on the portal, filling out the application form, and uploading the necessary documents.

What documents are required for the PMEGP scheme application?

Required documents include proof of identity and address, educational qualification certificate, caste certificate (if applicable), project report, and bank account details.

Vishwakarma Yojana 2023 | Upto 2 Lakh Loan for Artisans and Craftsman