The recently inaugurated administration under the leadership of Sukhvinder Singh Sukhu in Congress has promptly reinstated the Old Pension Scheme (OPS) for government employees in Himachal Pradesh. This decision has sparked a discussion on the two different Pension Schemes in India, and several other states are considering similar implementations.

In today’s article, we are to dig deep into this topic and will try to understand about Old Pension Scheme Vs New Pension Scheme and which is a better option for the employee and the government’s point of view. You are welcome to put in your thoughts and opinions through the comment section. Also, you can mail us in case of any doubt we will try to get back to you as soon as possible.

What is the Old Pension Scheme?

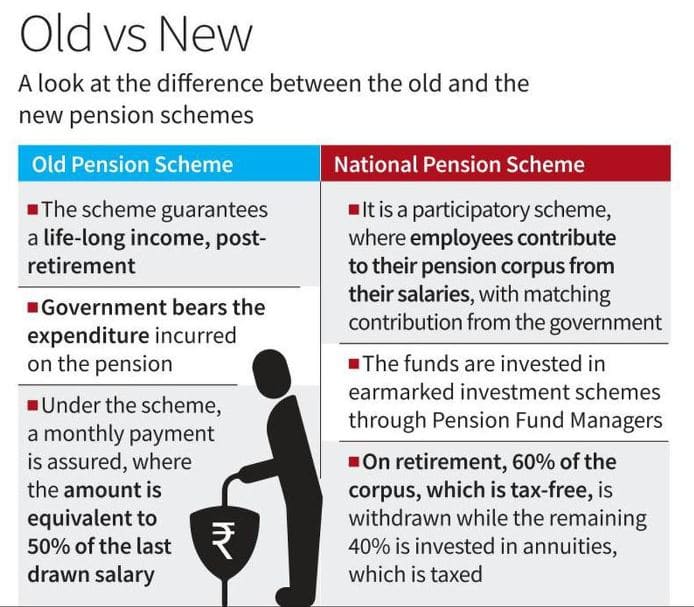

The Old Pension Scheme (OPS) serves as a post-retirement benefit for government employees, ensuring a predetermined sum to be disbursed to the retiree.OPS, commonly referred to as the “Defined Benefit Scheme,” offers government workers 50 percent of their basic salary to safeguard their financial future. This translates to a fixed monthly pension amount, such as receiving Rs 50,000 per month if the basic salary is Rs 1,00,000.

To address the rising cost of living, the government periodically increases the Dearness Allowance (DA) twice a year. This boost in DA not only leads to higher salaries but also results in increased pension payments.

The Old Pension Scheme is entirely funded by the government. Annually, the pension budget is unveiled during the budget announcement, and both the Centre and State governments are responsible for implementing the yearly DA increments for pensions.

Learn More about the Scheme with Advantages and Disadvantages

Advantages of OPS:

1. Lifetime Income Assurance: OPS ensures a consistent income stream for retirees throughout their lives.

2. Structured Formula and Pension: Under the old scheme, employees were entitled to a predetermined pension amount equivalent to half of their most recent salary.

3. Dearness Allowance (DA) Benefits: Retirees also benefited from biannual revisions of Dearness Relief (DR), and there were no deductions from their fixed pension payouts.

4. General Provident Fund (GPF) Inclusion: OPS included access to the General Provident Fund (GPF).

Disadvantages of OPS:

1. Unfunded Liability: OPS lacked a dedicated corpus for pensions, which could have grown over time and been used for disbursements.

2. Dependence on Annual Budget Allocation: The Union budget allocated funds for pensions each year without a clear plan for sustained future payments.

3. Burden on the Working Class: The ‘pay-as-you-go’ system raised concerns about inter-generational equity, as the current generation had to bear the increasing burden of pension payouts.

4. Extended Payout Periods: Improved healthcare leading to increased life expectancy resulted in longer pension payouts, posing financial challenges.

What is the New Pension Scheme or NPS?

In 1998, the Union Ministry of Social Justice and Empowerment initiated the Old Age Social and Income Security (OASIS) project. Its primary focus was addressing the absence of old-age income security among unorganized sector workers. The New Pension System (NPS) was conceptualized based on the recommendations of the OASIS project report, serving as the foundation for significant pension reforms.

NPS is a government-sponsored pension scheme that initially commenced in January 2004, primarily for government employees. Subsequently, it was extended to encompass all Indian citizens on a voluntary basis starting from May 2009. Furthermore, in December 2011, it was made accessible to corporates and, in October 2015, to Non-Resident Indians (NRIs).

It’s important to note that NPS does not involve full contributions from the government. The Pension Fund Regulatory and Development Authority (PFRDA) is the authorized body established by a parliamentary enactment. Its role is to regulate, promote, and ensure the orderly expansion of the NPS and related pension schemes falling under its purview. The NPS framework allows subscribers to make regular contributions to a pension account throughout their working years.

| National Pension Scheme (NPS) 2023 Key Highlights | |

| National Pension Scheme Launch Date | January 1, 2004, |

| National Pension Scheme Official Website | Click Here |

| National Pension Scheme Objective | To help individuals make regular contributions for planned savings, ensuring a secure future through a pension. |

| National Pension Scheme Ministry | Ministry of Finance |

| National Pension Scheme (NPS) Interest Rate | 9% to 12% |

| National Pension Scheme Employee Contribution | 14% for Government Employees10% for Private and self-employed individuals |

| National Pension Scheme Tax Deduction Limit | Rs 1.5 Lakh Under 80CCE |

| National Pension Scheme Nature | Mandatory for Government EmployeesVolunstry for others |

| National Pension Scheme (NPS) TollFree Number for Registered Subscribers (with PRAN) | Offline/Online |

| National Pension Scheme Toll-Free Number for Registered Subscribers (with PRAN) | 1800 222 080 |

| National Pension Scheme Helpline Number | 1800 110 708 |

Upon reaching retirement age, NPS subscribers have the option to withdraw a portion of the accumulated corpus as a lump sum. The remaining corpus can be utilized to purchase an annuity, ensuring a steady and reliable stream of income during the post-retirement phase.

Advantages of NPS:

1. Flexibility: NPS offers a variety of investment options and allows subscribers to choose from different Pension Funds (PFs) for managing their investments effectively. Subscribers can switch between investment options and fund managers as needed.

2. Simplicity: Opening an NPS account provides a Permanent Retirement Account Number (PRAN), which remains unique to the subscriber for their entire life.

3. Portability: NPS offers seamless portability, allowing subscribers to carry their accumulated corpus when changing jobs or locations, avoiding the loss of savings common in other Indian pension schemes.

4. Regulation and Transparency: NPS is well-regulated by the PFRDA, ensuring transparent investment norms and continuous monitoring of fund managers by the NPS Trust. It boasts the lowest account maintenance costs compared to similar global pension products, which is crucial for long-term retirement savings.

5. Low Cost and Compounding Benefit: With low account maintenance charges, NPS leverages the power of compounding over time, leading to substantial pension wealth accumulation by retirement.

6. Online Accessibility: Managing an NPS account is convenient through online platforms like the eNPS portal, enabling easy account opening and online contributions through CRAs’ eNPS portals.

Disadvantages of NPS:

1. Mandatory Deductions: NPS requires employees to contribute 10% of their base salary, in addition to the dearness allowance, which is deducted from their salary.

2. Uncertain Pension Amount: Unlike OPS, NPS does not guarantee a fixed pension amount, and there is no General Provident Fund (GPF) benefit.

3. Market-Linked Returns: One significant drawback of NPS is its reliance on market returns. The pension payout is subject to market fluctuations and is, therefore, speculative in nature.

Old Pension Scheme Vs New Pension Scheme

| Points of Differentiation | Old Pension Scheme (OPS) | New Pension Scheme (NPS) |

| Nature of the Schemes | OPS provides government employees with pensions based on their last drawn salary. | NPS offers payment to employees for their investments made during their employment in the NPS Scheme. |

| Amount of Pension Derived | OPS provides 50% of the last drawn salary as a pension. | NPS provides a lump sum of 60% after retirement and invests the remaining 40% in annuities to generate a monthly pension. |

| Benefits in Taxes | OPS does not offer tax benefits. | NPS allows employees to claim tax deductions of up to 1.5 lakh under Section 80C of income tax and up to 50,000 on other investments under Section 80CCD (1b). |

| Tax on Pension | There is no tax on the pension received under OPS. | In NPS, 60% of the NPS Corpus is tax-free, while the remaining 40% is subject to taxation. |

| Option of Investment | OPS does not provide investment options. | NPS offers two choices: Active and Automatic for investment preferences. |

| Eligibility | OPS is available exclusively to government employees. | NPS is open to any Indian citizen aged between 18-65 years. |

| Switching Schemes | Government employees under OPS can switch to NPS. | Generally, NPS cannot be switched back to OPS. However, central government employees can revert to OPS in case of the employee’s death or disablement. |

Why State Governments are reverting to OPS?

States are reverting to the Old Pension Scheme (OPS) for several reasons, primarily for short-term advantages:

1. Deferred Contribution: Shifting to OPS allows states to save immediate costs by not having to contribute the mandated 10% to 14% matching funds towards employee pension schemes.

2. Lower Impact on Salaries: This change also results in higher take-home salaries for employees, as they no longer need to allocate 10% to 14% of their basic pay and dearness allowance towards pension funds.

3. Concerns About Old Age Security: Some government employees worry that the pension they receive may not match the 50% of their last drawn salary, which is guaranteed under OPS.

4. Political Considerations: These transitions may be viewed as politically expedient, especially by Opposition parties seeking to broaden their influence in the current political climate.

While states may enjoy short-term fiscal benefits, the resurgence of pension liabilities over time can limit their capacity for more constructive expenditure.

“Resurfacing Old Pension Scheme (OPS): Unveiling the Concerns and Controversies”

Concerns have been raised by notable figures regarding the decision of certain states to revert to the old pension scheme (OPS). Raghuram Rajan, former RBI Governor, has voiced apprehensions and recommended the exploration of less expensive alternatives to meet the demands of government pensioners.

In its most recent report titled ‘State Finances: A Study of Budgets of 2022-23,’ the central bank has pointed out that the return to OPS by some states poses a significant risk to the “subnational fiscal horizon.” This shift could lead to the accumulation of unfunded liabilities in the coming years.

For instance, Punjab’s projected pension outlay for 2022-23 stands at Rs 15,146 crore, nearly one-third of the state’s tax revenues (OTR) amounting to Rs 45,588 crore. The report emphasizes that by deferring current expenses to the future, states run the risk of accumulating unfunded pension obligations in the years ahead.

D. Subbarao, former RBI Governor, has also expressed concern, describing the revival of the Old Pension Scheme by certain states as a regressive move. He asserts that this decision could grant government servants more privileges at the expense of the larger public, particularly those without a social safety net.

Conclusion

In conclusion, the shift of NPS-enrolled employees to the OPS regime carries substantial and largely unsustainable fiscal risks, particularly in light of the current proportion of pensionary liabilities within government expenditures.

The achievements in policy-making, which have been the result of bipartisan consensus and considerable effort, could potentially be reversed by proposals driven by short-term political motives.

It is essential for political parties to prioritize long-term perspectives over immediate relief and resist the allure of making fiscally irresponsible decisions that could have adverse consequences.

Very well written. Thank you for providing us this such content.