On February 12, 2024, the Odisha State Cabinet approved a remarkable Yojana called SWAYAM Yojana (Swatantra Yuva Udyami Yojana), intending to involve the youth from both urban and rural areas of the state in its economic and commercial revitalization efforts. This initiative seeks to actively engage the youth in fostering a renewed economic landscape within Odisha. This scheme will be in operation for 2 years and the youth will get an interest-free loan without any collateral. This scheme is similar to the central government scheme i.e. Credit Guarantee Scheme for Micro Enterprises. Refer to the article below for more comprehensive information on the Odisha SWAYAM Yojana for RURAL Youth.

What is the Odisha SWAYAM Yojana 2024?

Odisha Swatantra Yuva Udyami Yojana or SWAYAM Scheme is a credit guarantee scheme, focusing on the state’s youth. This scheme has been specially launched for the unemployed youth of Odisha. Recognized as SWAYAM, which stands for Swatantra Yuva Udyami, this initiative marks a significant milestone for the youth in the state. The primary objective is to streamline the self-employment process, making it more accessible for the youth. In the first phase of this program, the state aims to involve 1,00,000 eligible young individuals especially women from urban and rural regions.

The revitalization of the state’s industrial and commercial sectors will actively involve both urban and rural youth through the newly approved ‘SWAYAM’ Yojana by the state cabinet. This initiative is poised to enhance the overall business climate in the state.

Under this Yojana, youth aged 18 to 35 can avail of interest-free loans of up to ₹1 lakh. For this scheme, the state has set aside a budget allocation of ₹448 crores. The age limit for individuals belonging to Scheduled Tribes and Scheduled Castes is extended to 40 years. The youth will contribute to the state’s development through this program by engaging in small-scale, micro-enterprises, or business ventures. Let’s talk about the scheme in detail.

The program will run for 2 years from the State Government’s notification date, with the possibility of further extensions determined by the Government.

| Odisha SWAYAM Yojana 2024 Key Highlights | |

| Odisha SWAYAM Yojana Launch Date | February 12, 2024 |

| Odisha SWAYAM Yojana Official Website | Odisha SWAYAM Yojana Portal |

| Odisha SWAYAM Yojana Objective | To provide financial assistance to the Youth of Odisha to enhance the business environment within the state |

| Odisha SWAYAM Yojana Beneficiary | Youth of Odisha (Rural and Urban ) |

| Odisha SWAYAM Yojana Financial Assistance Amount | Rs. 1 lakh |

| Odisha SWAYAM Yojana Interest Rate | 0% (Interest Free |

| Odisha SWAYAM Yojana Age Limit | 18-35 years Upper Age Limit – 40 (for SC/ST) |

| Odisha SWAYAM Yojana Budget | 448 Crores |

| Odisha SWAYAM Yojana Duration | 2 Years |

| Odisha SWAYAM Yojana Repayment Duration | 4 Years |

| Odisha SWAYAM Yojana Mode of Application | Online |

| Odisha SWAYAM Yojana Helpline Number | 1800-34567-70 / 155335 (Toll Free) |

Odisha SWAYAM Yojana Objectives

- The prime objective of the Odisha Swatantra Yuva Udyami Yojana is to provide interest-free loans for the establishment of micro-businesses and ventures aligned with the individuals’ aptitude, skills, training, and local conditions, aiming to generate suitable revenue.

- In the initial phase of this initiative, the state administration aims to involve 1,00,000 eligible youth from both urban and rural areas. The state government is going to provide loans to women in the initial phase of the scheme.

- Under this scheme, the state with the help of the youth will generate income from small-scale, micro-enterprises, or business ventures.

- Through this scheme, the state will not only curb unemployment but also generate employment for other people.

- The program aims to provide financial support to individuals aged 18-35, enabling them to establish profitable self-employment ventures or micro-enterprises tailored to their skills, training, aptitude, and local conditions.

- The initiative facilitates easy access to credit through banks, accompanied by interest subsidies.

- It encourages the underemployed or unemployed individuals in poverty to establish small enterprises in manufacturing, servicing, and petty business sectors, responding to significant local demand.

Odisha SWAYAM Yojana Benefits

- The Odisha Swatantra Yuva Udyami Yojana benefits unemployed or underemployed individuals aged 18 to 35. The upper age limit is 40 years for SC/ST.

- Eligible applicants can avail interest-free bank loans of up to Rs. 1 lakh to initiate their business ventures.

- To support micro and small enterprises, the state government provides an 85% loan guarantee, with an additional 15% guarantee through the Credit Guarantee Fund Trust for Micro and Small Enterprises (CGTMSE).

- The entire interest burden on the loan is covered by the state government.

- The state government also bears the annual CGTMSE guarantee cost.

- The state government has allocated Rs. 448 crore from its budget for the implementation of this Yojana.

- No collateral is necessary, and borrowers are exempt from processing fees.

- The applicant has the flexibility to repay the principal loan amount over four years.

Mukhyamantri Bayan Jyoti Yojana 2024 | Gift of Rs 17,500 to Weavers of Odisha

Odisha SWAYAM Yojana Eligibility Criteria

To be eligible for the Odisha SWAYAM Yojana, applicants must adhere to the following criteria:

- Individuals aged 18-35 are eligible; for SC/ST/PwD applicants, the upper age limit is 40.

- Applicant’s family must be covered under the KALIA/BSKY Scheme or have an income of less than Rs. 2 lakh per annum for urban youth this limit is Rs 3 Lakh Per annum

- The applicant must possess a UDYAM registered/UDYAM assisted number.

Exclusion Criteria:

- Defaulters in any bank/financial institution or with outstanding loans for the same purpose from any Central/State Government Schemes are excluded.

- Regular employees of Central/State Government/PSUs/Statutory bodies and their families are not eligible.

- Families with one member already covered under this scheme will be excluded from availing benefits.

Odisha Nua-O Scholarship Scheme 2024 | Rs 10,000 Assitance for the Youth of Odisha

Odisha SWAYAM Yojana Documents Required

The expected necessary documents for the SWAYAM application include the following. Please note that this is an expected documentation that will be required. The organization can ask you for more details regarding your personal and business.

- Aadhar card

- PAN card

- Passport-sized photograph

- Mobile number

- Bank account details

- Domicile certificate

- Business details.

Odisha SWAYAM Yojana Financial Assistance 2024

The total project cost amounts to Rs. 1 Lakh, requiring the borrower to contribute 5% margin money. Consequently, the loan amount of Rs. 95,000/- will be subject to interest subvention, making it interest-free. Public Sector Banks, private scheduled commercial banks, Regional Rural Banks, and Co-operative banks covered under the Credit Guarantee Fund Trust for Micro and Small Enterprises (CGTMSE) are eligible participants in this scheme.

The loan will be disbursed in a maximum of 2 installments. The bank will charge the normal interest rate applicable to similar Central/State Government Schemes. The repayment period is 4 years, including a moratorium period ranging from 3 to 6 months as determined by the respective bank/financial institution.

The scheme incorporates a provision for credit guarantee coverage of up to 100% of the loan amount in collaboration with CGTMSE. The State Government guarantees up to 15% of the loan amount, in addition to the 85% covered under CGTMSE. CGTMSE will impose an annual guarantee fee as per norms on its share of guarantee coverage. The State Government will bear this cost on behalf of the borrowers.

The State Government covers the interest accrued from the principal, resulting in zero-interest for the borrower. The State Government releases interest subvention quarterly to the borrower’s account, pre-allocated with a nodal bank. Specific details on disbursing the interest subsidy among participating banks will be communicated separately by the PR&DW Department.

| Odisha SWAYAM Yojana Financial Assistance 2024 | |

| Odisha SWAYAM Yojana Loan Amount | Rs 95,000 (95%) |

| Odisha SWAYAM Yojana Margin Money | Rs 5000 (5%) |

| Odisha SWAYAM Yojana Loan Installments | 2 |

| Odisha SWAYAM Yojana Repayement Period | 4 Years |

| Odisha SWAYAM Yojana Interest Rate | 0% for the borrower |

Entrepreneurship Development Programme (EDP)

The BDO, in collaboration with banks and relevant departments, will conduct Entrepreneurship Development Programmes (EDP). These programs aim to orient and inform entrepreneurs and beneficiaries whose loans have been sanctioned, providing insights into various managerial and operational functions such as finance, production, marketing, enterprise management, banking formalities, bookkeeping, statutory compliances, etc., to enhance their business effectiveness. The EDP training will be offered in either online or offline mode.

Grievance Redressal

Applicants can register their grievances through the Jana Sunani Portal, a dedicated call center, or directly with the relevant Panchayat/Block/District/State authorities. The concerned authorities will promptly address and resolve the grievances raised by the applicants.

Odisha SWAYAM Yojana Application Process

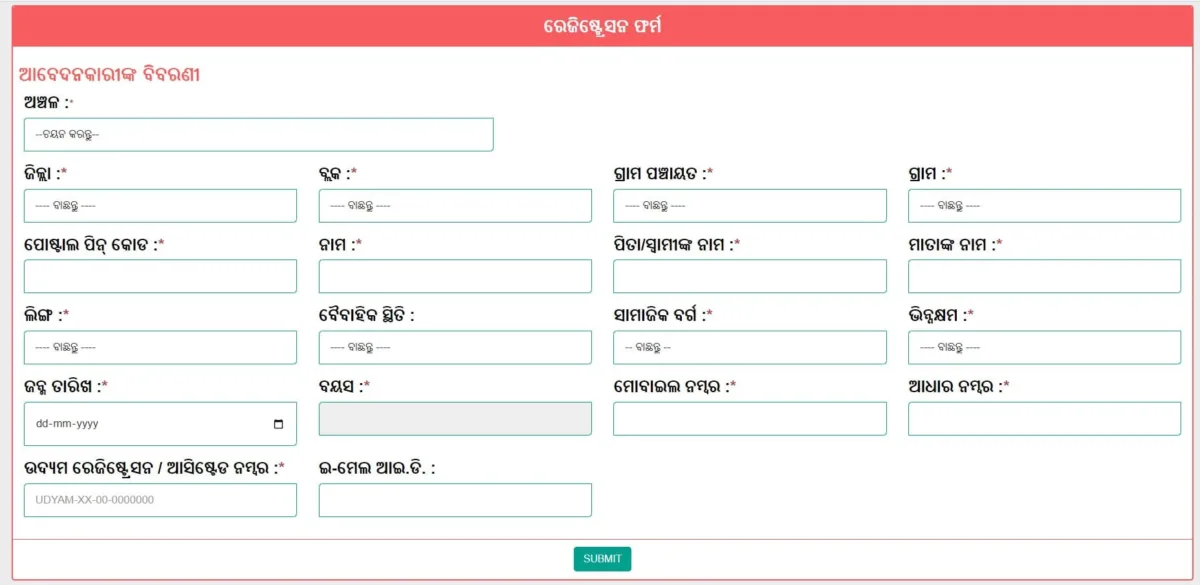

The official website for the Odisha Swatantra Yuva Udyami Yojana has been officially announced by the government or Department of Panchayati Raj and Drinking Water Department. However, you can also apply for the scheme through the Mo Sewa Kendra Official website or the OdishaOne Portal. Eligible applicants are advised to complete the application process. The general steps for applying to the Yojana are outlined below.

- Visit the official website of the Swatantra Yuva Udyami Yojana Portal.

- The homepage will appear on the screen.

- Click on the “Registration” option from the homepage of the SWAYAM Portal.

- A new page containing the application form will be presented. Fill in all the required information and submit.

- Fill in details such as name, father’s name, age, date of birth, address, etc., in the application form.

- Upload the required documents.

- Review the provided information carefully.

- Click on the “Submit” option to complete the registration process.

- Following successful registration, applicants can proceed to get the loan from the bank.

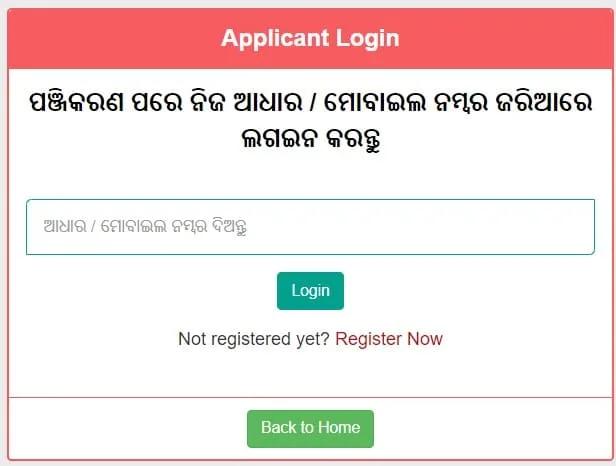

- “After registration, log in using your Aadhaar/mobile number.”

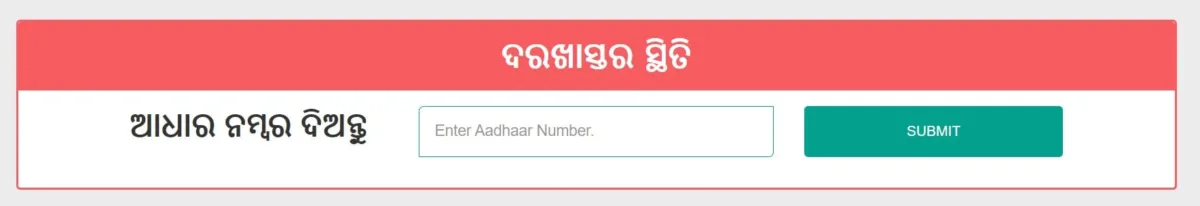

Odisha SWAYAM Yojana Check Application Status

After registering for the Odisha SWAYAM Yojana, the applicant needs to check whether his application is sanctioned by the authorities or not. To know this, one has to follow the required steps.

- Visit the official website of the Swatantra Yuva Udyami Yojana Portal.

- The homepage will appear on the screen.

- Scroll down and you will see the “Application Status” box.

- Here you have to enter your Application number given to you at the time of registering in the portal.

- You can now check your application status.

Odisha SWAYAM Yojana FAQs

What is Odisha SWAYAM Yojana

Odisha Swatantra Yuva Udyami Yojana or SWAYAM Scheme is a credit guarantee scheme, focusing on the state’s youth. This scheme has been specially launched for the unemployed youth of Odisha. The primary objective is to streamline the self-employment process, making it more accessible for the youth.

How much amount will be processed under the SWAYAM Scheme?

Under this Yojana, youth of the state can avail of interest-free loans of up to ₹1 lakh.

Is there any age limit required to apply for the SWAYAM Scheme?

The Odisha Swatantra Yuva Udyami Yojana benefits unemployed or underemployed individuals aged 18 to 35. The upper age limit is 40 years for SC/ST.

How to apply for the SWAYAM Scheme?

You can apply for the SWAYAM Scheme through the official website of SWAYAM Website or you can apply on the Odisha One Portal as well.

Farming plan