Karnataka Udyogini Scheme 2023: For centuries, women have faced social and economic exclusion, making them one of society’s most marginalized groups. They often have limited financial independence, rely on male family members for financial support, and are primarily confined to domestic roles, resulting in minimal economic autonomy. There are women who want to start something of their own and thus need financial assistance. Therefore, to protect them from going to private companies that provide loans at higher interest rates, the Government of Karnataka has launched the “Udyogini Scheme”. In this article, we will talk about the scheme in detail. If you want a comprehensive knowledge of the scheme, I advise you to read the article till the end.

Women entrepreneurs play a vital role in a country’s economy due to their low startup costs, job creation potential, and reach in both rural and urban areas, promoting balanced growth. A country’s economic progress relies on its economic, natural, and human resources. Utilizing all these resources is crucial for development. Both men and women should pursue careers, either as employees or entrepreneurs, to contribute to their country’s advancement.

However, women, especially those from disadvantaged backgrounds, often face challenges accessing financial support for their businesses. These challenges can stem from economic and social disadvantages. Despite their potential, few women choose entrepreneurship as a career due to various personal, economic, legal, and social constraints. Education doesn’t always determine their entrepreneurial success. Instead, experiences and circumstances play a significant role.

Research suggests that women are motivated to start businesses primarily by the desire for financial independence. Acknowledging that the Government of Karnataka launched the Udyogini Scheme in 1999. Let’s understand the scheme in detail.

What is the Karnataka Udyogini Scheme?

Udyogini Scheme, initiated in 1997-1998 and later revised in 2004-2005, is a Karnataka Government scheme designed to empower women by promoting self-employment, particularly in trade and services. It offers subsidized loans up to 50% through the Karnataka State Women’s Development Corporations, accessible via various financial institutions. This scheme was created to replace the practice of women borrowing from private lenders at high-interest rates. It supports various profitable business activities like bookbinding, chalk and crayon making, food processing, textile work, and more, providing women with self-employment opportunities.

For women from Scheduled Castes and Scheduled Tribes, the loan amount can range from a minimum of ₹1,00,000 to a maximum of ₹3,00,000, with a subsidy covering 50% of the loan. To be eligible, the family’s annual income should not exceed ₹2,00,000.

For women in the special category and general category, the maximum loan amount is ₹3,00,000. Special category women and general category women can receive a subsidy of 30%, capped at ₹90,000. Additionally, selected beneficiaries will receive Entrepreneurship Development Program (EDP) training.

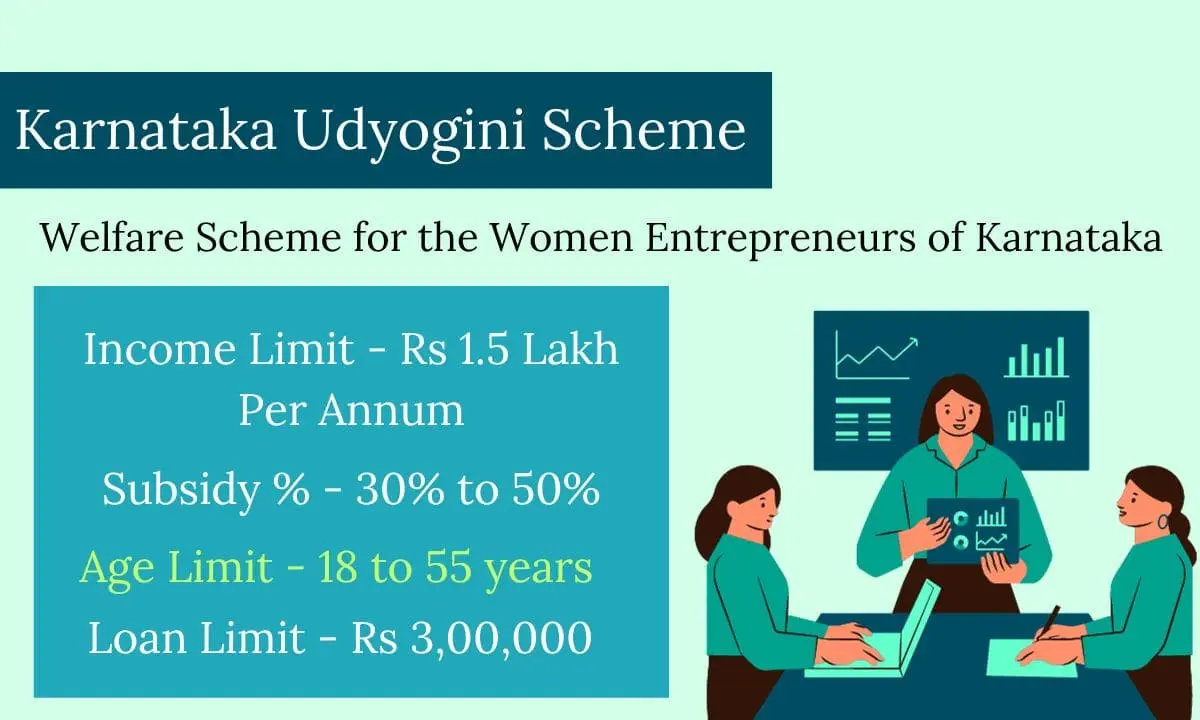

| Karnataka Udyogini Scheme 2023 Key Highlights | |

| Karnataka Udyogini Scheme Launch Date | 1998-99, relaunched in 2004-05 |

| Karnataka Udyogini Scheme Official Website | Click Here |

| Karnataka Udyogini Scheme Objective | To provide financial assistance to women entrepreneurs in Karnataka |

| Karnataka Udyogini Scheme Beneficiaries | Women of Karnataka especially women from backward castes, handicapped women, and destitute women |

| Karnataka Udyogini Scheme Loan Amount | Rs 3,00,000 ( Maximum)Rs 1,00,000 ( Minimum ) |

| Karnataka Udyogini Scheme Subsidy | 30 to 50% |

| Karnataka Udyogini Scheme Age Limit | 18 to 55 years |

| Karnataka Udyogini Scheme Income Limit | ₹ 1,50,000/- for women belonging to general and special categories. No limit on family income for widowed or disabled women. |

| Karnataka Udyogini Scheme Mode of Application | Online/Offline |

| Karnataka Udyogini Scheme Helpline Number | Not yet launched |

Karnataka Udyogini Scheme Objective

The Udyogini scheme’s objective is to empower women economically and socially by offering loan subsidies. These loans come with a reasonable interest rate to protect women from exploitation by local moneylenders. The interest rate typically aligns with what each bank charges its regular customers, usually at the current Bank Rate plus 1%. Additionally, the scheme seeks to promote financial independence among widows and disabled women by providing them with financial assistance without obstacles. In summary, the objective of the scheme is to

- Foster women’s self-sufficiency through entrepreneurship and microenterprises.

- Mitigate high-interest borrowing from moneylenders.

- Offer financial support.

- Provide skill development opportunities.

Karnataka Udyogini Scheme Features

The Udyogini scheme encompasses several important aspects:

- Encouraging women to secure loans from banks and financial institutions to initiate income-generating activities.

- Providing eligible women beneficiaries with interest-free loans, ensuring fairness and impartiality in the process.

- Making financial assistance more accessible and affordable for women belonging to categories such as SC/ST and other special groups.

- Reducing the risk of women resorting to high-interest loans from private lenders or other financial entities.

- Offering Entrepreneurship Development Program (EDP) Training to enhance the skills of women beneficiaries.

Karnataka Udyogini Scheme Loan Amount

Before you make the decision to apply for a loan under the Udyogini scheme, it is essential to check the loan amount that is available based on the category. All the information regarding the loan amount is provided in the tabular form below.

| Category | Loan Amount Range | Subsidy Percentage | Maximum Subsidy Amount | Family Income Limit |

| Scheduled Castes and Tribes | ₹1,00,000 – ₹3,00,000 | 50% | 50% of loan amount | Up to ₹2,00,000 |

| Special Category | Up to ₹3,00,000 | 30% | ₹90,000 | ₹2,00,000 (no limit for widowed or disabled women) |

| General Category | Up to ₹3,00,000 | 30% | ₹90,000 | ₹2,00,000 (no limit for widowed or disabled women) |

Karnataka Udyogini Scheme Eligibility Criteria

In order to apply for the Karnataka Udyogini Scheme, it is essential to check the complete Udyogini Scheme eligibility criteria. Here is the complete list of eligibility criteria for the Karnataka Udyogini Scheme.

- The applicant must be a female.

- For women in the general and special categories, the family income should be below ₹1,50,000, while there’s no income limit for widowed or disabled women.

- The applicant’s age should fall between 18 and 55 years, irrespective of category.

- The applicant should be a permanent resident of Karnataka.

- The applicant should have a clean financial record, with no past loan defaults.

Reservation/Preference/Priority:

- Priority will be given to those in extreme poverty, widows, destitute individuals, and the physically challenged.

- Candidates who have previously completed skill development or vocational training through KSWDC or other relevant departments may also receive preference.

- Approximately 10% of the target allocation is earmarked for individuals associated with World Bank-assisted Swashakthi or Stree Shakthi groups.

Karnataka Udyogini Scheme Documents Required

While applying for the Karnataka Udyogini Scheme, the banks will require you to attach some documents that will secure your loan under this scheme. Here are the complete documents that will be required to apply for the scheme.

- Three passport-sized photographs of the applicant.

- Certification demonstrating training or experience related to the requested loan activity.

- A comprehensive Project Report outlining the details of the proposed activity seeking financial assistance.

- Either a Ration Card or Voter ID Card.

- The Family’s Annual Income Certificate.

- Caste Certificate (for SC/ST applicants).

- Quotations for machinery, equipment, and other capital expenses.

Karnataka Udyogini Scheme Application Process (Offline)

Given below is the step-by-step process of the Udyogini Scheme that you can follow while applying for the same through the offline process. You will find the answers to the Udyogini Scheme and How to apply Offline.

- Visit the nearest bank with the necessary documents and complete an application form. You can find these forms at the Deputy Director/CDPO offices or on the official bank websites.

- Submit the filled application form and required documents to the nearest bank/KSFC branch.

- Bank/KSFC officials will review your documents and project proposal and process the loan application.

- The bank sends a request to the Corporation for subsidy release and once approved, the bank disburses the loan amount.

- After approval, the loan is deposited into your bank account or directly to the machinery or equipment supplier’s account.

Karnataka Udyogini Scheme Application Process (Online)

Before applying for the Karnataka Udyogini Scheme online, consider taking a look at the step-by-step process of the Karnataka Udyogini Scheme online. It is the most simple and straightforward approach to apply for the scheme.

- Visit the official website of the participating banks and apply for the loan online.

- CDPO reviews applications and sends them to the Selection Committee after on-site verification.

- The Selection Committee assesses the applications and forwards them to the banks for loan disbursement.

- Bank/KSFC officials verify documents and the project proposal for loan processing.

- Banks request subsidy release from the Corporation upon approval, and the loan is then disbursed.

- Once approved, the loan amount is either deposited into the applicant’s bank account or directly to the machinery or equipment supplier’s account.

Karnataka Udyogini Scheme List of Businesses Allowed

The Karnataka Udyogini Scheme provides a comprehensive list of approved businesses. If you meet the eligibility criteria, applying for a loan for any of these businesses increases your chances of approval. Given below is the complete list.

| Agarbatti Manufacturing | Diagnostic Lab | Leaf Cups Manufacturing | Ribbon Making |

| Bangles | Edible Oil Shop | Milk Booth | Shops & Establishments |

| Audio & Video Cassette Parlour | Dry Cleaning | Library | Sari & Embroidery Works |

| Bakeries | Dry Fish Trade | Mat Weaving | Security Service |

| Banana Tender Leaf | Eat-Outs | Match Box Manufacturing | Shikakai Powder Manufacturing |

| Bottle Cap Manufacturing | Fish Stalls | Old Paper Marts | Soap Oil, Soap Powder & Detergent Cake Manufacturing |

| Beauty Parlour | Energy Food | Mutton Stalls | Silk Thread Manufacturing |

| Bedsheet & Towel Manufacturing | Fair-Price Shop | Newspaper, Weekly & Monthly Magazine Vending | Silk Weaving |

| Book Binding And Note Books Manufacturing | Fax Paper Manufacturing | Nylon Button Manufacturing | Silk Worm Rearing |

| Cleaning Powder | Gift Articles | Photo Studio | Tea Stall |

| Cane & Bamboo Articles Manufacturing | Flour Mills | Pan & Cigarette Shop | Stationery Shop |

| Canteen & Catering | Flower Shops | Pan Leaf or Chewing Leaf Shop | STD Booths |

| Chalk Crayon Manufacturing | Footwear Manufacturing | Papad Making | Sweets Shop |

| Chappal Manufacturing | Fuel Wood | Phenyl & Naphthalene Ball Manufacturing | Tailoring |

| Cotton Thread Manufacturing | Ink Manufacture | Radio & TV Servicing Stations | Vegetable & Fruit Vending |

| Clinic | Gym Centre | Plastic Articles Trade | Tender Coconut |

| Coffee & Tea Powder | Handicrafts Manufacturing | Pottery | Travel Agency |

| Condiments | Household Articles Retail | Printing & Dyeing of Clothes | Tutorials |

| Corrugated Box Manufacturing | Ice Cream Parlour | Quilt & Bed Manufacturing | Typing Institute |

| Dairy & Poultry Related Trade | Jute Carpet Manufacturing | Real Estate Agency | Woolen Garments Manufacturing |

| Crèche | Jam, Jelly & Pickles Manufacturing | Ragi Powder Shop | Vermicelli Manufacturing |

| Cut Piece Cloth Trade | Job Typing & Photocopying Service | Readymade Garments Trade | Wet Grinding |

Karnataka Udyogini Scheme FAQs

What is the Karnataka Udyogini Scheme?

Udyogini Scheme is a Karnataka Government welfare scheme designed to empower women by promoting self-employment, particularly in trade and services. It offers subsidized loans up to 50% through the Karnataka State Women’s Development Corporations, accessible via various financial institutions.

What is the maximum loan limit for the general category under the Udyogini Scheme?

Under the Udyogini Scheme, the maximum loan limit is Rs 3,00,000 for the general category.

I am currently 35 years old. Am I eligible for the scheme?

Yes, you are eligible. Under the scheme, the age limit is 18 to 55 years.

What is the subsidy percentage for the general category under the Karnataka Udyogini Scheme?

For the general category, a total of 30% with a maximum cap of Rs 90,000 is available under the Udyogini Scheme.