The Department of Posts presents a range of secure and lucrative small savings schemes for Indian citizens. These schemes, including the National Savings Certificate, Sukanya Samriddhi Yojana, PPF, RD, TD, and Mahila Samman Certificate, offer not only safe investments but also competitive interest rates. In this discussion, our focus will be on the National Savings Certificate, an exceptional small savings scheme ideal for modest investments. Let’s delve into the details of this scheme.

What is a National Savings Certificate 2024?

The National Savings Certificate (NSC) is a Small Savings Scheme designed to offer an attractive interest rate on invested funds, backed by the government. With a fixed maturity period of 5 years, individuals can initiate an account with a minimum investment of Rs 1000, without any specified maximum limit. Furthermore, there is no restriction on the number of accounts one can open, making it accessible to a broad range of investors.

Geared towards benefiting low to mid-income individuals, the NSC provides a substantial interest rate. Investing in this government-backed scheme also offers tax advantages, allowing for a tax benefit of up to Rs 1.5 lakh under Section 80C of the Income Tax Act.

This comprehensive article aims to provide detailed information about the NSC Scheme, including its features and advantages. Additionally, it will shed light on the scheme’s drawbacks and outline circumstances where potential investors might reconsider applying for it. Before delving into these aspects, let’s first explore the key highlights of the NSC scheme.

| National Savings Certificate (NSC) Scheme Key Highlights | |

| National Savings Certificate Launch Date | 8th May 1989 |

| National Savings Certificate Official Website | NSC Official Website |

| National Savings Certificate Objective | To provide a good investment option to low and mid-income citizens who want to have a higher interest rate even with low investment |

| National Savings Certificate Beneficiary | All the Indian Citizens |

| National Savings Certificate Helpline Number | 18002666868 |

| National Savings Certificate Interest Rate | 7.7% (2024) |

| National Savings Certificate Minimum Investment | Rs 1000 |

| National Savings Certificate Maximum Investment | No maximum Limit |

| National Savings Certificate Maturity Period | 5 Years |

| National Savings Certificate Tax Benefit | Yes, Up to 1.5 Lakh Under 80C |

| Who can invest | 1. A single adult 2. Joint Account (up to 3 adults) 3. A guardian on behalf of minor or on behalf of a person of unsound mind 4. A minor above 10 years in his own name. |

Who can not apply for the NSC Scheme?

Here are the restrictions in applying for the NSC Scheme

- Non-resident Indians (NRIs)

- Hindu Undivided Families (HUFs)

- Trusts

- Private and Public Limited Companies (PLCs)

NRIs are not eligible to invest in NSCs because they are not considered to be resident Indians. HUFs are not eligible to invest in NSCs because they are considered to be separate entities from their members. Trusts and PLCs are not eligible to invest in NSCs because they are not considered to be individuals.

National Savings Certificate Benefits

The National Savings Certificate (NSC) has various benefits. Those are as follows.

- Guaranteed interest: NSCs offer a guaranteed interest rate, which the government fixes. It is revised quarterly. This means that you can be sure of earning a good amount of interest on your investment, as per the government guidelines.

- Tax benefits: You can save up to Rs. 1.5 lakh in taxes every year by investing in NSCs as through this scheme you can claim tax deductions under Section 80C of the Income Tax Act for your investment.

- Liquidity: Although NSC has a lock-in 5 years but you can encash your NSCs before 5 years from the date of issue if you have a valid reason.

- Safety: NSCs are backed by the government, which means that your investment is safe. Even if the government defaults on its payments, you can still get your money back.

- No penalty for premature encashment: There is no penalty for premature encashment of NSCs. However, you will lose out on some of the interest if you encash your NSCs before the maturity date.

- Can be used as collateral for loans: NSCs can be used as collateral for loans. This means that you can use your NSCs to secure a loan from a bank or financial institution.

National Savings Certificate Eligibility Criteria

- The NSC scheme is open to any Indian citizen.

- To open an NSC account, the individual must be at least 18 years old.

- Joint accounts are permissible, allowing up to three adults to be joint account holders.

- Minors above the age of 10 can independently open an NSC account in their name.

- For minors below the age of 10, a guardian is required to open an NSC account on their behalf.

National Savings Certificate Documents Required

To initiate an application for the NSC scheme at a post office, certain documents must be submitted. The required documents include:

- Proof of Identity: Acceptable forms include a passport, PAN card, driving license, voter ID, or any other government-issued identification.

- Proof of Address: This can be demonstrated through a utility bill, bank statement, or any document indicating your current address.

- Photograph: A recent passport-size photograph is required.

- Completed NSC Application Form: Obtainable from any post office, this form is necessary for the application process.

- Cash or Cheque: The desired investment amount in NSC must be provided in either cash or cheque.

- Guardianship Certificate (In Case of a Minor): If the NSC account is being opened on behalf of a minor, a guardianship certificate must be presented.

- Nominee Details: Information about the nominee(s) is required, specifying individuals entitled to the NSC proceeds in the event of the account holder’s demise.

It is important to note that the account should be opened at a convenient post office, as subsequent visits may be necessary for depositing funds, encashing certificates, and making account modifications.

National Savings Certificate How to Apply 2024 (Offline)

Follow these steps to apply for the NSCs scheme in the post office.

- Visit the nearest post office and obtain the NSC Application Form.

- You can download the NSC Application Form PDF from the official website of DOP.

- Fill out the NSC application form with utmost carefulness. You can get this form from any post office.

- Submit self-attested copies of the required KYC documents. These documents include proof of identity, proof of address, and a photograph.

- Make the payment of your investment in the form of cash, cheque, or demand draft.

- The post office will issue you an NSC certificate.

National Savings Certificate How to Apply 2024 (Online)

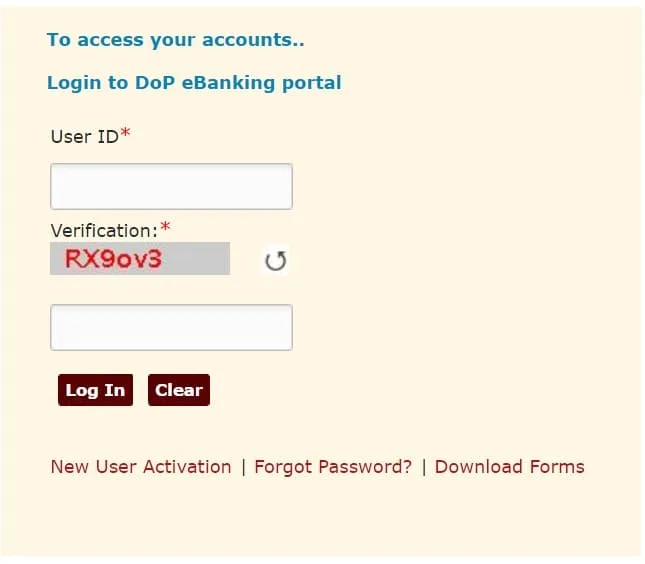

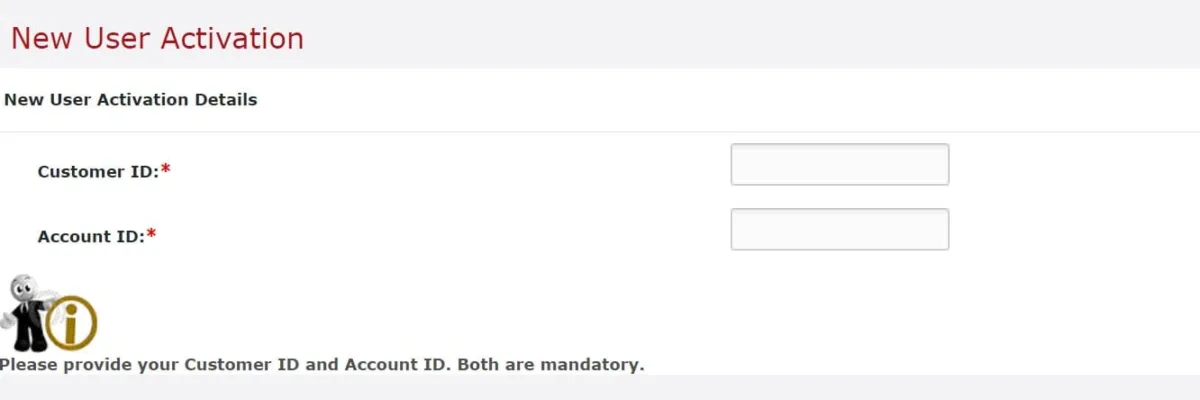

- Open the Department of Posts (DOP) net banking and log in.

- Under ‘General Services,’ choose ‘Service Requests.’

- Click on ‘New Requests’ and select ‘NSC Account – Open an NSC Account (For NSC).’

- Enter the deposit amount and choose the debit account linked to the PO savings account.

- Review the terms and conditions by clicking ‘Click Here’ and accept them.

- Enter the transaction password and click on ‘Submit.’

- View and download the deposit receipt.

- Log in and go to ‘Accounts’ to review the details of your NSC account.

Note: Ensure the chosen post office for account opening is convenient, as subsequent interactions may be necessary for account management.

NSC Scheme Interest Rate History

Since its inception, NSC interest rates have changed many times. Last quarter the interest rate was 7.7%. For the July- Sept 2023 quarter, the interest rate will be announced soon.

| Period | Interest Rate (% per annum) |

| January 2024 to March 2024 | 7.70% |

| October 2023 to December 2023 | 7.70% |

| July 2023 to September 2023 | 7.70% |

| April 2023 to June 2023 | 7.70% |

| January 2023 to March 2023 | 7.00% |

| October 2022 to December 2022 | 6.80% |

| July 2022 to September 2022 | 6.80% |

| April 2022 to June 2022 | 6.80% |

| January 2022 to March 2022 | 6.80% |

| October 2021 to December 2021 | 6.80% |

| July 2021 to September 2021 | 6.80% |

| April 2021 to June 2021 | 6.80% |

| January 2021 to March 2021 | 6.80% |

Premature Closure of the NSC account

The lock-in period of NSC is 05 years however, you can prematurely close the account before 5 years due to the following conditions

- On the death of a single account, or any or all the account holders in a joint account

- On forfeiture by a pledgee being a Gazetted officer.

- On order by court.

Pledging of the NSC account

You can pledge or transfer an NSC as security, by submitting a prescribed application form at the concerned Post Office supported by an acceptance letter from the pledgee.

Transfer/pledging can be made to the following authorities.

- The President of India/Governor of the State.

- RBI/Scheduled Bank/Co-operative Society/Co-operative Bank.

- Corporation (public/private)/Govt. Company/Local Authority.

- Housing finance company.

Transfer of the NSC account from one person to another

One can transfer the NSC from one person to another on the following conditions.

- On the death of an account holder to nominee/legal heirs.

- On the death of the account holder to joint holder(s).

- On order by the court.

- On pledging of account to the specified authority.

Conclusion

Overall, the NSC scheme is a good investment option for small and medium-income investors who want to save tax while earning returns. However, it is important to consider the risks and drawbacks before investing.