The UYEGP Scheme is an initiative aimed at providing subsidies of up to 25% of project costs exclusively to citizens of Tamil Nadu through the MSME department. It is designed to address unemployment among economically and socially disadvantaged individuals in the region. Specifically targeting educated but jobless individuals, the scheme encourages self-employment opportunities in local communities, thereby curbing rural-to-urban migration driven by unemployment.

Beneficiaries receive financial support to establish manufacturing, service, and business ventures. In this post, we will explore the rationale behind the introduction of the Unemployed Youth Employment Generation Programme, along with its key features, benefits, and the application process. In this article, we will talk about the uyegp scheme details, uyegp scheme apply online, uyegp scheme subsidy, uyegp application form, uyegp scheme pdf and uyegp scheme guidelines in detail.

What is the UYEGP Scheme?

The Government of Tamil Nadu, under the Department of Micro, Small, and Medium Enterprises, has initiated the Unemployed Youth Employment Generation Programme (UYEGP). Alongside various other challenges in starting a business, entrepreneurs often face difficulties in securing immediate funding for launching their ventures. In certain cases, banks may not extend assistance to first-time entrepreneurs for various reasons. To address this issue, the Tamil Nadu government has introduced a credit program specifically tailored for small enterprises.

The UYEGP Scheme aims to encourage unemployed youth to establish their businesses and promote entrepreneurship among them. While the state government is committed to assisting, certain criteria such as age, educational qualifications, and family income must be met by applicants to qualify for the scheme. Under this program, loans will cover up to 90-95% of the project’s cost, with eligible beneficiaries being eligible for a 25% subsidy.

A notable aspect of the scheme is that applicants are not required to provide any assets or guarantees. Financial support will be facilitated through commercial banks. Promoters are expected to contribute no more than 10% of the total scheme amount, while other stakeholders involved in the scheme will also assist new entrepreneurs in starting their businesses.

| UYEGP Scheme 2024 Key Highlights | |

| UYEGP Scheme Launch Date | 2024 |

| UYEGP Scheme Official Website | UYEGP Scheme |

| UYEGP Scheme Objective | To mitigate the unemployment problems of socially and economically weaker sections of society |

| UYEGP Scheme Beneficariy | educated but jobless individuals |

| UYEGP Scheme Subsidy | 25% of project cost |

| UYEGP Scheme Minimum education | 8th Pass |

| UYEGP Income Limit | 5 Lakh Per annum |

| UYEGP Scheme Subsidy Amount | Maximum Rs.3.75 lakh |

| UYEGP Scheme Age Limit | 18-45 (55 in case of special categories) |

| UYEGP Scheme Mode of Application | Online |

| UYEGP Scheme Department | Micro, Small and Medium Enterprises Department |

| UYEGP Scheme Helpline Number | Click Here |

UYEGP Scheme 2024 Objective

The main aim of the UYEGP scheme is to decrease unemployment within socially and economically marginalized communities, specifically targeting educated individuals who are currently jobless. The scheme facilitates their self-employment endeavors by providing loans and subsidies from the state government to establish service, manufacturing, and business ventures. By extending assistance to disadvantaged groups across the state, the government endeavors to improve the quality of life for citizens belonging to minority communities.

UYEGP Scheme 2024 Benefits and Features

- To address unemployment challenges among economically and socially disadvantaged groups, the UYEGP scheme requires a sponsorship contribution of 10% for general schemes and 5% for special category schemes.

- Individual-based capital subsidy at a rate of 25% of the project cost is provided for construction, commerce, and service projects, with maximum project costs set at Rs. 15,00,000, Rs. 50,000, and Rs. 500,000 respectively.

- Under the UYEGP plan, the interest rate follows RBI guidelines, facilitating district-level beneficiary selection to encourage greater participation from each district.

- Recipients of the scheme are mandated to undergo a seven-day Entrepreneur Development Programme (EDP) course.

- Financial support is accessible through various institutions, including nationalized banks, private banks, and the Tamil Nadu Industrial Cooperative Bank.

- Marketing assistance, including buyer-seller meetings, is organized by the District Industries Center (DIC) at regular intervals.

- The program emphasizes district-level beneficiary selection to ensure equitable distribution of benefits.

- Loans up to Rs. 15 lakhs are available through CGTMSE without the need for collateral or security.

- The General Manager of the relevant District Industries Center arranges frequent buyer-seller meetings to provide marketing support.

UYEGP Scheme 2024 Eligibility Criteria

- Applicants are required to possess at least an eighth-grade education.

- Anyone above the age of 18 is eligible to apply for the UYEGP scheme. However, special category applicants must be below the age of 55, while general category applicants must be below 45.

- The combined annual income of the applicant and their spouse should not exceed Rs. 5,00,000.

- Applicants must have been residents of Tamil Nadu for the past three years.

- Successful completion of training is a prerequisite for obtaining a UYEGP loan.

- Applicants should not have previously received any loans or subsidies from the State/Central Government.

- Project Loan For Business up to Rs. 15.00 lakh

UYEGP Scheme 2024 Documents Required

The documents required for the UYEGP scheme are as follows:

- Identity proof (e.g., copy of Election ID Card/Aadhaar card)

- Copy of PAN Card

- Passport size photo

- Income Certificate

- Educational Qualification proof (Two Copies):

- Transfer certificate/Record Sheet issued by School/College

- Proof of age

- Caste/Community Certificate

- Ration Card (For applicants without a Ration Card):

- Nativity certificate from the Thasildhar/Aadhar card copy/Election voters identity card copy

- Project Report

- Valid Quotations with GST number

- Valid certificate for Ex-Serviceman/Differently abled/Transgender

- Bank account details

- Affidavit:

- Typed in a ₹20/- Non-Judicial Stamp Paper

- Certified and Signed by the Notary Public

- Submitted along with a copy of the Rental/Lease Agreement to the bank during loan sanctioning.

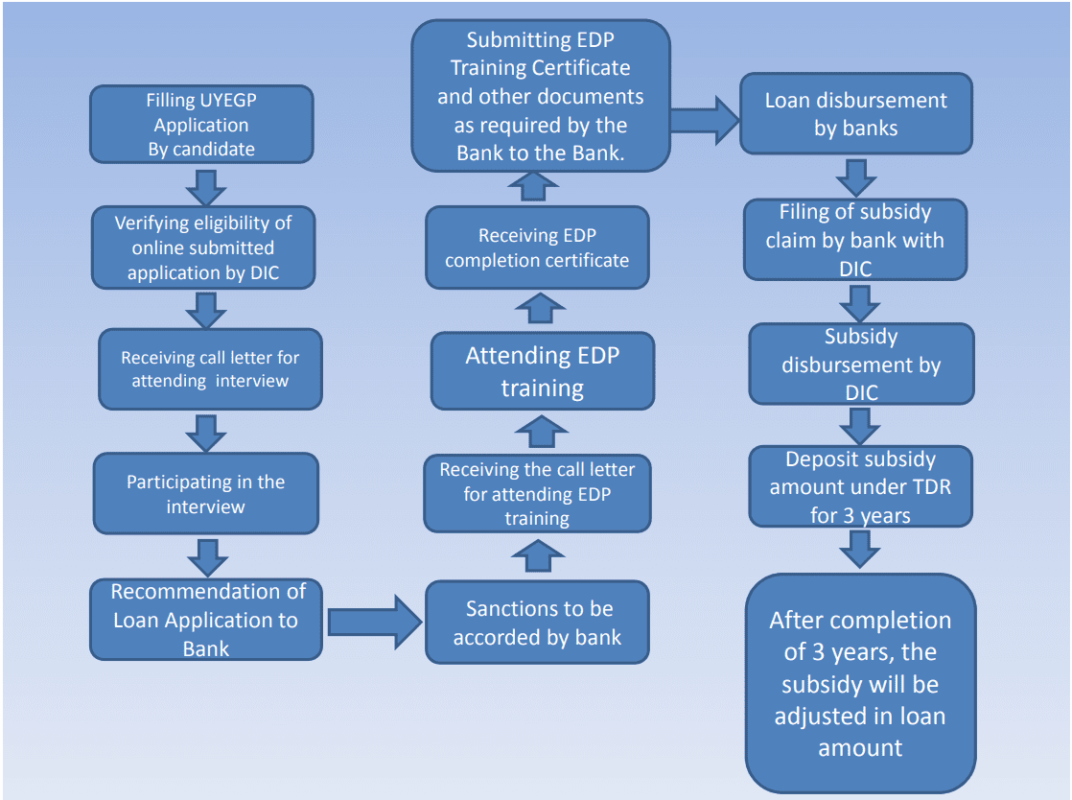

UYEGP Scheme 2024 Application Process

To apply for the scheme, follow these steps:

- Visit the official website and navigate to the UYEGP section under MSME.

- Click on the “Apply Online” link and select “New Application” to access the application form.

- Provide accurate basic information about yourself, including email and educational background.

- Upload scanned photographs as per the website’s specifications.

- Fill in details regarding the Line of Activity, the Category of the Venture, the Address for Activities, and Project Outlay.

- Review the list of required documents for upload.

- Proceed with the application and receive an application ID upon submission.

- Access the “Upload Documents” section and submit the necessary files along with the application ID.

- Await further communication from authorities regarding verification and next steps.

- Upon acceptance, attend an interview if called.

- Upon successful interview, the bank will be instructed to approve the loan.

- Once the loan is approved, submit an affidavit along with relevant documents to the bank.

- Attend EDP training upon receiving a letter, and obtain a certificate upon completion.

- Submit the training certificate to the bank for loan disbursement.

Important Links related to the scheme

UYEGP Scheme FAQs

What is the component of Project cost?

In the case of general category loans, a capital expenditure loan, one cycle of working capital, and an own contribution of 10% of the project cost are required. For special category loans, an own contribution of 5% of the project cost is necessary.

Whether the cost of land and building included in the project cost?

No.

Is collateral security mandatory under the UYEGP Scheme?

According to RBI guidelines, UYEGP loans for projects costing up to Rs 10.00 lakhs do not require collateral security. These projects are also eligible for coverage under CGTMSE.

What documents are required to submit an online application under the UYEGP Scheme?

The applicant must submit their application, along with the project profile and quotations, to the respective District Industries Centre. Copies of certificates demonstrating:

Educational qualification (Transfer Certificate / School Record Sheet copy)

Quotation and Project Report

Nativity (Copy of Ration card or Nativity certificate obtained from Revenue Department authority)

Community

Ex-servicemen status (where applicable)

Proof of being differently-abled (where applicable)

Which agency is responsible for implementing the scheme at the district level?

District Industries Centres (DICs) in the respective districts, along with the Office of the Regional Joint Director of Industries and Commerce for Chennai District, will serve as the implementing agencies for the scheme.

What is the maximum project cost under each category?

Rs. 10.00 lakhs for the Manufacturing Sector

Rs.3.00 lakhs for Service Sector

Rs.1.00 lakh for the Business Sector.

What is the repayment tenure under the scheme?

Repayment tenure will be 5 years or as fixed by the bank by the guidance of RBI